Serbia: Rates to stay on hold

We look for the central bank to keep rates on hold tomorrow, in order to further assess the “effects of past monetary policy easing”

With any drop in inflation in 1H18 attributed to “the high base for prices of petroleum products and other products which recorded one-off hikes in early 2017”, we expect the central bank to keep the key policy rate unchanged at 3.5%. The decision is in balancing the recent up-tick in inflation expectations and mild weakening pressure on the currency with a sound fiscal performance and the region’s more hawkish overall mood.

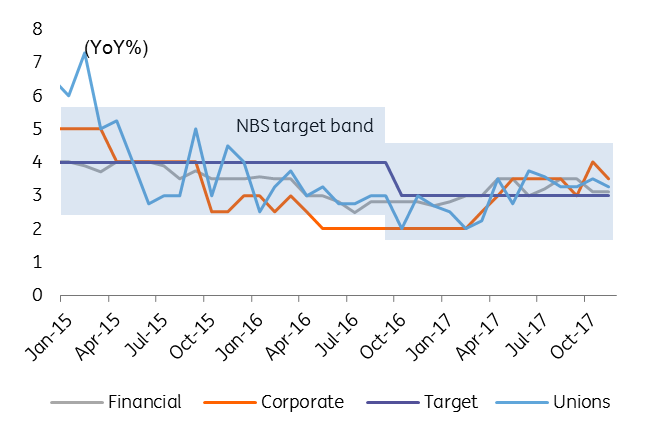

Inflation expectations

After taking advantage of the window of opportunity and cutting rates twice in September and October, the National Bank of Serbia has had time to see lower rates filtering through into the cost of credit, lower bond yields and mild pick-up in economic activity. Though inflation expectations remain well anchored within the central bank target, a gradual rise in inflation is expected in 2H18 as the base effect will dissipate. This might be accompanied by slightly more expansive fiscal policy (with the 2018 budget targeting a 0.6% of GDP deficit, from a 1.2% surplus in 2017) and stronger domestic demand. On the external front, the expected Fed hikes could trigger some capital flight from emerging markets.

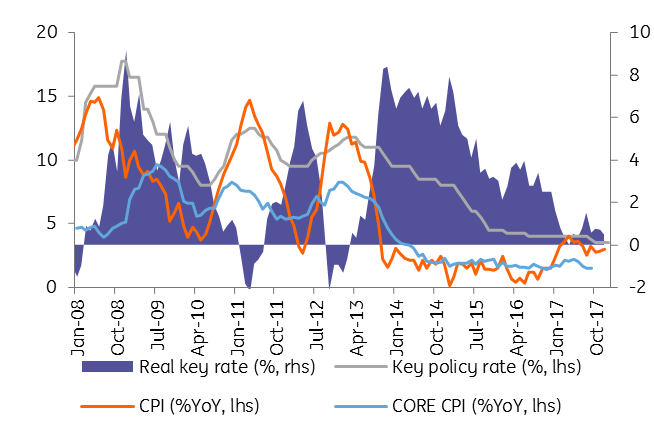

CPI

Underlying monetary conditions are more accommodative than apparent in the key rate level. Unsterilized surplus liquidity is keeping the cost of lending relevant interest rate indices at well below 3.5%. Add to this one-sided FX intervention to prop-up the Serbian dinar over the last month and the risk of a rate cut seems rather remote.

With 21 out of 23 analysts surveyed by Bloomberg sharing the same expectation as us (with the other 2 looking for a 25bp rate cut), the NBS decision should have limited impact on local currency debt and the tightly managed exchange rate.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap