BriefING Romania

Strong October 2020 auction

EUR/RON

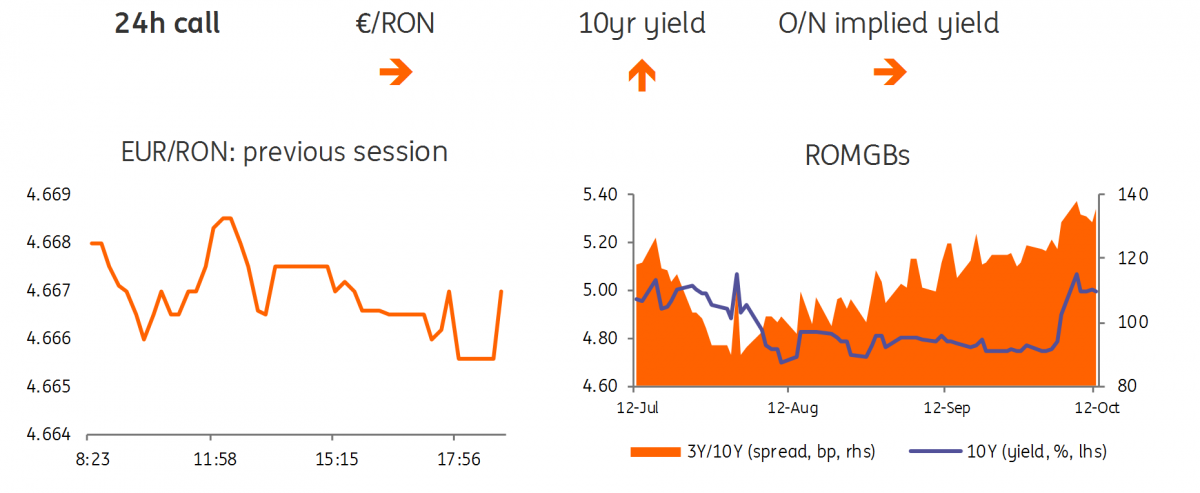

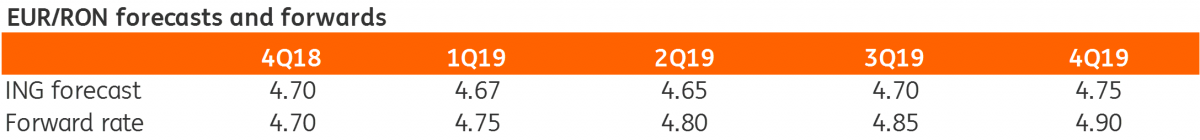

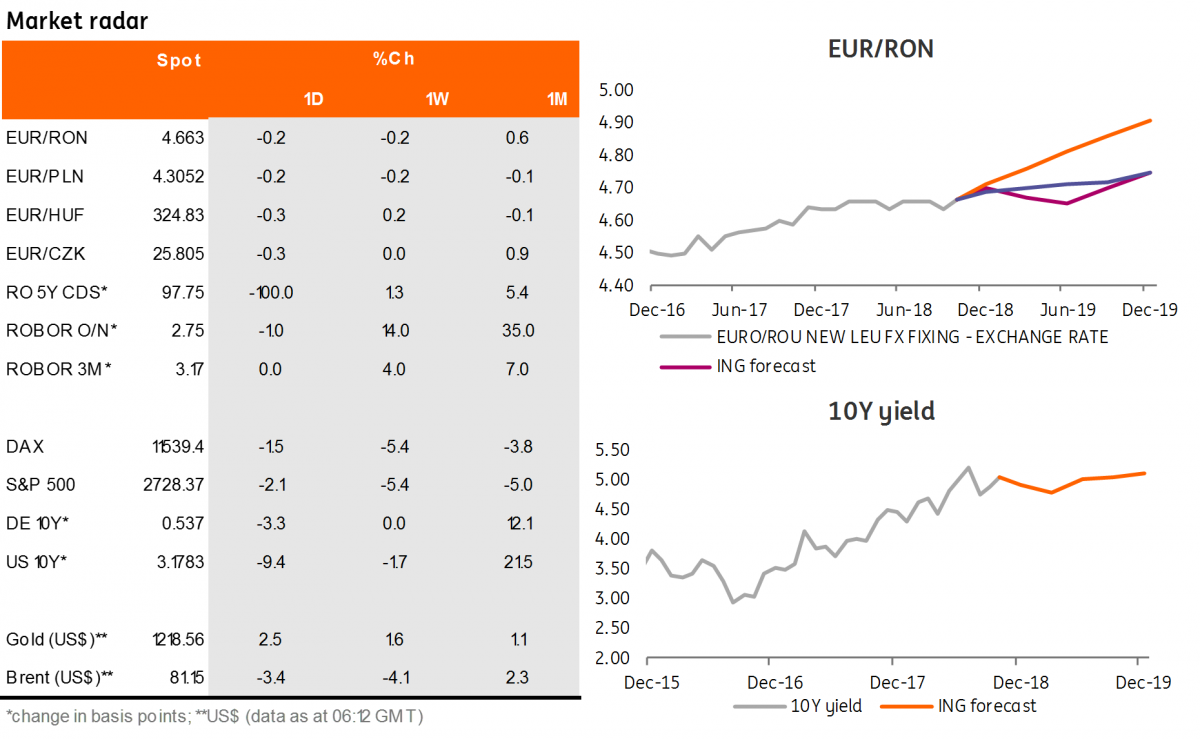

The EUR/RON traded very quietly again yesterday, moving within a tight 30 pips range around 4.6650 throughout the day, against our call for an upside test. Global sentiment seems to have improved overnight, hence a re-test of the 4.6700 level could be set aside for now.

Government bonds

The Oct-2020 auction has been the highlight of the day for the ROMGBs market as the Ministry of Finance nearly doubled the initial RON500 million target, allocating RON953 million from a RON1.38 billion total demand. Yield-wise it came in line with our call, at a 4.07% average and 4.10% maximum but this could obviously have been better had the MinFin stuck to the initial 500 million target. Otherwise, a rather dull market which closed broadly flat versus the previous day.

Money Market

Cash rates continued to point to a comfortable liquidity situation in the money market, trading flat around 2.85%. Uncertainty regarding the National Bank of Romania's liquidity injections was better reflected in the longer tenors which continued to see some paying interest as the curve flattened, with 1M implied yield shifting towards 3.40% and 1Y at 3.85%. In the end, it all seems to be FX dependent as the NBR still looks determined to protect the Romanian leu at the expense of higher interest rates, if needed. The minutes of the last NBR rate-setting meeting mentioned that “the continued relative stability of the EUR/RON exchange rate over the recent months” is “most likely attributable to the considerable differential of interest rates on the local market versus those prevailing in Europe and regionally.”

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap