Russia: State of the Nation - more about the state

The budget will remain socially focused, local business climate still needs to find ways to overcome administrative challenges and prospects of an easing foreign policy remain unclear - these are our three main key takeaways from President Putin's presidential 'State of the Nation' address yesterday

The primary focus of this year's presidential address was social policy. According to media reports, almost 48% of the President's speech was about issues related to social benefits, combating poverty, indexation of pensions, healthcare, education and budget sector salaries, which is four times more than last year. We think this change of focus is an attempt to partially compensate for the impact of the unpopular decisions to hike the retirement age and VAT rate, as well as to address the negative demographic trends.

The list of announced measures is long and includes targeted benefits for families with several children, higher disability benefits, subsidies to mortgages, higher payments for regional doctors and teachers, higher pension indexations. The additional cost of these initiatives to the budget appears modest, as the first deputy prime minister and finance minister, Anton Siluanov estimated the presidential package at RUB 100-120 billion per year, which is 0.5% of the annual federal expenditures and 0.3% of the annual consolidated budget spending, which suggests, budget stability remains a priority. Given that the budget execution keeps bringing positive surprises on the non-oil revenue side in 2018 and early 2019, the announced extra social spending is unlikely to become a burden.

The current rhetoric suggests households high dependence on state injections is here to stay and might even increase if they require additional support

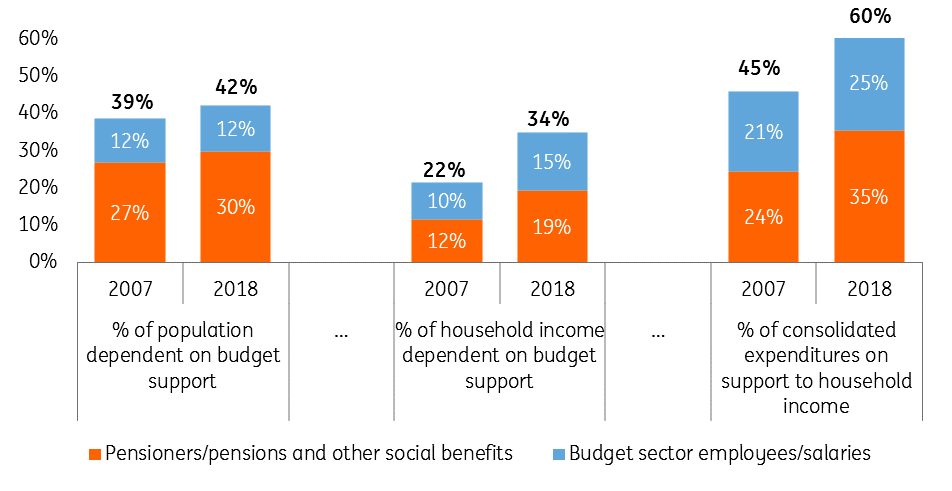

At the same time, the presidential address confirmed, that the direct support of the household income remains the primary reaction to the deteriorating consumption trend. According to our estimates, thanks to the indexation of state salaries in healthcare, education, military and state administration, as well as growth in pensions and other social benefits, the share of household income directly dependent on budget expenditures increased from 22% to 34% over the last 11 years.

Conversely, the share of consolidated budget expenditures channelled to support household income went up from 45% to 60%. The current rhetoric suggests households high dependence on state injections is here to stay and might even increase if they require additional support.

Social focus of the Russian budget policy

The challenges to business climate the investment community has been focused on in recent days due to the prosecution of top managers of an investment fund, accounted for only 7% of the President's speech, and included proposals to create a digital platform that would allow businesses to publicly report cases of administrative pressure or unfair prosecution. President Putin also reiterated his long-lasting push towards de-criminalisation of the legal framework for economic activities.

Two key questions are if the government manages to stay within the spending guidelines and if state investments result in broader-based investment growth

Another topic related to the business environment was 'state investments' into infrastructure, which accounted for the remainder of the 10% of the speech, confirming the priority of large state-sponsored projects. According to our estimates based on previously announced parameters of the national projects, the government will spend RUB 14 trillion in the next six years (1.0-1.5% of GDP per year) on infrastructural projects in transportation, IT and urban development. The projects have already been budgeted into the spending program and don't represent a threat to budget stability.

However, the two key questions are if the government manages to stay within the spending guidelines and if state investments result in broader-based investment growth, as the infrastructure related to football championship, Crimea, and oil & gas sector failed to do so in 2018.

Lastly, according to media reports, foreign policy and military were given far less attention - down from 36% to 14% this year. This change of tone seems to correlate with the normalisation of Russia's military spending from the post-Soviet high of 4.4% GDP in 2016 to 2.7% GDP in 2018, which is below the 12-year average. At the same time, it remains unclear if the tone and content of the President's address provide any grounds for easing foreign policy tensions anytime soon.

Given the upcoming conclusion of the Robert Mueller investigation next week and the re-introduction of DASKA act, envisioning sanctions against the new state debt and banks, foreign policy uncertainties surrounding Russian assets are likely to persist at least in the near future.

Download

Download snap22 February 2019

In case you missed it: Hoping for stability This bundle contains {bundle_entries}{/bundle_entries} articles