Bank of Russia delivers a 100bp hike but the signals become less hawkish

The Bank of Russia raised its key rate by 100 basis points to 8.5%, in line with expectations. The commentary remained hawkish, but the tone became a bit softer, as apparently the bank's view on supply chain disruptions has improved. The end of the hike cycle is not guaranteed, but not excluded if CPI expectations stabilise in the coming months

| 8.50% |

Russian key rateA 100 bp hike |

| As expected | |

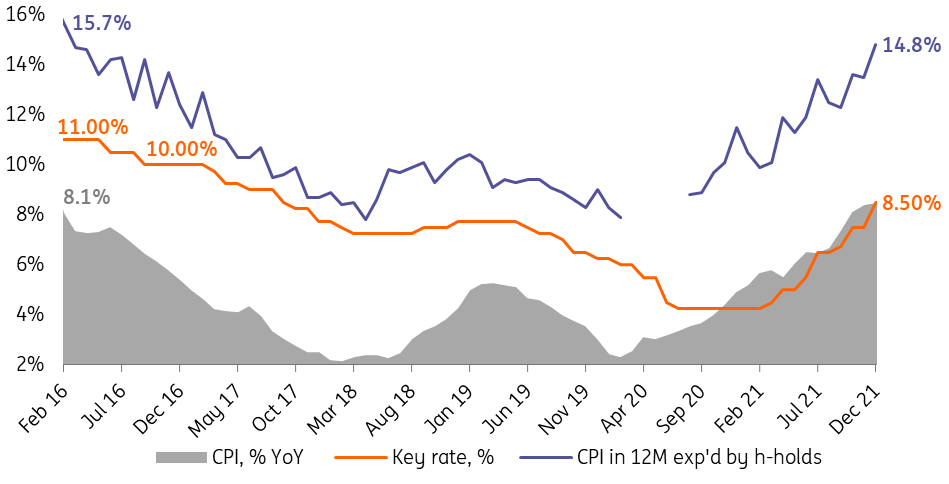

The Bank of Russia's 100 basis point hike came in line with our and market expectations. The stabilisation in the weekly and annual CPI inflation rates seen at the beginning of December was outweighed by the recently reported deterioration in the 12M inflationary expectations by households, as we show in the first chart below.

The tone of the commentary remained hawkish, but the commentary became a bit softer.

Quotes on the hawkish side:

- the balance of risks for inflation is markedly tilted to the upside, inflation is developing above the Bank of Russia’s October forecast, indicators reflecting the most sustainable price movements still appreciably exceed 4% (annualised)

-

Households’ inflation expectations went up again in December to a fresh five-year high. Recent data also indicate that businesses’ price expectations are holding close to multi-year highs. Analyst expectations for 2022 have increased slightly, but are anchored close to 4% for the medium term. - this is the first time the Bank of Russia has indicated a change in analysts' expectations

-

Bank of Russia reiterated its challenging committment to bringing down CPI to 4.0-4.5% by the end of 2022.

Softening of the tone vs. October press release:

- The CBR view on global supply chain disruptions seems to have been improved, as now they are seen not as pro-inflationary risks but factors potentially hampering an inflation slowdown. Moreover, the list of disinflationary risks has been widened to incorporate a faster — relative to the baseline scenario — normalisation of production and logistics chains in the Russian and global economies

- The expectations of further multiple increases of the key rate voiced in the October statement have been replaced with being open to the prospect of a further key rate increase (singular) at upcoming meetings.

Based on the current communication, the scope for further increases is 0-50 bps.

Key rate up 100 bp, as deterioration in inflationary expectations outweigh some recent stabilisation in CPI

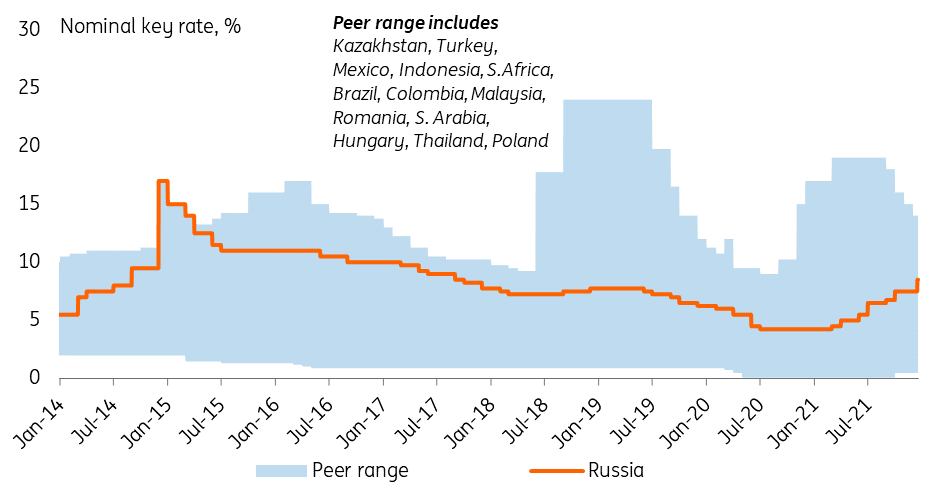

Russia is now in the mid-range of peers in terms of nominal key rate...

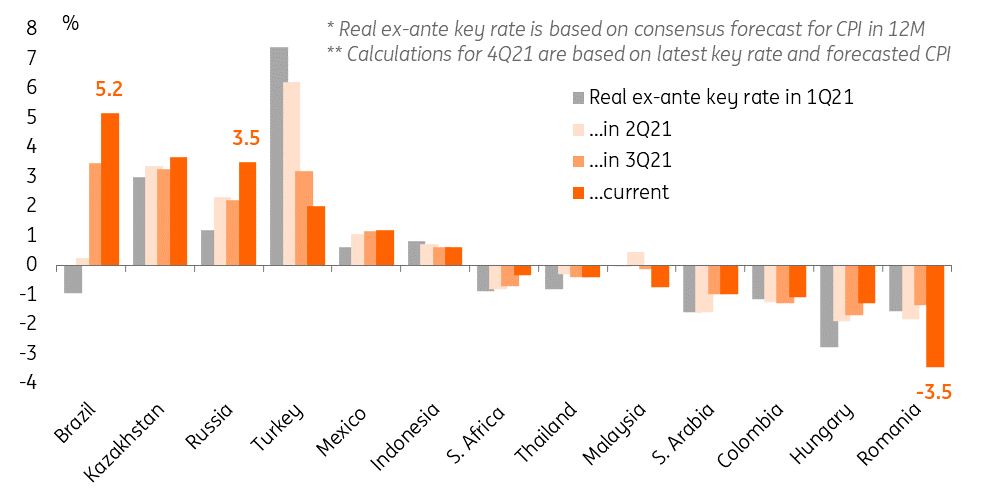

...and close to the top in terms of real rate, based on expected CPI

Today's key rate decision and the commentary should be largely neutral for debt and FX markets. The cautious tone of the commentary and the Bank of Russia's reiterated commitment to achieving 4.0-4.5% CPI by the end of next year suggests that further rate hikes remain a possibility, but the slight softening in tone indicates that the upside should be limited to 50 bps from the current level. Meanwhile, assuming the stabilisation of CPI and expectations in the next couple of months, which is our base case assumption at the moment, a flat 8.5% key rate is a possibility. In any case, any easing in the key rate approach is unlikely to be seen at least until the second half of next year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap