Russian CPI still on the rise, but lower than expected

Despite the lower than expected inflation number, the near-term inflationary trend, although upward-looking, is likely to fit into the central bank guidelines. Assuming no external shocks, we reiterate our call for a flat key rate of 7.5% in the medium term

| 3.5% YoY |

October CPI growthUp from 3.4% in September |

| Better than expected | |

CPI angling towards lower bound of central bank's target

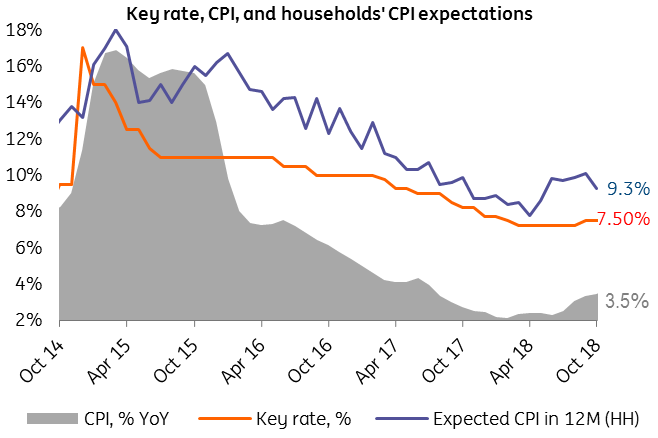

The acceleration of CPI in Russia from 3.4% year on year in September to 3.5% YoY in October was more modest than we and the market expected. The key reason for the positive surprise was the 0.5% YoY drop in the price of fruits and vegetables (4% of the consumer basket) in October after a 3.4% YoY spike in the preceding month, which is most likely related to this year's shifted seasonality. Excluding this volatile item, food price growth accelerated by 0.6 percentage points to 3.1% YoY, non-food price growth edged up by 0.1 pp to 4.1% YoY, and services accelerated by 0.2 pp to 4.0% YoY.

The small positive surprise in October doesn't cancel out the general upward CPI trend, prompted by the low base effect in the food segment, the 13% year-to-date depreciation of the rouble, and the upcoming hike in the VAT rate from 18% to 20% in 2019.

Our mid-term outlook on the rouble, CPI and the key rate is made under the assumption of external status quo which can not be guaranteed at the moment

Nevertheless, combined with the government's recent agreement with the oil sector to freeze the local gasoline prices until the end of March 2019, weakening GDP growth trend, and the improvement in households' inflationary expectations, it suggests actual CPI is unlikely to overshoot the central bank's 3.8-4.2% threshold at the end of the year and 6.0% in 1H19.

The case in favour of unchanged key rate strengthens

Overall, we see October CPI data and other recent developments supportive of our call, and expectations by some market participants for further rate hikes might be overly pessimistic.

The arguments in favour of hikes are also weakened by the fact that the Bank of Russia put the monthly purchases of FX on hold in mid-September and the liquidity surplus in the banking sector is shrinking at the rate of RUB500-600 billion per month causing an indirect tightening in the monetary conditions. This trend, however, has yet to translate into weaker lending activity, which so far has been gradually accelerating on the corporate and retail sides.

Unless external conditions deteriorate

At the same time, our mid-term outlook on the rouble, CPI and the key rate is made under the assumption of external status quo which can not be guaranteed at the moment.

In general, portfolio capital flows into emerging markets and into Russia specifically, which seem to determine the rouble's movements year-to-date, could potentially be negatively affected by any escalation in the US-Russia and/or US-China tensions. Today's US mid-term elections should be considered as the near-term watch factor, as according to our global strategists, a possible loss of Republican majority in the House could trigger a more hawkish US stance on the foreign policy.

It's worth remembering, the DETER and DASKAA bills that might come into consideration sometime after the US Congress comes back from recess next week, as well as chemical weapons-related sanction 'menu' to be considered late November, include a ban on non-resident participation in the placement of the new Russian state debt. Enforcement of such a measure could trigger deterioration of our market-related forecasts.