Russia to fully de-dollarise its sovereign fund - with little implication for the market

Russia announced a full de-dollarisation of the National Wealth Fund, which means selling US$40 bn in favour of gold, yuan, and euro. This will be done internally between the government and Bank of Russia. A further accumulation of FX as per the fiscal rule will continue to involve USD on the local market with subsequent conversion on external markets

Today, the Russian Finance Minister Anton Siluanov announced that Russia will fully de-dollarise the National Wealth Fund (sovereign fund), converting its remaining US$40 bn into Chinese yuan, gold, and euro within a month's time. The share of USD will drop from 35% to zero, while euro will go up to 40%, Chinese yuan to 30% and gold to 20%. While the ruble initially reacted positively to the news, we believe it to be neutral.

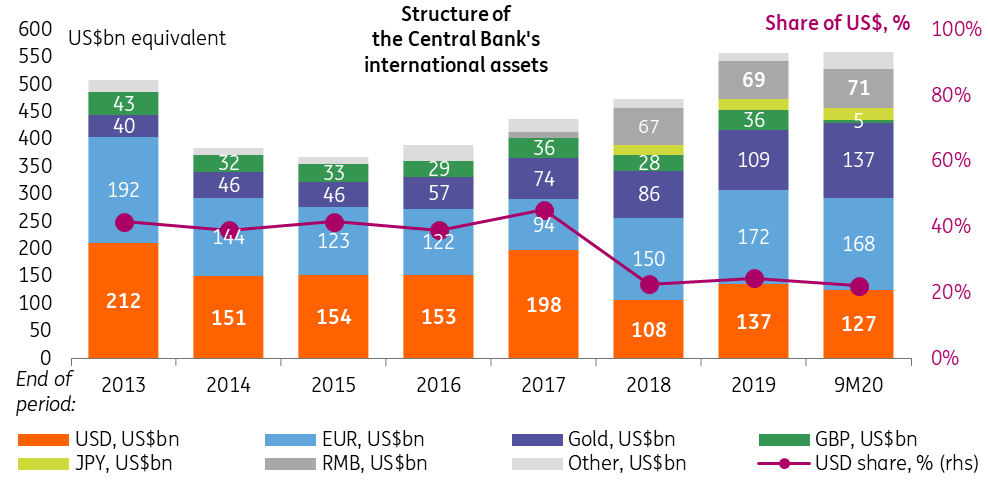

- The de-dollarisation is unlikely to involve any open market transactions. With the NWF essentially being an FX deposit with the central bank, the entire deal can be covered by the central bank's international reserves, which are larger and more diversified than the NWF (Figure 1). In order to reach the targeted FX structure, the Ministry of Finance has to sell US$40 bn and GBP4 bn, exchanging them for US$23 bn equivalent of gold, US$18 bn equivalent of CNY and US$5bn equivalent of EUR. As of the end of 3Q20 (latest available disclosure date) the Central Bank of Russia had EUR143 bn, US$71 bn equivalent of CNY, and US$137 bn equivalent of gold.

- We do not believe that MinFin's move to ditch the USD (apparently done in order to reduce exposure to foreign policy risks) will necessarily trigger de-dollarisation of CBR reserves (which would require external open market transaction). As of the latest available disclosure date, the CBR had US$127 bn of USD, or 22% of the total (Figure 2). First, according to international agreements, central banks are less exposed to sanction risks than governments, lowering the urgency to fully de-dollarise. Second, compared to other macro parameters, the share of USD in the Russian central bank's international assets already appears low vs. around 60% in Russian exports, 40% in Russian imports, 60% in Russian foreign debt, 45-65% in Russian international private assets, and 60% in global international reserves.

- As of current FX purchases (a further note will be released on this today), we doubt the local FX market has the capacity to directly accommodate the new MinFin structure. Local FX market turnover as of 2020 (Figure 3) was still dominated by USD (87%) with the rest being mostly EUR. In order to mirror the MinFin’s FX purchases, the CBR is likely to rely on USD and EUR on the local market, subsequently using external markets to convert it into the assets actually required by MinFin.

Figure 1: The Bank of Russia has an ample and diversified asset structure to accommodate MinFin's needs

Figure 2: USD accounts for around 20% of the CBR reserves

Figure 3: Local FX market allows CBR to buy only USD and EUR

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap