Singapore: December inflation beats expectations

With expectations of continued low inflation and firmer growth this year, we don’t think Singapore's central bank will change its current monetary policy stance anytime soon

| 0.8% |

December CPI inflation |

| Higher than expected | |

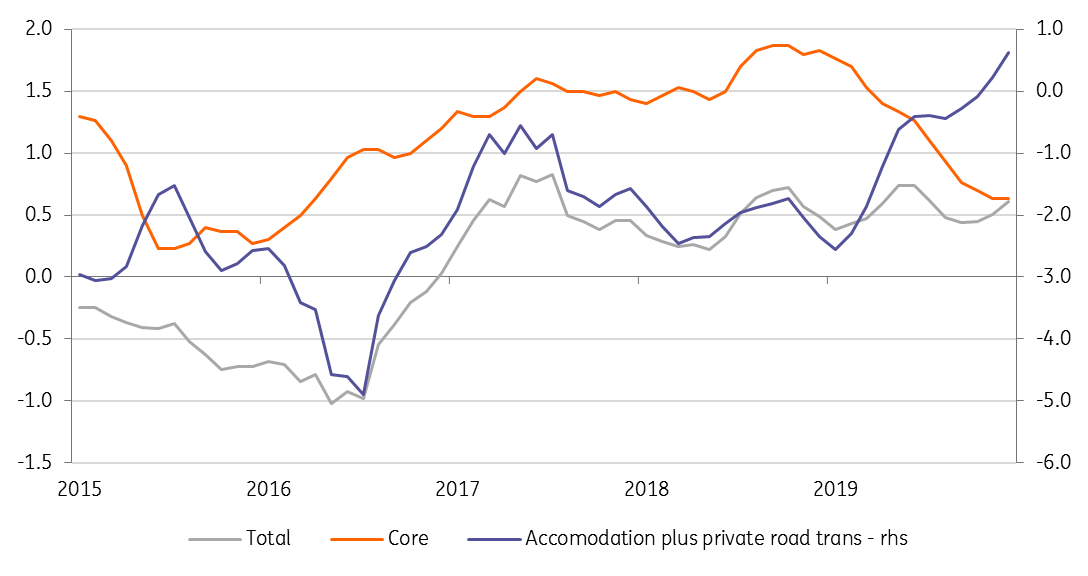

Both headline and core inflation rose

December consumer price inflation came in at 0.8% year-on-year, surpassing expectations of 0.7% and up from 0.6% in November. This is also the highest reading in seven months. What caused it? Higher inflation in food, transport, communication, and education costs stood out.

And, confounding the consensus of a slowdown to 0.5%, core inflation rose to 0.7% from 0.6%. The core measure excludes accommodation and private road transport prices from total CPI, which leaves food as the heavy-weight here, having risen to a three-year high of 1.8% (up from 1.7% in November).

Not a problem in 2020

Annual inflation of 0.6% in 2019 was slightly higher than the 0.5% rate flagged by the Monetary Authority of Singapore (MAS). And the core rate of 1.0% was at the low end of the MAS’s 1-2% indicative range.

We don’t see inflation being a policy problem in 2020. The MAS expects a 0.5-1.5% range for both total and core inflation this year, which is where we see it staying; more likely near the low end of the range, as demand-side price pressure will continue to be muted.

Stable MAS policy ahead

With expectations of inflation continuing to be low and growth gaining some traction this year, we don’t think the MAS will change its current monetary policy stance anytime soon.

The policy guides the Singapore Dollar Nominal Effective Exchange Rate (S$NEER) in an undisclosed trading band, which the MAS currently has on an appreciation path albeit at a slightly reduced rate of appreciation in the last policy review in October 2019. The MAS could rationalise this on firmer accommodation and transport inflation. The MAS's next review is scheduled in April 2020.

Consumer Price Index (% YoY, 3-month moving address)

Download

Download snap

24 January 2020

Good MornING Asia - 24 January 2020 This bundle contains {bundle_entries}{/bundle_entries} articles