Russian activity: resilient in the face of the second wave

Despite the second wave of Covid-19, consumption resumed a recovery path in October, but this has come at the expense of a lower savings rate given increased underemployment. The corporate side appears stable, with construction volumes flat and corporate lending picking up. Yet we aren't building our hopes up for the year-end and 2021 numbers

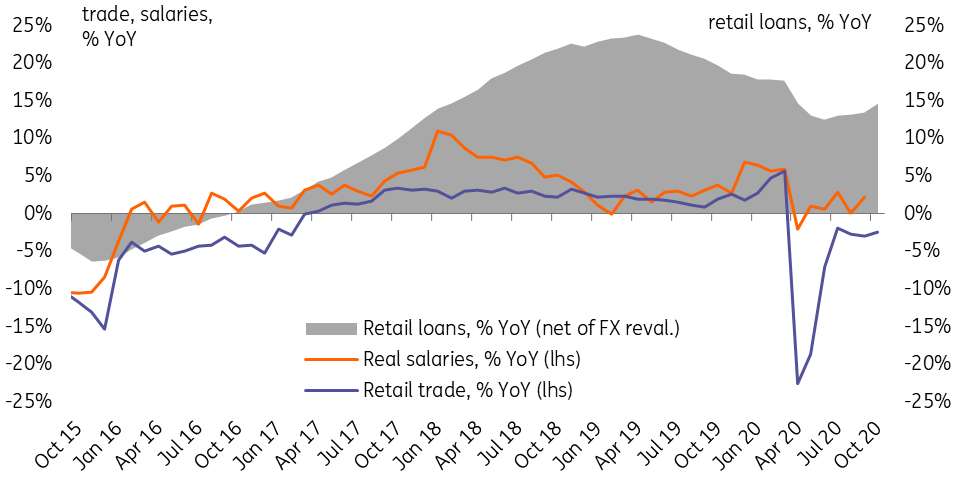

Retail trade growth continued to improve in October, with a drop of just 2.4% YoY being close to our above-consensus 2.5% expectations and better than -3.0% seen in September. The number is better than suggested by the high frequency mobility and transaction indicators, which have been pointing at the negative impact of the pandemic resurgence that started in early to mid-October. We have several explanations for the better-than-expected statistics:

- Given the lack of strict lockdown measures and the fact that targeted limitations focused on dining, entertainment and recreation venues, the core negative impact is likely to be focused on the services segment rather than food and non-food retail, which continued to recover in October.

- As we mentioned earlier, the local consumption trend remains affected by the outward tourism factor and the end of the tourist season (flights to Turkey reopened in August) could result in some repatriation of spending flows as of last month.

- The household income trend is not negative, with October salaries (data not available yet) likely to have been supported by a 3% increase in budget sector salaries (20-25% of the employed). September salary numbers exceeded expectations with a 2.2% YoY increase in real terms (versus 0.1% growth in August) based on improvements across various sectors, and social benefits supported by the fiscal policy. Unemployment was stable in October at 6.3%, which is positive. However, we remind that employment (70.3m people) is currently down 2.5% YoY, or 1.8m people, explaining the nearly 5% YoY drop in the real disposable income figure in 3Q20 and preventing material improvement any time soon.

- Looking at the banking statistics, it appears that the positive consumption data was supported by a decline in the savings rate, as retail deposit growth retreated to 6.3% YoY (net of FX revaluation) in October from c.7% in the previous four months. At the same time, retail trade growth accelerated 1.1ppt to 14.7% YoY, reflecting the continued positive effect of the subsidised mortgage programme, that has recently been extended into 2021.

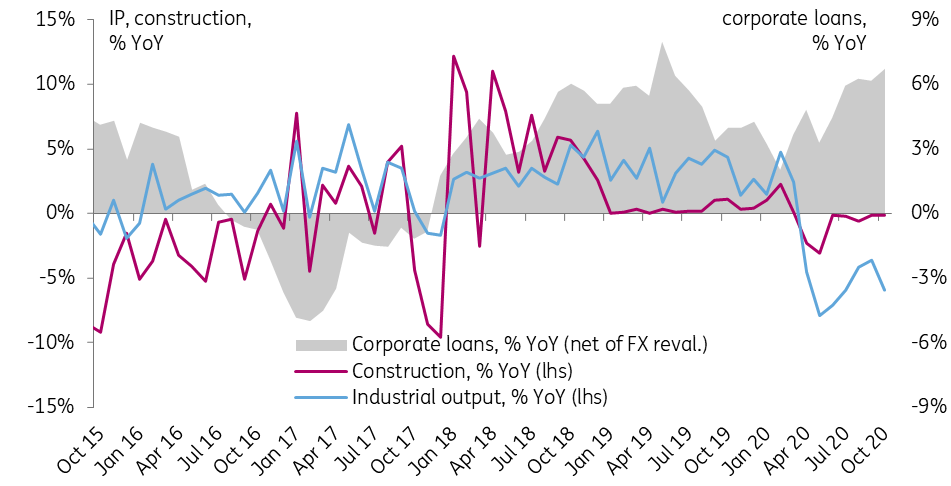

The corporate/producer trends appear stable as, in addtion to better-than-it-seems industrial production, construction remains flat. Surprisingly, the producer trend is increasingly supported by the banking sector, with lending to non-financial corporates picking up to 6.7% YoY (net of FX revaluation) in October, the fastest pace since mid-2019. Given that the banks were simultaneously occupied by financing the budget deficit (purchasing around RUB1tr of OFZ for a second month in a row), the pick up in corporate lending may signify some increase in corporate investment demand after the 2Q20 fall. According to data released by Rosstat, fixed investment growth improved from -7.6% YoY in 2Q20 to -4.3% YoY in 3Q20 (our estimate based on the officially released -4.1% YoY for 9M20).

Figure 1: Consumer trend is still on recovery path, now thanks to declining savings rate

Figure 2: Producer trend stable, corporate lending is picking up

October activity data suggests that the second wave of Covid-19 has not had a material impact on the recovery path so far, which strengthens the case against a cut in the key rate in the near term. Meanwhile, the challenges to further recovery include the increased reliance of consumer recovery on leverage and savings, below-potential employment, a generally cautious mood at the household level, and repositioning in the fiscal policy from infrastructure investments towards social support, restraining recovery at the corporate level. As a result, we reiterate our expectations of modest economic growth for 2021, which are likely to prevent the Bank of Russia from reversing its dovish stance in the medium term.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap