Russian activity moderated ahead of a fiscal boost

July data points at a moderation of economic growth, but the the extra social payments at around 1% of annual household income to be disbursed in August-September are to provide some support in the near term. Combined with a surprisingly strong local labour market and global cost inflation, our near-term GDP and CPI view have room to increase

Consumption moderates on base effects, but fundametals solid

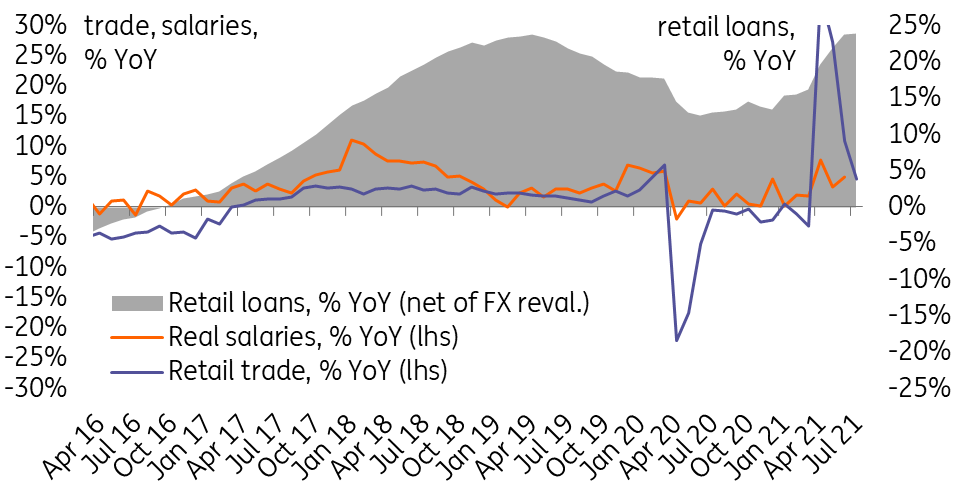

Russian retail trade growth slowed down from 23.5% year-on-year in 2Q21 to 4.7% YoY in July, slightly below consensus but beating our conservative 4.0% YoY assumption. The deceleration itself was fully expected given the higher base effects (2Q20 was the low point, after which recovery started), return of outward tourism, and that economic activity broadly reached the pre-pandemic levels in 2Q21, but several non-technical positive points need to be mentioned.

- In August, Russian families with schoolchildren received an extra RUB200bn in one-off social support from the government, while for September, RUB500bn will be distributed among pensioners and the military as per the president's request. The combined sum is equivalent to around 1.0% of the total annual household income, which is most likely to be channeled into private consumption. Earlier we indicated that additional pre-election spending (Parliamentary elections are to take place in mid-September) is a realistic upside risk to the near-term economic trends. In our estimates, the August-September handouts may add around 0.8 percentage points upside to annual household consumption in 2021 and 0.2-0.3 pp boost to GDP growth.

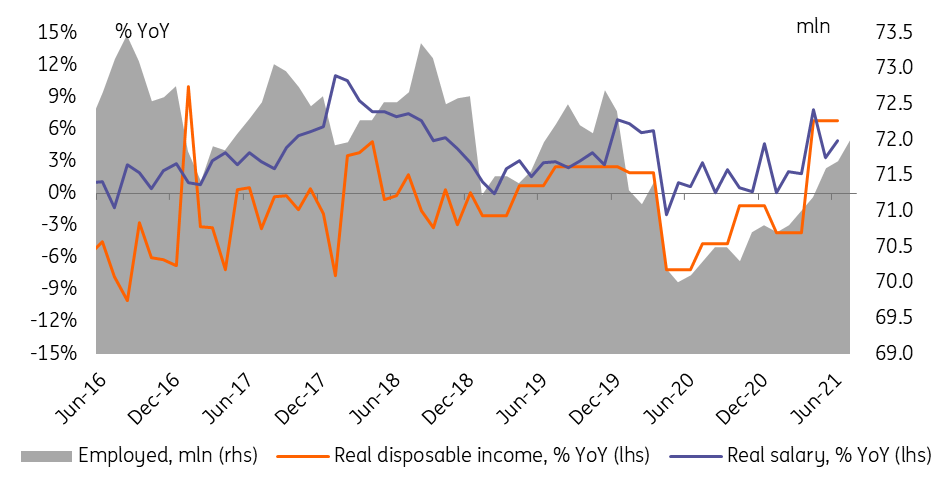

- The true positive surprise came from the labour market, and it does not yet reflect the upcoming social support cheques. First, the unemployment rate dropped materially from 4.8% to 4.5%, below the consensus range, reflecting a 0.3 million spike in the number of officially employed to 72.0 million, a 20-month high. Second, the June real salary growth accelerated to 4.9% YoY, exceeding the consensus range, despite elevated inflation. The support to the labour income appears broad-based, including commodity extraction, manufacturing, retail, services, construction, state administration, and education, suggesting a mix of private and budget sources of financing.

- A stronger reliance on social and labour income would be a welcome change from the previous situation of credit-driven growth, which now seems to be moderating, judging by the stabilisation of retail lending growth and some recovery in deposit inflow, according to the banking sector statistics for July.

Figure 1: Employment keeps recovering, positive for income growth

Figure 2: Credit growth close to it peaks

Producer trends also moderating, fiscal support remains a factor of uncertainty

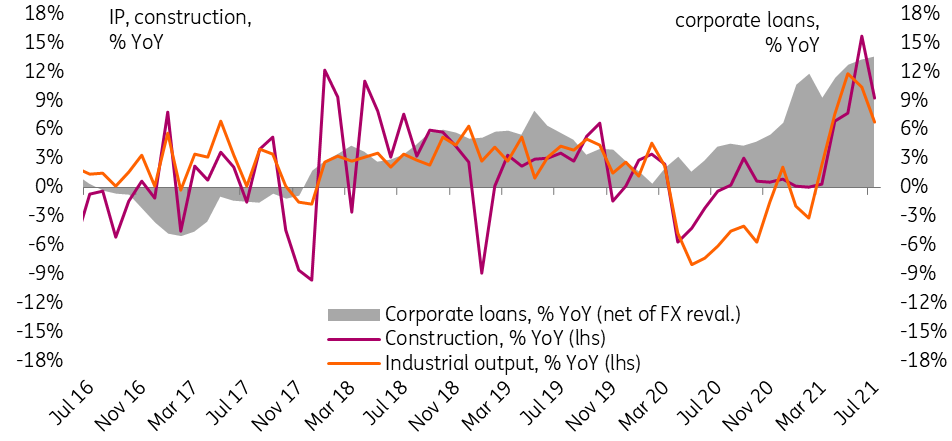

Producer data is painting a more mixed picture, with industrial output decelerating to a below-expected 6.8% YoY in July, while construction picked up to an above-expected 9.3%, with the housing segment continuing to take the lead. We continue to see consumer-focused sectors taking the lead in the recovery, with infrastructure-focused industries lagging behind. We also believe the fixed investments growth, which posted an impressive 11.0% YoY growth in 2Q21 (after a 5.3% YoY decline in 2Q20), should also return to a more normal reading in 2H21.

The budget factor is important here as well. While previously the government promised RUB1.2trn local investments out of the National Wealth Fund over 2021-23 (in addition to the regular budget spending), now the scale of proposed investments has increased to RUB1.5trn, but it appears that the start of the projects are delayed till the next year. The difficulties with financing non-social projects in Russia are not new and related to the potentially high liability of the government's contractors in case of irregularities. The regular spending backlog of around 1% of GDP accumulated over the previous years is a good illustration. As a result, the expected quasi-budget support to the producer side may support the mood in the state-driven sectors, but execution will remain the key factor of uncertainty.

Figure 3: Producer side is moderating, expecting further state support

GDP and CPI forecasts have upside potential

The additional social payments of August-September did not come as a surprise and are largely incorporated into the current view on the Russian economic activity, inflation, and the budget balance. Meanwhile, the strong recovery in the local labour market and household income (ahead of the pre-election paychecks) suggests that our 3.8% GDP growth expectations for 2021 (which are in line with consensus) have some room for improvement, in case our fears of additional lockdowns in 4Q21 amid sluggish vaccination rate fail to materialise.

On the negative side, the current CPI trend, including the surprising acceleration in inflation from 6.5% YoY in July to 6.7% YoY as of late August (final monthly figure to be released on 8 September) amid the strong local labour market and global wave of cost inflation suggest that our CPI expectations of 5.7% YoY for 2021 can prove too optimistic.

At the same time, the current GDP and CPI trends seems to be more in line with Bank of Russia's view, allowing us to maintain expectations of 25-50 bp upside in the key rate from the current 6.5% level until the year-end.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more