Russia intensifies net foreign debt redemption in 3Q

Russian companies and banks reduced their foreign debt by US$15bn in 3Q18, rolling over just 20% of the principal scheduled for redemption. This is the lowest quarterly refinancing ratio since 2014 and may indicate the corporates' preference to reduce foreign debt exposure amid increased external uncertainties

| $15bn |

3Q net redemption of corporate foreign debt($25bn YTD) |

According to the fresh CBR data, the Russian corporate sector, including banks and companies, has lowered its nominal foreign debt by $19 bn in 3Q18 to $409 bn. Adjusted for the FX revaluation affecting the non-USD portion of the foreign debt (40% of the corporate foreign debt is RUB- and EUR-denominated), this translates into US$15bn net redemption over the last quarter. This figure is higher than the US$10bn we expected (Russia 3Q BoP) and appears large for the following reasons.

- It is higher than the US$10bn seen in 1H18, and it brings the 9M18 figure to US$25bn, which is comparable to the annual net redemption seen in 2016-2017.

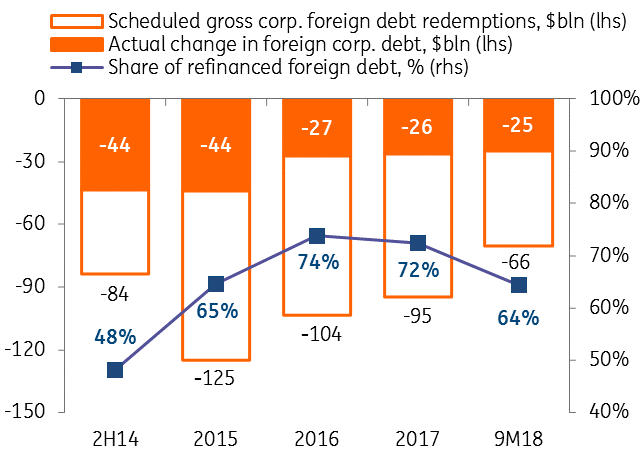

- Comparing this number with the gross redemption schedule also available from the CBR, it shows that the corporates refinanced only 20% of the gross foreign debt due in 3Q18, much lower than the 80% seen in 1H18 and 65-74% in 2015-17.

- More intense corporate foreign debt redemption was seen only in 2H14 - right after a number of large Russian companies were added to the OFAC's SSI list.

We see the more intense foreign debt redemption as a possible reaction to the increased external policy uncertainties for the Russian corporate sector since April this year.

Corprorate foreign debt redemption: net vs gross

The decline in the corporate foreign debt is the key component of the net private capital outflow, which totalled US$19bn in 3Q18 and US$32bn in 9M18. According to the CBR data, US$26bn repayment is due in 4Q18 and US$50bn is due in 2019. Therefore, the ability and willingness of the corporates to refinance their external liabilities will be the key prerequisite for the net capital outflow staying within the CBR's forecast range of US$27-38bn for 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap