Precious Metals: The dollar giveth, the dollar taketh away

A strong beat in Friday's US jobs report has furthered investor expectations of rising inflation and additional rate increases. The former continues to drive precious metals despite soaring yields whilst the latter is a potential headwind

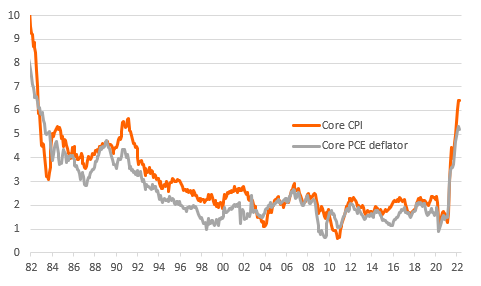

Inflation, Inflation, Inflation

Inflation expectations have allowed gold to make gains this year despite surging yields. On Friday, the US jobs report showed wages grew 2.9% year-on-year in January, the fastest since 2009. The spread between the 10-year and the inflation-linked swap hit new highs on the news as the missing addition to low unemployment seemed to be finally picking up.

With equity valuations appearing vulnerable to higher borrowing costs, stock markets have since sold off significantly. Our FX strategists point out that the asset performance this week is the typical risk-off pattern that was seen in six of the seven instances of VIX spiking above 50% since 1990. The 10-year yield has come down 3bp from its Friday high along with the equity exodus. Funds have generally moved to risk-averse assets as the sell-off originated from within equity markets, not externally. So why then has gold’s self-haven status disappointed?

In times of distress, gold can indeed fall with equities when sold to meet margin calls, but CFTC data shows longs held firm last week and only mild dips in open interest thereafter. Gold's relative stability might therefore add the perspective that distress is not the correct word. The ING team are calling it a ‘’healthy correction’’. Equity valuations may have run ahead of themselves but the economic backdrop is solid.

Given this, it is the greenback that appears to have outshone gold's safe-haven appeal and has rebounded 1% against the Euro so far this month. Our FX team think this is temporary and fundamentals will revert towards a weaker 1.30 by year-end. This is not expected to be derailed whether its three or four rate hikes this year. But higher rates are indeed headwinds for the non-yielding precious metals. The jobs data and the dual addition of “further” in Fed commentary seem to have emboldened expectations of four rate hikes although our economists are sticking to three for now. The probability of March is now priced at an 84% certainty.

Inflation swaps diverge further after US jobs report

Market Fundamentals pick up in Q4

When flows settle down, fundamentals might yet have their turn to direct markets and seem to have improved in Q4. The World Gold Council (WGC) published its 2017 report yesterday. Ironically, amid the current volatility, gold investment demand was down 7% last year because of competition from equities and cryptocurrencies. However gold investment did start to come back in favour by Q4 as inflation themes emerged. We note ETF holdings were up 6% in H2 2017 but the 940koz level this year has almost halved since prices have peaked.

Jewellery accounts for over half of gold demand and increased 4% last year. China registered its first demand increase since 2013, a decent 3% that was spurred by a 6% pick up in Q4. India also had its strongest quarter for at least 17 years (which is in part the seasonal boost of the wedding season). Total year Indian jewellery demand recovered 12% from a low 2016 as the goods and services tax and demonitisation effects rolled over.

Silver and palladium behaving badly

If gold can be blamed for not rising through the equity turmoil then the steeper sell-offs in silver and palladium- compared to the solely industrial metals- is more extreme still. Copper is down 1% month-to-date.

After a 3.8% plunge on Friday, the gold/silver ratio briefly hit above 80 for the first time since early 2016. The ratio has risen from 75 since Q4 2017 as silver has lacked gold’s investor appeal as an inflation hedge. ETF silver holdings are down 3% since June 17 compared to +4% inflows for gold. Commitment of trader data shows longs are back to December rate hike lows and on Friday’s sell-off, the open interest rallied 6% which suggests investors are rebuilding shorts. Over half of silver usage is industrial so given our positive outlook for the global economy, the gold/silver ratio should not be at Great Financial Crisis levels, and we expect a move back towards 70 by year-end. Silver's fundamentals are turning as the silver institute expects robust demand to create a mild deficit this year after a 32.2Moz surplus last year.

Gold-to-Silver Ratio at GFC highs

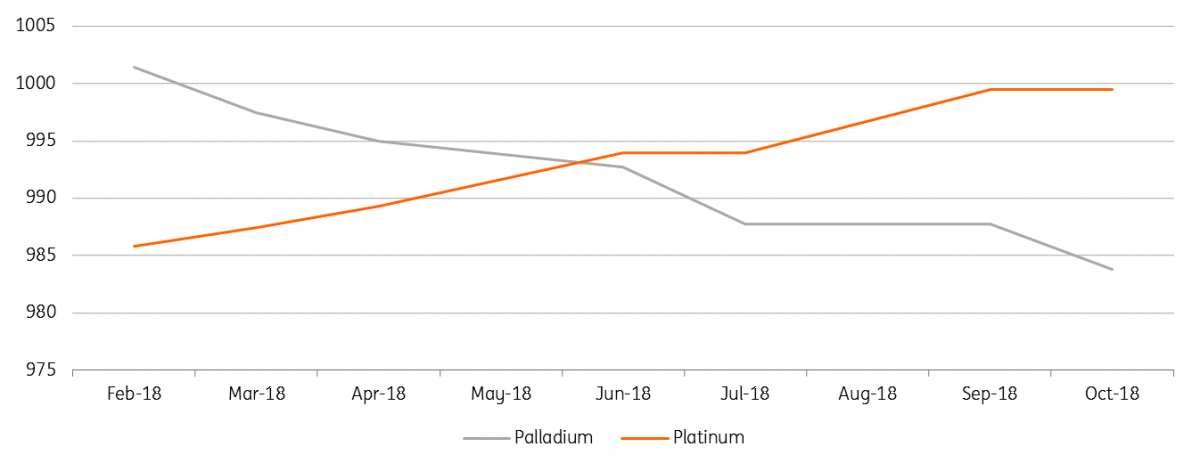

Platinum-Palladium heading back to parity?

Palladium continues to see profit-taking after its 53% rally in 2017 and the CME contract managed money longs reduced by 7% last week. The platinum-palladium ratio has recovered to 0.98 from its 0.86 lows and the forward curve is expecting platinum to be back on top by July. Through the Friday sell-off, Palladium backwardation briefly narrowed but quickly returned which is keeping this an expensive ratio for investors to short. The funds continued to add length to platinum last week with the longs now up 70% since the start of the year.

Forward Curve Puts Platinum back on top by July

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap