Russian key rate still has upside

In the face of uncertainty around the CPI trend, we expect the Bank of Russia to make a cautious 25 basis point hike to 6.75% this Friday, but it may signal scope for a further increase to 7% or above in the medium-term, before an eventual cut in 2022-23. This should keep the Russian real rate elevated, being supportive of the ruble, all else equal

Bank of Russia is likely to act cautiously this month

Our base case scenario for this Friday's key rate decision is a 25 basis point hike to 6.75%, putting us in the middle of the consensus range of 6.50-7.00%. We see several reasons why the Central Bank of Russia has to proceed with the hiking cycle after a +225 basis point move year-to-date, but the actions from now on should be far more cautious than the previous 50-100 basis point steps.

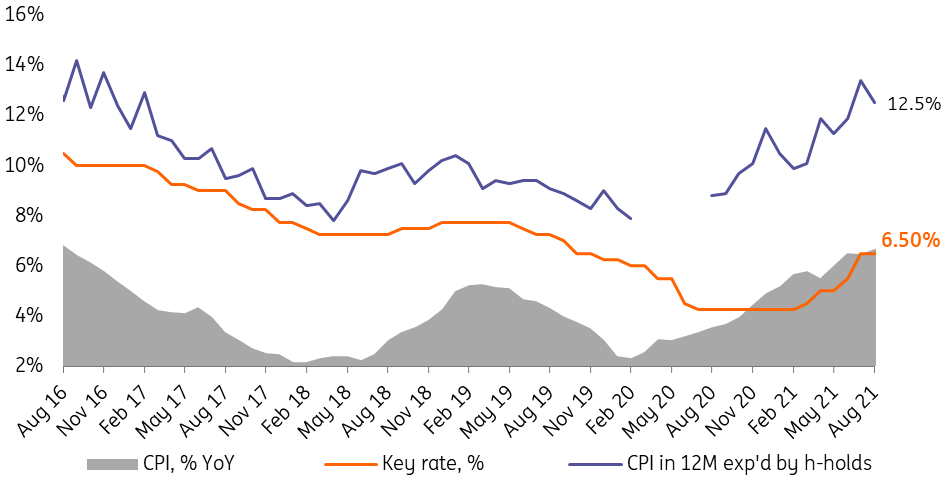

- Indeed, the current inflationary trend is a concern. After a brief plateau at 6.5% year-on-year in June-July, inflation seems to be looking up again, and based on preliminary weekly data could reach 6.7% or higher in August, as the seasonal monthly deflation in fruit and vegetables proved shallow, while prices in other segments pressed on, supported externally by global supply chain disruptions and internally by strengthening in the labor market. While the final numbers on August CPI have yet to be confirmed (release date is 8 September), our expectation for a year-end CPI forecast at 5.7% is becoming rather optimistic, but still appears in line with the Bank of Russia's 5.7-6.2% YoY range.

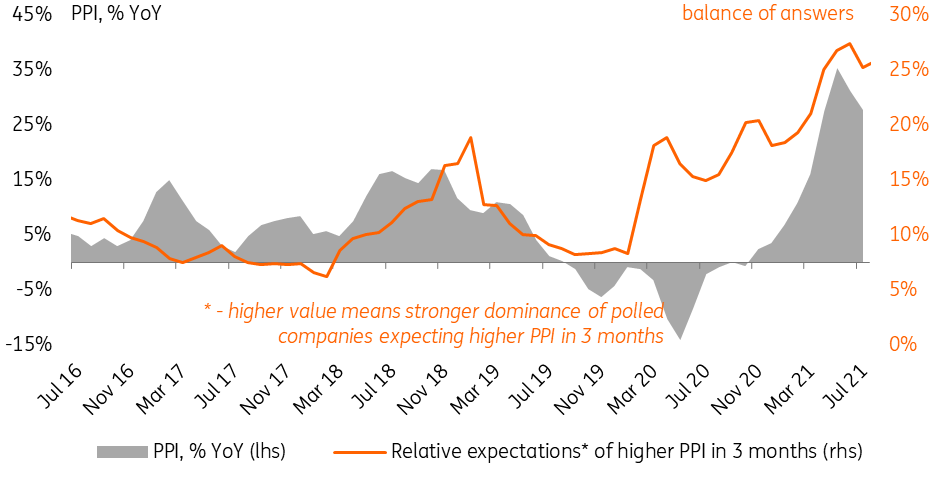

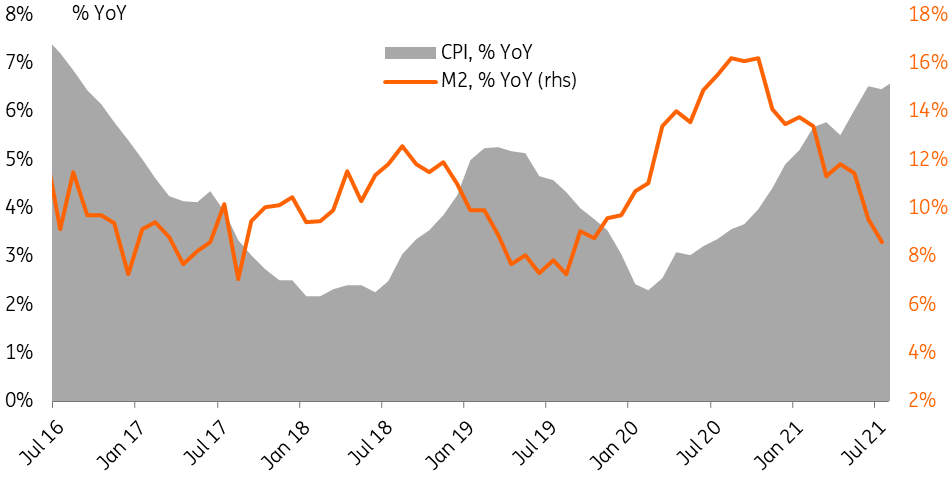

- At the same time, a longer-term inflationary pick up appears less certain, given the cautious stabilisation in household and corporate inflationary expectations in July-August, moderation in corporate and retail lending growth, and a further deceleration in the monetary supply growth.

- While the market is focusing on the potential 0.2-0.3ppt inflationary effect of the extra social payments that households are to receive in August-September, it seems to have already been incorporated into the Bank of Russia's macro forecast in July. In fact, it appears that the sharp 100bp hike this summer has front-run the fiscal action.

- Ahead of the blackout period, CBR officials indicated no desire to adjust their signal from July, i.e. that "the Bank of Russia will consider the necessity of a further key rate increase at its upcoming meetings". We interpret this as a sign that the range of decisions to be seriously discussed will be between no change and 50 basis points. The additional social spending is not considered fiscal easing as it is financed by higher-than-expected non-fuel revenues of the budget.

Figure 1: Current CPI keeps bringing negative surprises, but the longer-term expectations seem to be stabilising

Figure 2: PPI and corporate inflationary expectations are stabilising, but so far are highly elevated

Figure 3: Monetary supply growth keeps decelerating, suggesting downside to CPI in the medium-term

Medium-term signal the key uncertainty as both local and global context need to be incorporated

As usual, the CBR commentary will be key to gauging the medium-term prospects for the key rate after Friday's decision. We believe the rhetoric will remain focused on the elevated inflationary risks, potentially hinting at the higher likelihood of the key rate overshooting the 6.5-7.0% range in the event of negative CPI surprises and positive GDP developments. At the same time, we see a number of arguments in favour of restraining the hawkish bias for now.

- Local economic activity seems to be moderating as GDP has reached pre-Covid levels, meanwhile the risks to mobility remain for 4Q21, in our view, given the spread of the Delta variant, while Russia's vaccination rate, at 30%, is still lagging most of its peers.

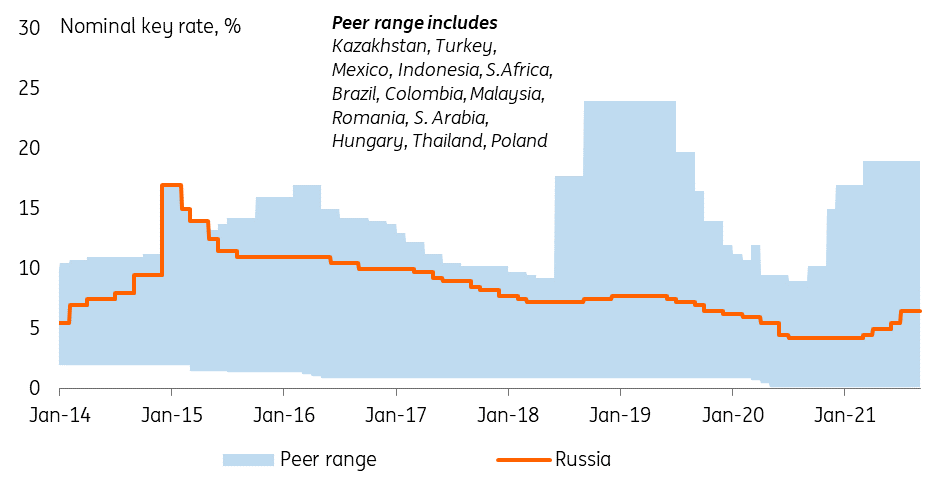

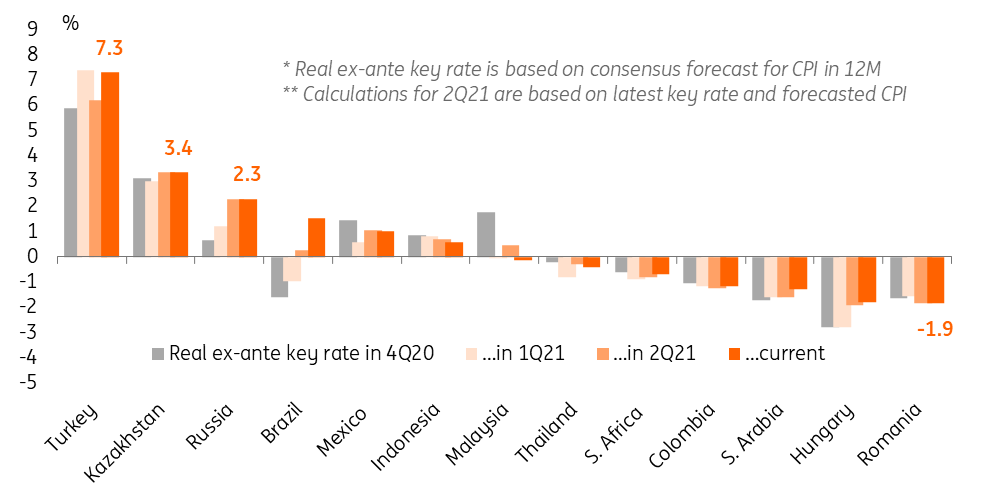

- Most of the CBR's peers have a wait-and-see approach to rising inflationary risks. If Turkey is excluded from the set, Russia's nominal rate is close to the top of the range. However, we do note that the Latin American peers Brazil and Mexico increased rates in August, suggesting that the frame of reference for Russia remains uneven, and upside risks to the global emerging markets rates space exists.

- Looking at the real rates, based on CPI expected by the market in 12 months, it appears that, at current levels, the Russian real rate is hovering around 2%, which is the upper border of the neutral stance and remains in the top-3 among peers. This suggests that a further noticeable deterioration in inflationary expectations would be required to justify high upside to the nominal rate.

Figure 4: Russia's EM/commodity peers are keeping their monetary policy steady

Figure 5: Russia's real rate remains in top-3, borders on tight stance

Current environment appears benign for Russian assets

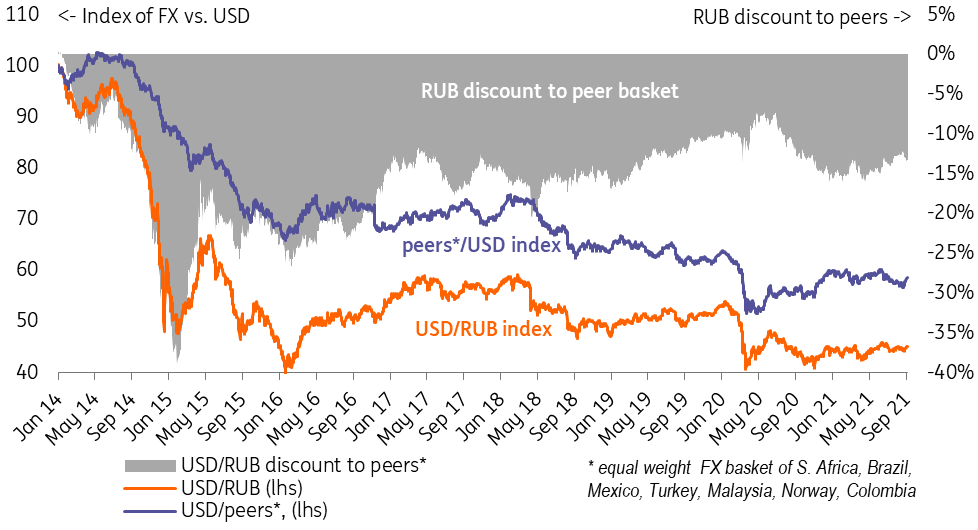

From a portfolio flows perspective, the current rate environment appears favourable for Russian assets. Following a normalisation of the foreign policy newsflow and the CBR's July tightening in stance, the Russian local currency public debt market (OFZ) saw inflows of nearly US$5bn, allowing USD/RUB to narrow its discount to EM/commodity peers from 14-15% in June to 12-13% in July-August. A reiteration of the CBR's strict approach to inflation targeting, which we see as a base case for Friday, should be largely neutral for the ruble and the bond market. A more hawkish outcome, such as a 50bp hike, plus no indication of an end to the hike cycle, should obviously be negative for the front end of the curve but is unlikely to discourage the longer end.

Figure 6: Global mood towards ruble remains favourable so far

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap