Slower UK wage growth welcome news for the Bank of England

Momentum is fading in the UK wage numbers, and this will be welcome news for the Bank of England. The uncertainty surrounding the US banking sector does question whether the Bank of England will hike by 25bp next week, and remember the bar for pausing hikes appears to be much lower in the UK than at the Fed or ECB judging by recent official commentary

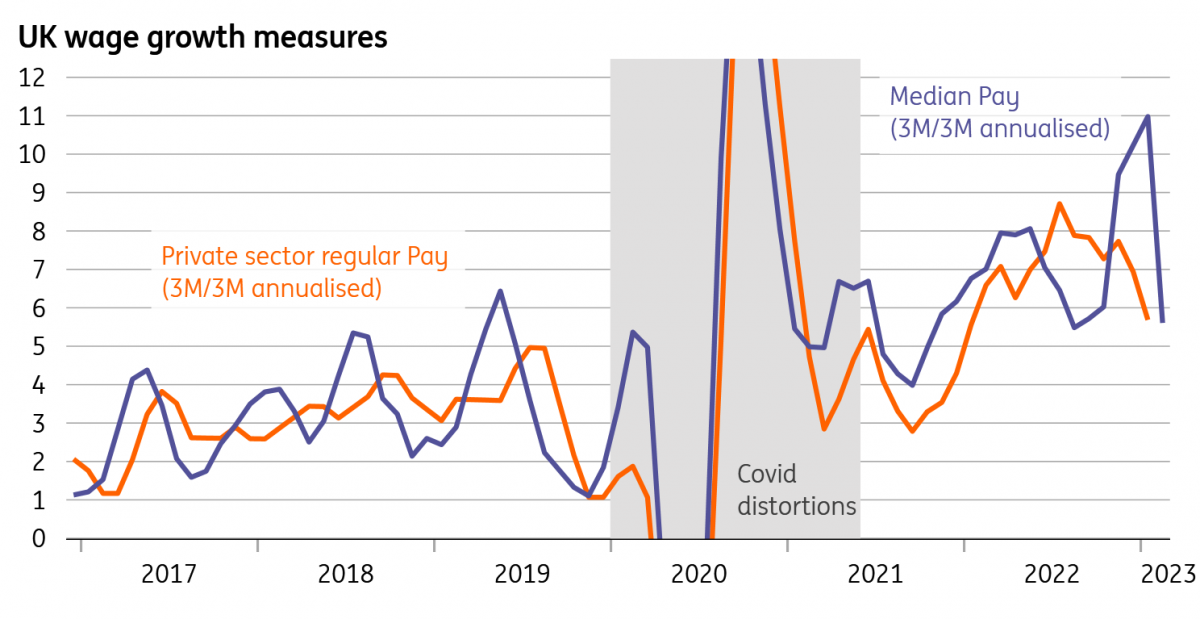

The latest UK data show clear signs that wage growth might finally have peaked. While there were early hints of this in last month’s data, a moving average of the three-month annualised rate of regular pay growth – a better measure of momentum in the wage numbers than year-on-year growth rates – has clearly slowed over recent months. If that sounds a bit complicated, an easier way of thinking about it is that the average regular pay level has increased by just £1 in each of the past two months, having typically risen by £3-4/month throughout most of 2022.

Measures of UK wage growth momentum are slowing

This will be welcome news for the Bank of England, and echoes the message from its Decision Maker Panel (DMP) survey where wage growth expectations among firms appear to have peaked. It tallies with the gradual fall in unfilled job vacancies over recent months, though the caveat is that some of the underlying causes of worker shortages (and higher wage growth) don’t appear to be resolved.

The number of people outside of the labour market due to long-term sickness has begun to increase again, and this is widely seen as part of the story on labour shortages. The latest DMP survey also pointed to a rebound in the number of firms finding it “much harder” to hire than normal, albeit the percentage is still down on last summer’s highs.

Rates of long-term sickness are increasing, even if overall inactivity is down from its peak

Nevertheless, taken with last month’s dip in core services inflation, and the backdrop of firms lowering their pricing expectations, this latest wage data makes next week’s Bank of England decision more uncertain – as too does the situation in the US banking sector.

While the direct implications for the UK are so far unclear, it’s clear from recent BoE communication that the bar for pausing rate hikes is much lower than at the Fed or ECB. Policymakers are clear that they’ve done a lot of tightening already, and much of the impact is still to come through.

So while for now we’re inclined to stick with our previous base case of a 25bp hike at next week's meeting, the chances of 'no change' have undoubtedly risen. Much, unsurprisingly, depends on the fallout of the SVB collapse over the coming days.