Russia: Industrial production shows no improvement in September

Russian industrial output numbers for 2019 and 8M20 received a noticeable backward-looking boost from the national statistical service, but the September 2020 number of -5.0% looks like a disappointment relative to the new dataset. Metals extraction and processing appear to be the weak link

Any comparison of September's 5.0% year-on-year drop of industrial production to consensus would be irrelevant given that this release has been accompanied by a massive backward-looking revision of the dataset starting 2019 – which is a part of Rosstat's (the national statistics service) regular routine of expanding the data inputs. Overall, the new data paints a better picture of the IP performance in 2019 and in 8M20 than previously believed, but compared to that the most recent September data looks like a disappointment. Extraction and processing of metals seems to be the primary source of the negative surprise in September, which may be a reflection of demand concerns amid the new round of global growth fears and the moderation of the local fiscal support we discussed recently.

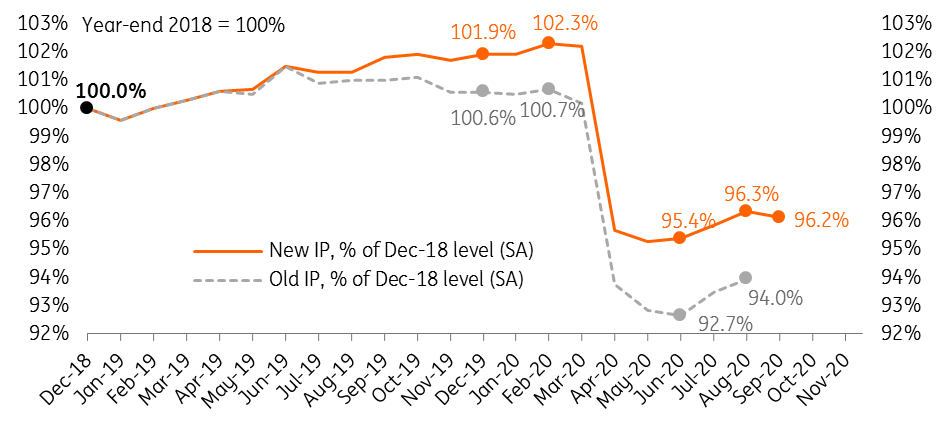

- The seasonally adjusted monthly growth data (Figure 1) suggests that the industrial output was showing stronger performance than initially believed in 2019, and the drop in 2020 appears to be shallower than reported up until recently. This relative strength in 2020 despite the higher statistical base of 2019 is a positive surprise, leaving scope for an upward revision in the GDP performance for 2019 by 0.3ppt and for 8M20 by 0.4ppt. However, outside the area of statistics this is largely neutral. The September 2020 seasonally-adjusted monthly performance is negative, which is in line with the recent deterioration in the PMI reading in Russia and other CEE countries.

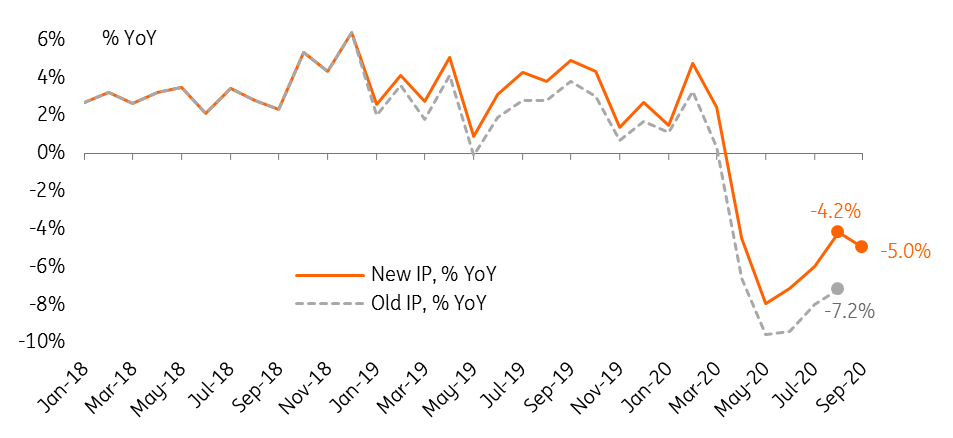

- This backward revision is mirrored in the YoY growth statistics, which are more closely followed by the market (Figure 2). The -5.0% YoY result for September is a deterioration relative to the upgraded -4.2% YoY reading for August. We are particularly surprised by this, as the September growth numbers should have benefited from the favourable calendar effect (September 2020 has one working day more than September 2019), while August and July this year suffered from the opposite effect.

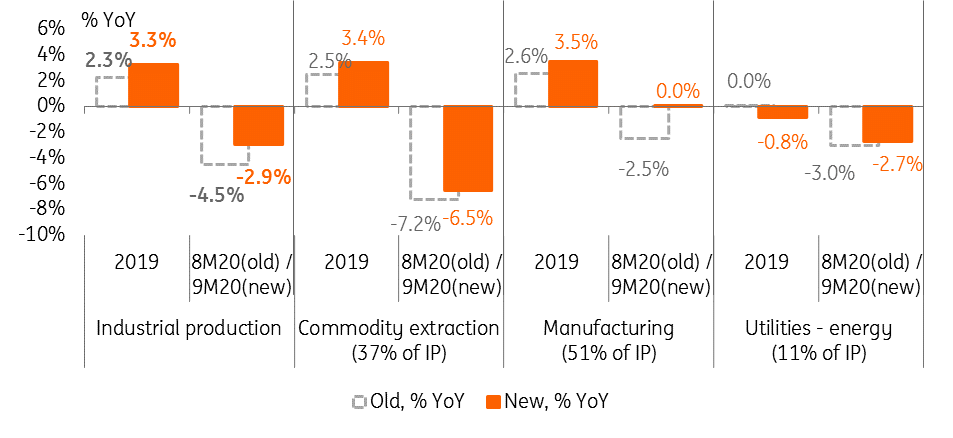

- Looking at the composition of the 2009 and 8M20 upgrade of the industrial output dynamic (FIgure 3), it appears that it was broad-based, with manufacturing being the primary driver, followed by commodity extraction. Together, those two segments account for 88% of the industrial output. However, looking at the September 2020 figures, it appears that a number of subsegments in the new dataset showed weak YoY performances even relative to the unrevised August numbers (which obviously set a low bar). These include extraction of metal ore (-2.6% YoY in September vs. +0.8% YoY in August) and manufacturing of finished metal goods (-0.8% vs. +5.7%).

Figure 1: Seasonally-adjusted levels show stronger IP performance in both 2019 and in 8M20

Figure 2: September 2020 confirms moderation in the post-Covid recovery

Figure 3: Manufacturing was the key driver of the backward-looking upgrade

The noticeable upward revision in the industrial output dynamic to -2.9% YoY for 9M20 makes our full-year IP target of -4.5% easy to outperform, and gives more credit to our optimistic GDP expectations for 2020 (a drop of 2-3%). Meanwhile, the negative surprise for September suggests fragility of the post-Covid recovery to global growth concerns and to fiscal consolidation. The risk of negative surprises on the activity side in 4Q20 may serve as an additional argument for the Bank of Russia to maintain its moderately dovish signal for the medium-term at the upcoming monetary policy meeting, regardless of the near-term key rate decision.