Singapore domestic exports still falling

January non-oil domestic exports (NODX) fell 10.1%YoY (-5.7%MoM), which is a faster pace of decline than in December, and will encourage some fiscal offset from the government.

| -10.1 |

YoY%-8.5% in Dec 2018 |

| Lower than expected | |

No moderation in the rate of decline

Non-oil domestic exports for Singapore were much weaker than the consensus had been expecting (Bloomberg consensus was -3.2%YoY) and our tentative statistical payback forecast (+2.9%) proved well wide of the mark.

We did get a small bounceback in pharmaceuticals (15.4%YoY from -26.8%), but petrochemcicals weakened further to -11.8% from -3.5% in December.

Furthermore, the all-important electronics sector continued to fall, dropping 15.9%YoY - an acceleration in decline from 11.2% in December. The deterioration was especially marked in integrated circuits and PCs. Other electronic components remained bad, but not particularly worse than last month.

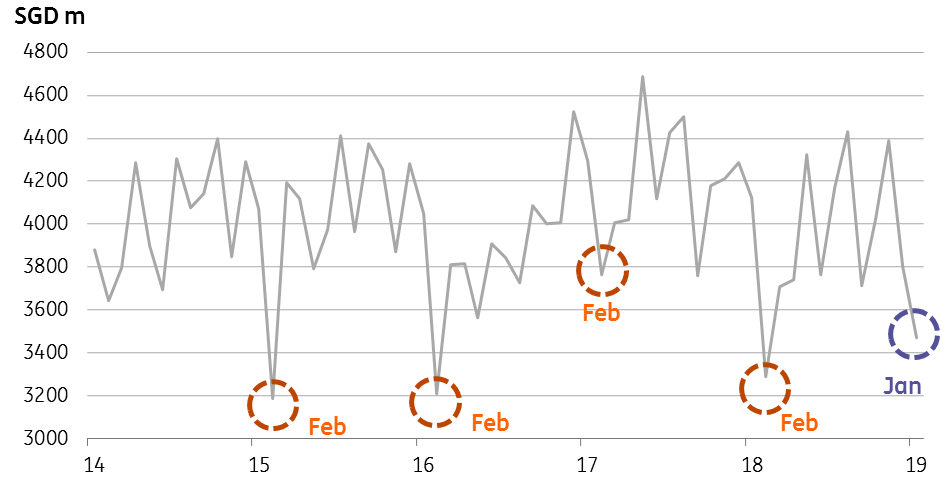

Electronics Exports (SGD Millions)

Worst could be over?

Although it looks bad, and there is a temptation to draw a very negative conclusion from today's figures, there is a chance that we are seeing the seasonal low for electronics. These have a tendency to trough in February, posting lower figures than today's SGD3.4bn January figure in 2018, 2016, and 2015. A slight shifting in the seasonal norms for electronics might have brought forward the low point this year to January, and means we could see a bounce in February, with misaligned seasonal lows delivering a boost to next months year on year comparison (so long as it doesn't fall further in the meantime).

That said, any such seasonal bounce might prove very short-lived, and the negative petrochemical result is very worrying. This points to a broad weakness in external demand, with these products ubiquitous in almost all production and packaging. Any bounce in electronics may be short-lived against a much wider downturn in demand, and the government's budget due out later today will likely need to incorporate some offsetting measures to stimulate the domestic economy in the face of mounting external weakness.