Singapore: Covid-19 lockdown hits spending

As things adjust to the post-Covid-19 new normal, more jobs are likely to be lost along the way, keeping consumption weak for some time to come

| -40.5% |

April retail sales growthYear-on-year |

| Worse than expected | |

Worst-ever retail sales

Singapore’s retail sales crashed by 40.5% in April from a year ago and 31.7% from the previous month (seasonally adjusted). This is the worst sales growth ever recorded since the series started back in the mid-1980s. And it was pretty much expected as the Covid-19 lockdown, starting on 7 April, dented spending.

As expected, supermarket sales continued to outperform with a 30% year-on-year surge, while non-essential consumer spending of all sorts was hit hard. Motor vehicle sales remained the weakest area with a 68% YoY plunge, which is not a surprise as we saw new registrations plunge in April. Among other big drags were watches and jewellery (-81%), clothing (-75%), department stores (-75%), and recreational goods (-55%).

More weakness ahead

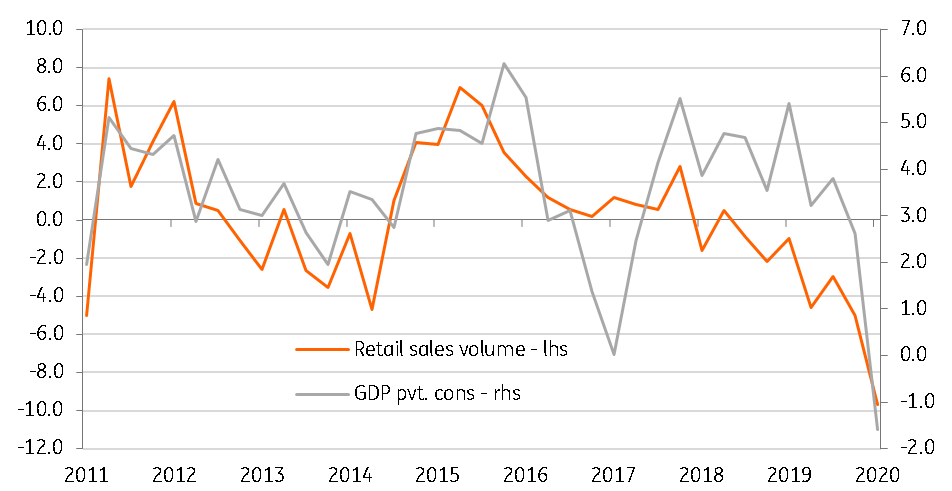

Private consumption explains almost a third of the negative swing in GDP growth in the 1Q20 (to -0.7% YoY from +1.0% in 4Q19). April data leaves no doubt that it’s going to be a far bigger drag in the current quarter, supporting our view of a 6.8% YoY GDP fall.

Continued weak consumer spending remains a baseline scenario for the rest of this year. The lockdown measures continued for all of May, followed by some relaxation starting this month. Yet, it will be a long time before the economy is fully back on its feet; a gradual three-phase reboot won’t be completed until an effective vaccine for Covid-19 is found. And, as things adjust to the new normal more jobs are likely to be lost along the way, keeping consumption weak on the expenditure-side of GDP growth for some time to come.

Retail sales vs. GDP private consumption (% year-on-year)

Download

Download snap

8 June 2020

Good MornING Asia - 8 June 2020 This bundle contains {bundle_entries}{/bundle_entries} articles