Serbia central bank cuts rate by 25bps to 3.25%

The decision was in line with our call but somewhat against the consensus view. However, we think we'll see another rate cut this year with the timing depending on the FX markets and international backdrop

| 3.25% |

Key policy rateLower than consensus |

The communication which followed the National Bank of Serbia's (NBS) decision underscored that “inflation pressures remained subdued”.

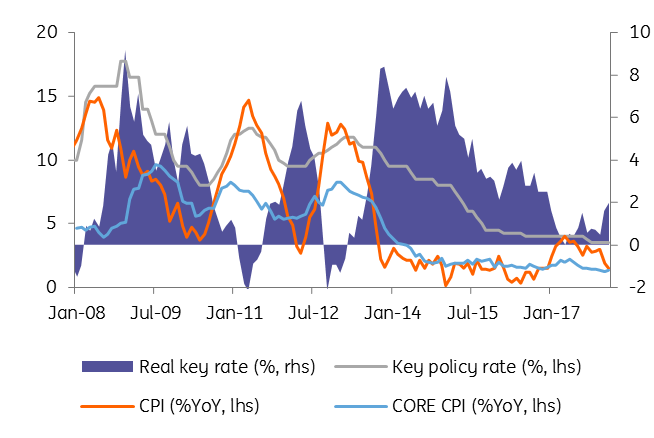

Projections for the coming period point to a slowdown in inflation due to important base effects as the one-off hikes from early 2017 start to drop off the statistical base. Annual CPI fell to 1.5% in February 2018, from 1.9% in January 2018 with core inflation coming in at 1.3% year on year, confirming expectations.

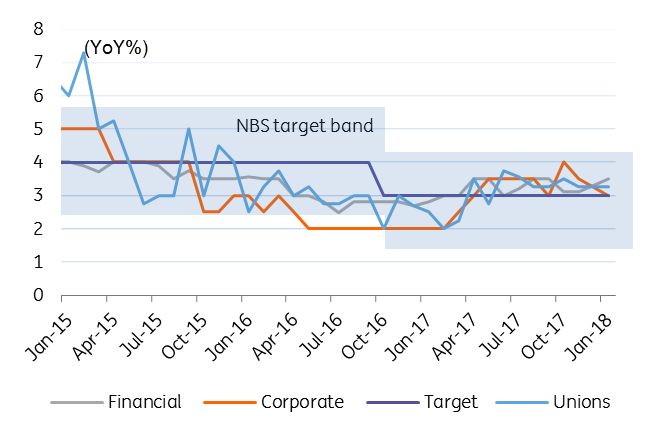

Core inflation remains below the target band

The inflation rate is expected to stay near the lower end of the target band this year and only to reach the mid-point of the 1.5% - 4.5% target band towards the end of 2019, helped by increasing domestic demand.

Contained inflation expectations

The main risks stem from the external environment, NBS’s Executive Board mentioning the uncertainty in commodity prices which the Board don’t expect to rise significantly and international financial markets which are dependent on the FED and ECB policies.

Nevertheless, these risks are viewed as broadly contained, with the Board citing that “the resilience of the Serbian economy to potential adverse effects from the international environment has increased” due to the “strengthening of domestic macroeconomic fundamentals and a more favourable outlook for the period ahead”.

All in all, today’s decision should be favourable for Dinar denominated debt, and the RSD weakness should be short-lived. We think that the NBS will cut rates once more this year with the timing depending on the currency market and international backdrop.