Russians stock up ahead of VAT hike

Russian retail trade picked up in November driven by the non-food segment and financed by retail loans and previously accumulated savings. It appears Russian households have expedited expensive purchases ahead of the upcoming VAT rate hike. We thus see the uptick as temporary and remain bearish on 2019

| +3.0% YoY |

November retail trade+2.6% YoY for 11M18 |

| Better than expected | |

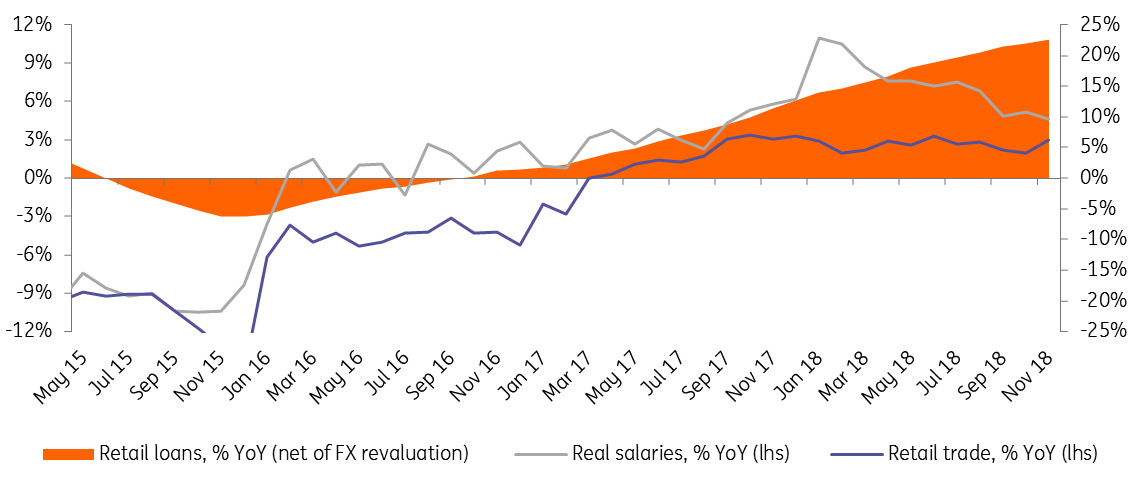

The activity data for November is positive on the consumption side. Retail trade growth accelerated from 2.6% YoY for 9M18 and 2.0% YoY in October (revised up from the previous estimate of 1.9% YoY) to 3.0% YoY in November, significantly exceeding our 2.0% forecast and 2.1% consensus. Meanwhile, the income fundamentals were more or less in line with expectations, as the unemployment rate went up slightly from 4.7% to 4.8%, while real salary growth decelerated from 8.0% YoY for 9M18 and October's 5.2% YoY (revised up from the previous estimate of 4.4%) to 4.6% YoY in November.

The breakdown of the retail trade growth suggests that the acceleration in consumption was driven by the non-food segment, where the growth sped up from 3.4% YoY in 9M18 and October to 4.3% YoY in November. The additional spending on durables came at the expense of savings, as retail lending growth decelerated to 5.8% YoY (adjusted for FX revaluation effect) in November vs the 7.5% YoY average for 10M18. The reliance on leverage has also increased, as retail lending growth continued to speed up to 23% YoY from the 18% YoY average for 10M18.

As retail deposits and loans dynamic mainly reflect middle- to upper-income households' behaviour, the acceleration in the retail trade growth likely reflects purchases of durables pushed forward in the wake of a hike in the VAT rate, which is scheduled to take place on 1 January 2019. The latter might have already contributed to the recent acceleration in CPI, which according to the preliminary weekly data has reached 4.0% YoY as of 17 December and may hit the upper bound of the Central Bank of Russia (CBR) target range of 3.8-4.2% for year-end 2018.

Overall, we treat the current acceleration in consumption as temporary and continue to expect private consumption to slow from 2.5% in 2018F to 1.0% in 2019F. Combined with rather modest corporate activity amid the hawkish CBR stance, this could result in stronger calls in favour of easing in the budget policy going forward, which we continue to see as one of the key local macro risks for 2019.

Consumer activity indicators

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap