Russia: Consumption recovery stalls in September

The 3.0% YoY drop of retail trade in September underpins the halt in the post-Covid recovery, which we also observe on the corporate side. The good news is that the hiccup in consumption likely reflects a higher savings rate rather than a deterioration in the income trend. The bad news is that consumers may remain cautious well into 4Q20

| -3.0% |

September retail trade, % YoYdown from -2.7% YoY in August |

| Worse than expected | |

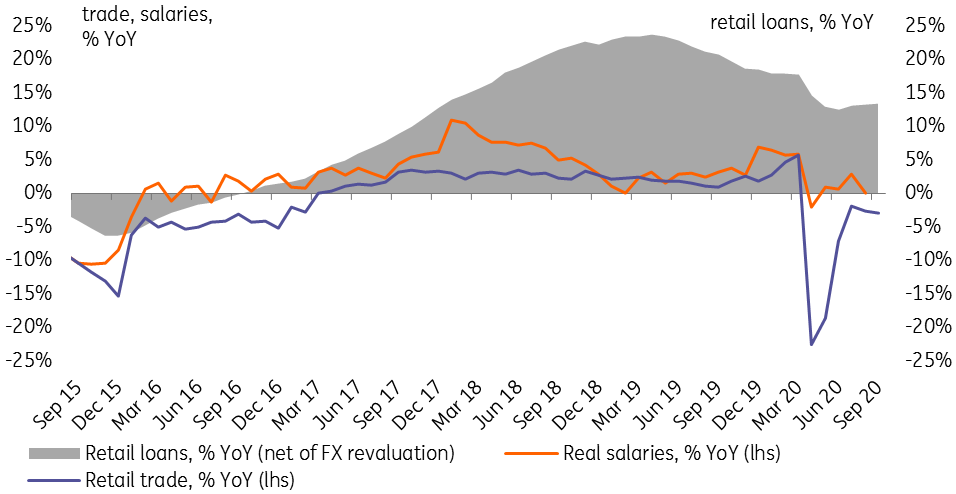

Consumption recovery keeps stalling

In September, retail trade was down 3.0% year-on-year, which is a deterioration compared to the 2.7% YoY drop seen in August, and a disappointment relative to both the -2.1% YoY consensus and our more cautious -2.5% YoY outlook. Here are the main observations:

- We do not take the deepening retail trade drop in September as a sign of material deterioration in consumer strength. To remind, the opportunity to travel to Turkey and several other resort destinations has been reopened to Russians since mid-August, which may have resulted in a 2-4 percentage point drag on the local demand.

- Income trend remains in check, with the unemployment rate dropping unexpectedly by 0.1ppt to 6.3%, with the number of officially employed staying flat at 70.5 million. Real wage growth in September disappointed but remained positive at +0.1% YoY after +2.9% YoY in August (the latter number has been upgraded from 2.3%). The real disposable income drop recovered from -8.0% YoY in 2Q20 to -4.8% YoY on massive social support: non-pension social benefits were up 40-45% YoY in 3Q20, and the overall budget fulfillment despite moderation in spending growth remains socially focused. Overall social benefits (including pensions) account for around 22% of the household income structure. We suspect that income from entrepreneurship (SMEs) and property, which normally accounts for 10% of household income, remained a drag on the statistics.

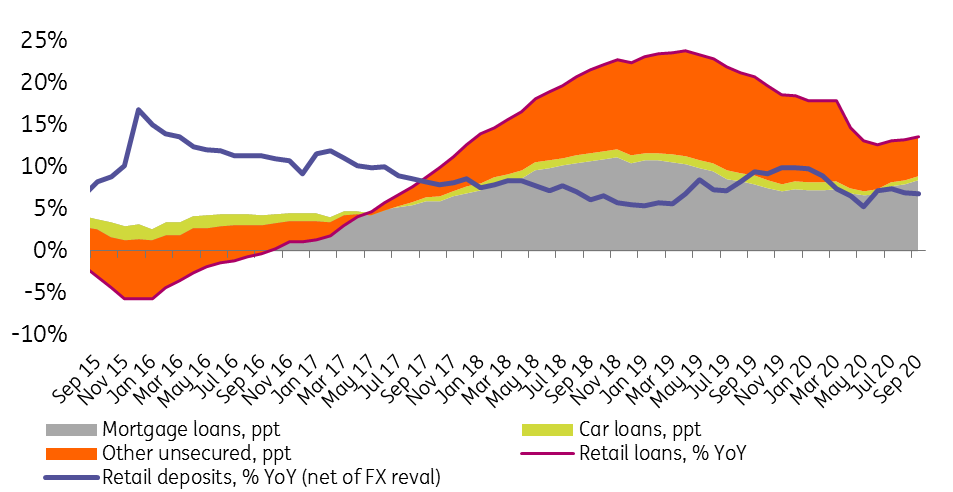

- Consumption remains supported by the banking sector. Retail lending continued to accelerate in September, largely driven by the mortgage segment, but consumer loans, according to Bank of Russia data, are also growing, which should be supportive of retail trade.

- In part, the September hiccup in retail trade may reflect an increasing savings rate. Retail funding base also did not deteriorate, with ruble deposit growth accelerating from 10.5% YoY in August to 10.8% YoY in September, and overall retail deposits growing 6.8% YoY (net of FX revaluation), in line with August. Households sold around US$0.6 billion of FX in September amid RUB weakness, but at the same time bought around US$0.8bn of equities, exceeding the August number. Overall, Russian households bought around US$5.0bn worth of equities in the last 12 months (vs. around US$0.7bn for the whole 2019) suggesting excess savings in the affluent household segment. According to our estimates, around US$37bn this year will be saved by local households on the lack of outward tourism, with only 50-70% of that sum channeled into local consumption, with the rest saved or invested.

Figure 1: Consumption recovery stalls in September

Figure 2: Retail loans and deposts growing steady

The key concerns regarding consumption are forward-looking, as the jitters related to the second wave of Covid and gloomy mood in the corporate sector may keep pressuring consumer confidence in 4Q20. With a 4.8% YoY drop for 9M20, our -4.0% expectations for the full-year is at a moderate risk of underperformance. Uncertainties regarding the medium-term growth trend should be an argument for the Bank of Russia to maintain its dovish stance at the upcoming 23 October meeting.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap