Russia: Corporates are back to foreign debt redemption

Russian corporates reduced foreign debt by US$11bn in a tumultuous 2020 after a steady 2019. Still, with 89% of the debt refinanced, foreign debt redemption is not a material pressure factor for the ruble. The large drop in non-debt foreign liabilities was more important, but this appears to be a one-off so far

Corporate sector has reduced foreign debt by US$11bn in 2020 after keeping it flat in 2019

The Bank of Russia released its first estimate of the foreign debt as of year-end 2020, which gives additional cover to the general balance of payments data we covered earlier. In general, the numbers support our take, that the structure of the capital outflow changed last year. We have the following observations:

- Nominal corporate foreign debt (of banks and non-financial companies) remained flat at US$390bn in 4Q20. However, as up to 45% of the corporate debt is denominated in EUR and RUB, the seemingly flat performance of the headline US$-denominated number should be adjusted for the global US$ depreciation that took place during 4Q20. As a result, we estimate that the Russian corporate foreign debt actually declined by US$11bn in 4Q20 after a flat 2019 and 9M20.

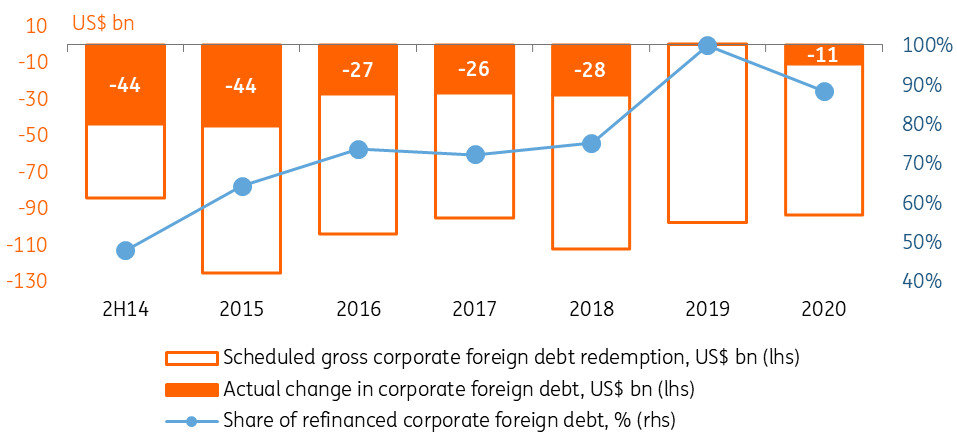

- The full-year net corporate foreign debt redemption of US$11bn suggests that around 89% of the debt scheduled for redemption last year has been refinanced. This is obviously lower than 2019, when there was no net redemption, but higher than the 48-75% rate seen in the sanction environment of 2014-18 (Figure 1). It appears, that the corporate sector resumed its risk-averse behavior amid the global uncertainties of 2020 and persistent foreign policy risks. Still, a low double-digit decline in the corporate foreign debt is not a material pressure factor for the balance of payments, given the current account surplus of US$32.5bn in 2020 and its likely expansion to US$40-50bn this year.

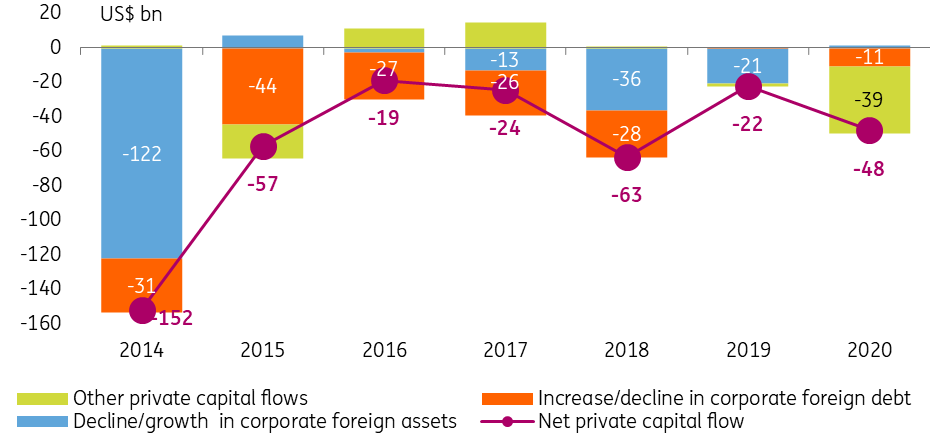

- In 2020, the composition of the net private capital outflow from Russia changed materially (Figure 2). If in 2019, it was fully assured by the accumulation of foreign assets, which we took as a sign of low local investment demand, in 2020, foreign debt redemption contributed to 23% of the capital outflow. Still, it does not explain the material acceleration of the latter from US$22bn in 2019 to US$48bn in 2020.

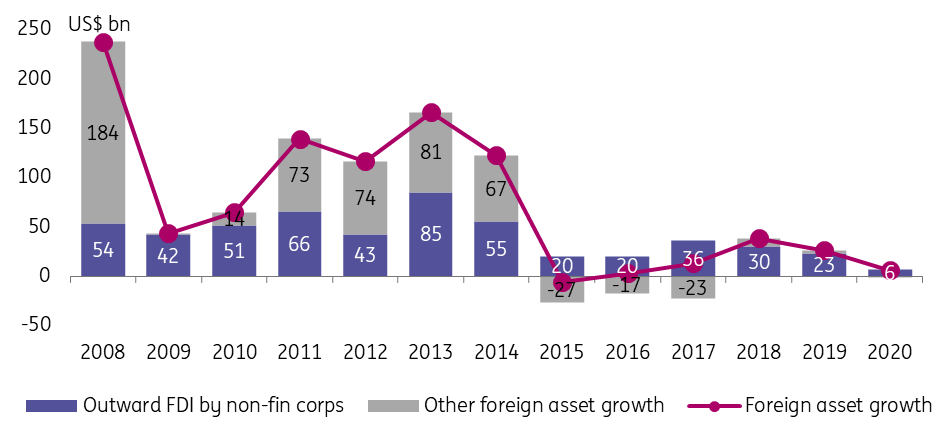

- It appears, that the US$36bn drop of non-debt foreign liabilities (equity foreign direct investment (FDI) and portfolio investments into banks and non-financial corporates), the largest since 2008, was the key pressure factor for Russia's capital account in 2020 (Figure 3). On the positive side, such drops are symptomatic of crisis years (2008, 2014-15), and the equity support from abroad historically tends to recover in the aftermath of a crisis. At the same time, the revision of double taxation treaties with countries accounting for around 50% of Russia's stock of FDI, is clouding the outlook for 2021.

- On another positive note, the appetite to accumulating foreign assets, which was the primary cause of our concern in the previous years, seems to be declining (Figure 4), however, without a structural improvement in the investment climate this process may resume along with expansion of the current account surplus.

Figure 1: Corporate sectors back on deleveraging track in 2020

Figure 2: Foreign debt redemption explains around 23% of the net private capital outflow for 2020

Figure 3: In 2020, non-debt foreign liabilities saw the largest drop since 2008

Figure 4: Appetite for foreign asset accumulation seems to be declining

The persistent global uncertainties, low local investment demand, and sanction risks may force the corporate sector to resume moderate deleveraging this year, however, this trend is unlikely to put much pressure on the ruble as long as the FDI trend recovers.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap