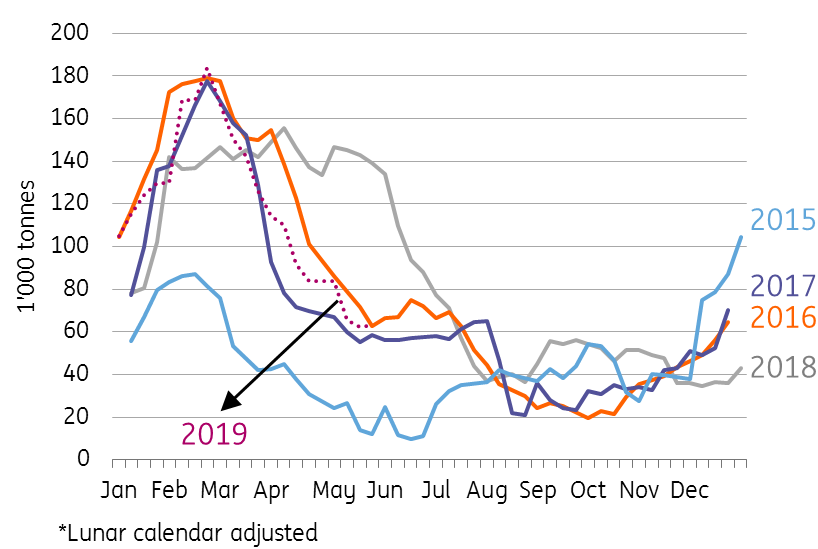

Seasonal demand lull starts to push Chinese copper stocks higher

The trade war truce from the G20 meeting has improved sentiment for copper with LME prices bouncing back over US$6,000/t. In China, a seasonal demand lull sees inventory on the rise. We see a divergence in short term relative strength between LME and ShFE, and this may encourage cross-market arbitrage

Restriction on category 6 copper scrap imports by China go into effect from today (1 July) ⇒ category 6 scrap imports now subject to import quota approval

- The recent scrap copper import quota approved including category 6 scrap copper was reported at 240kt → but the approval took longer than the market anticipated;

- A tighter scrap availability has helped to narrow the spread between cathode and scrap and knocked down the cost advantage by using scrap that used to be much cheaper ⇒ less substitution to cathode and in favour of cathode demand.

Inventory movements diverge between China and ex-China market: Shanghai Futures Exchange(ShFE)+non-ShFE warehouse vs London Metal Exchange (LME)

- A reversal in inventory movement from China in sight entering into Q3 ⇒ seasonal demand lull puts a cap on ShFE prices

- Recent ShFE on warrant stocks on the rise, though moderately;

- A surge in total social stocks from Guangdong warehouses. They are reported at 41,900t (+8,000t from last week) due to import arrivals and slowed inventory loading out; ⇒ sparking worries over domestic demand;

- The average operating rate from semis manufacturers in June was measured at 80.76% (-1.64% year on year) according to Shanghai Metals Market data;

- However, recent LME inventory steadily declining;

- LME cash-3-month spread remained in contango but is narrowing

Trade war truce has eased tensions and pushed LME copper through US$6,000/t;

- According to the latest CFTC data, the speculative net short in COMEX copper declined by 10,077 lots over the reporting week, as short-sellers covered 13,303 lots, while the longs liquidated 3,226 lots;

A divergence in short term underlying market dynamics (LME vs ShFE) may encourage cross-market arbitrage

Things to watch

- Spot TC (treatment charges) for Chinese smelters continued to decline and have broken US$60/t; ⇒ further squeezing smelters’ margins, but supply response yet to be seen;

- Weak macro data release today including June PMIs from China and UK; More evidence is needed to keep the sentiment. In China, the market waits for more stimulus measures.

ShFE Stocks On Warrant