Singapore inflation close to its peak

As inflation in Singapore accelerates to 2.4% surpassing forecasts, we believe we're close to the peak. With the balance of risks tilted towards growth, the current fiscal-monetary policy mix may persist beyond this year

| 2.4% |

CPI inflation in MayYear-on-year |

Inflation remains at a seven-year high

We thought Singapore’s CPI inflation peaked at 2.1% year-on-year in April and would have eased slightly to 2.0% in May. On the contrary, it accelerated to 2.4%, which is still the highest reading since the end of 2013 with core inflation rising to 0.8% YoY from 0.6%.

A 0.8% month-on-month rise in total inflation was unusually big for May.

It was led by a 2.7% MoM jump in housing and a 0.5% MoM rise in the transport component - the heavyweights in the CPI basket. The monthly jump in housing was mainly the reversal of the quarterly Services & Conservancy Charges (S&CC) rebate to public housing provided in April, leaving the year-on-on year inflation in this component little changed at 0.6% (0.5% in April). And, rising Certificate of Entitlement (COE) costs for private cars have been pressuring transport inflation higher, which rose to 11.0% YoY from 9.7% in April.

Among other CPI components, food inflation continued at more than a decade low of 1% YoY, while tighter Covid-19 movement restrictions weighed on the remaining product and services prices. Yet, the pass-through of higher utility and transport to other CPI components is reflected in some pick-up of core inflation.

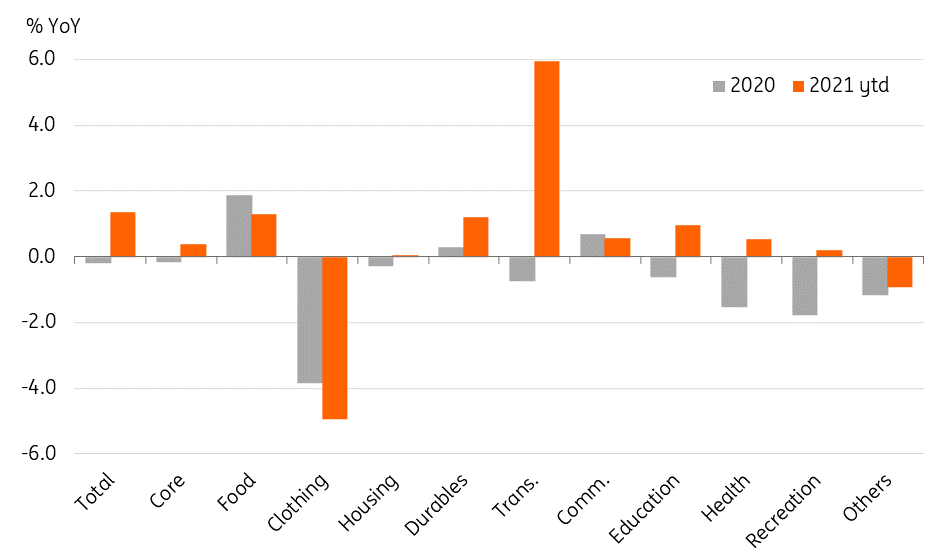

Where is inflation coming from?

Almost near the cycle peak

Although we were wrong about decelerating inflation in May, we believe we are close to the peak this year and we should see it slowing in the months ahead as base effects fade. We are maintaining our inflation forecasts for 2021 at 1.4%, which is near the top end of the central bank's 0.5% to 1.5% forecast range for this year. Our forecast for core inflation is 0.7% (MAS 0% to 1.0%).

As inflation stays within the official forecast range, growth will continue to be the main driver for any potential policy changes. Fiscal policy is doing the most of the heavy-lifting to soften the impact of Covid-19 on domestic demand (read latest here). But the neutral monetary policy of zero S$-NEER appreciation has also been supportive of the export recovery. We think this policy mix may persist beyond this year.