Bank of Japan - change of tune

Only a short while ago, the Bank of Japan (BoJ) was still hinting optimistically about a change in policy in 2019/2020. Now that prospect seems to have evaporated and Governor Kuroda is talking down policy change prospects - what has changed?

What has changed? Locally, not much

In compiling a list of what has changed to deliver this abrupt change of view from the BoJ, from the perspective of the Japanese domestic economy the answer is "not much". Sure, on paper, the third quarter looks a disaster, with an annualised 2.5% contraction. But bear in mind that Japan was hit by a genuine natural disaster, earth's most powerful storm of 2018 at the end of the third quarter, causing floods and massive infrastructure damage and, as a result, the domestic picture actually looks less worrying.

Natural disasters are of course awful. But from a GDP perspective, their negative impact tends to be fleeting, with the more medium-term effect of clear up and rebuilding / replacement rather positive. So in fact, the growth outlook for 4Q18 and the following few quarters is actually better than it was.

No, if we are to find an answer, we need to look elsewhere.

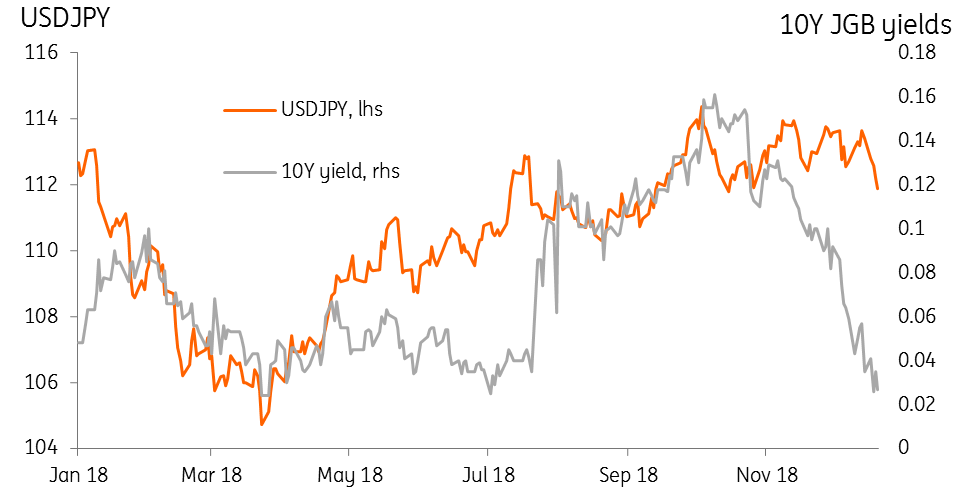

10Y JGB yields and USDJPY

Look over here

If we want to understand why Governor Kuroda is not worried to see 10Y Japanese Government bond yields down to a fraction above zero after rising as high as 0.16% in October, we would do better to look elsewhere - namely the US and, as importantly, the Eurozone.

Whilst the Fed was tightening happily and the ECB was steadily moving towards normalization of its own monetary policy - most importantly the removal of its negative deposit rates, the BoJ could gradually allow policy to drift in a slightly less accommodating direction.

But with the Fed getting dovish overnight, global equity markets getting hammered, Eurozone growth looking very spotty, and the prospects for further movement from the ECB dimming, the cover for the BoJ's stealth taper has been blown up. The yen is appreciating against the USD and Kuroda is now trying to talk down normalization expectations to limit the currency fallout. We suspect he might have his work cut out, especially if the USD embarks on a generalized weakening next year - which we think it will.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap