Russia suspends FX purchases to mitigate foreign policy pressure on the market

The Russian central bank suspended its FX purchases today, removing an extra $0.5bn of daily FX demand from the market. Due to foreign policy pressure the ruble exchange rate started to noticeably underperform other EM/commodity currencies. A change in the behaviour suggests that the market is starting to price in negative foreign policy scenarios

Bank of Russia suspends FX & gold purchases equivalent of around $0.5bn per day...

Today, Bank of Russia temporarily suspended its daily FX & gold purchases conducted within the framework of the fiscal rule. Prior to today's decision, the Central Bank was fully mirroring Minfin's off-market FX & gold purchases equivalent to RUB36.6bn per day announced for January this year. In practice, this means that while the Finance Ministry will continue the accumulation of liquid assets in the sovereign fund through off-market transactions with the Central Bank, the market FX interventions will stop. According to our estimates, starting from 14 January, the Bank of Russia bought RUB220bn worth of FX & gold out of RUB586bn announced for the 14 January - 4 February period (Figure 1).

Even though the Finance Ministry's FX & gold savings were fully de-dollarised in 2021, the market interventions by CBR were still conducted predominantly in USD given the latter's 85% share in the local FX market's average daily turnover. According to the Bank of Russia's data, the total daily turnover of all segments of the local FX market (including spot, derivatives, over-the counter and centralized exchange trading) averages at the equivalent of around $50bn. Therefore, the suspension of FX purchases by CBR is equivalent to around 1% of the total daily FX turnover. But the impact should not be underestimated, because of the constant direction of the CBR interventions.

Figure 1: Bank of Russia suspends market FX purchases, similar to August 2018

... responding to the foreign policy-driven market sell-off

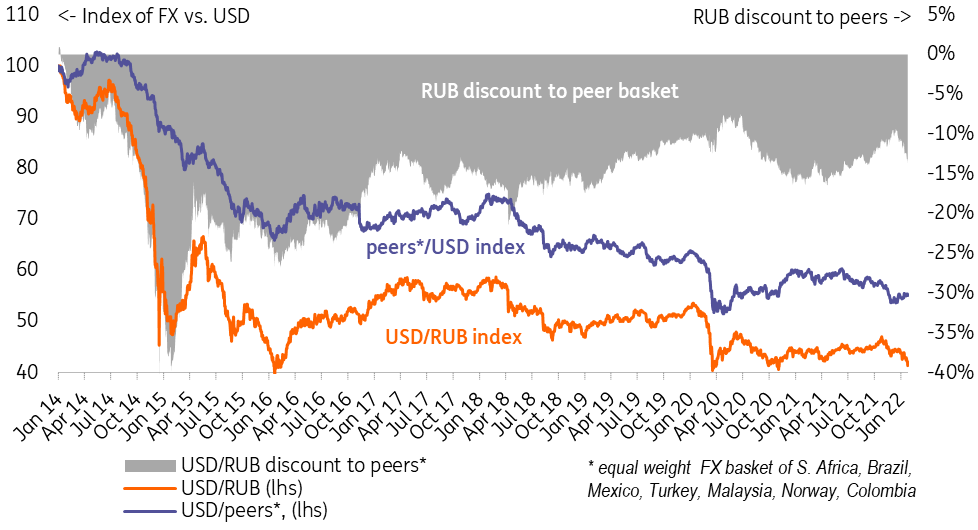

The CBR decision to suspend the FX purchases followed the logic of a similar decision made in August 2018, when the ruble exchange rate came under foreign policy-related pressure amid high oil prices. Over the period from August to December 2018 the CBR underbought around $32bn worth of FX, stabilising the ruble vs its peers (Figure 2). Once the market situation stabilised, the CBR started to gradually catch up on the FX purchase backlog in 2019-20 and later in 2020 netted it out with a similar FX sales backlog that emerged because of the specifics of the Sberbank equity handoff deal between the CBR and the government.

This time the ruble already depreciated to USD by 5.5% year-to-date despite the spike in oil prices to 3-year highs and peers' appreciation to USD by 0.7%. A rapid escalation of foreign policy tensions and increased sanction risks perception is embedded in Russian assets. The country-specific discount in USDRUB widened from 11% to 14%. This means that without the recent round of foreign policy tensions USDRUB would have been trading at around 74.0, RUB 5.0 stronger than the current market rate.

Until the recent several days, bond and equity markets were the main victims of the sell-off, while the FX market was relatively stable thanks to high oil prices and the need of local exporters to convert FX ahead of the tax payments which take place every second half of the month. While we believe the support from the local exporters is still there, it may now be not longer strong enough to offset capital outflows. According to our estimates, non-resident holders of OFZ (local currency public debt) sold $0.7bn worth of papers last week after a flat start of the year. We also believe that the local private capital outflow must have accelerated materially: a net outflow of $15-20bn should not be excluded for January, as only that sum would be strong enough to offset the current account surplus of $15-20bn also expected for this month on seasonality and oil prices. Such balance of payments configuration suggests that the local corporates, households, and foreign investors may be starting to price negative foreign policy scenarios, that are outside our constructive base-case.

Figure 2: Ruble's discount to peers widened by 3 percentage points year-to-date

FX volatility ahead, longer-term trend to be determined by foreign policy

We welcome the CBR decision to suspend the FX purchases that otherwise would have sterilized around 50% of monthly current account surplus in 1Q22. However, the capability of this measure to assure a confident ruble recovery should not be overestimated given the mounting foreign policy uncertainties at this point as well as global jitters regarding potential Federal Reserve actions.

Russia's macro insulation from adverse foreign policy scenarios have greatly improved since 2013 thanks to the CBR's transition to inflation targeting and free-floating ruble regime, decline in the fiscal breakeven Urals from $115/bbl to $65/bbl, presence of 12% GDP-large sovereign fund, modest public debt at 17% GDP, reduction of the non-resident share in the OFZ market from 24% to 19%, increase in the share of non-fuel goods from 33% to 50% of merchandise exports, increase in the CBR reserves from 22% to 37% of GDP (to 1.3x of total foreign debt), decline in the share of the US and EU in exports from 47% to 38%, decline in the USD share of exports from 80% to 56%. We also note that unlike 2014, commodity prices are strong and sanctions are no longer 'black swans' for Russia. That is why regardless of the foreign policy developments we find the repetition of 2014 scenario of a widening in the RUB's country discount to peers to 40% to be unrealistic.

Nevertheless, as we mentioned earlier, the insulation from new sanctions under discussion (from ban on foreign participation in the new sovereign debt, leading to lost annual portfolio inflows of around $5-10bn - to cut-off from dollar transactions for financial institutions accounting together for up to 70% of Russia FX balance sheet) would not be bullet proof. Our base-case scenario of the ruble's return to USD 70-75 (within 10% discount to EM-commodity peers) is becoming more remote and dependent on eventual de-escalation on the foreign policy front. Outside the base case, long-term ruble performance will be event-dependent, with a very wide 15-25% range of eventual RUB discount to peers.