Russia balance of payments: mostly supportive of ruble

A higher-than-expected current account surplus of US$8.7bn and portfolio investment inflow of US$2.3bn are the two key positives from the July balance of payments. This allows the ruble to defy the seasonality and perform better than its peers. However, the elevated private capital outflow and global uncertainties remain risks factors in the near term

July balance of payments: strong current account and portfolio inflows vs. local capital outflow

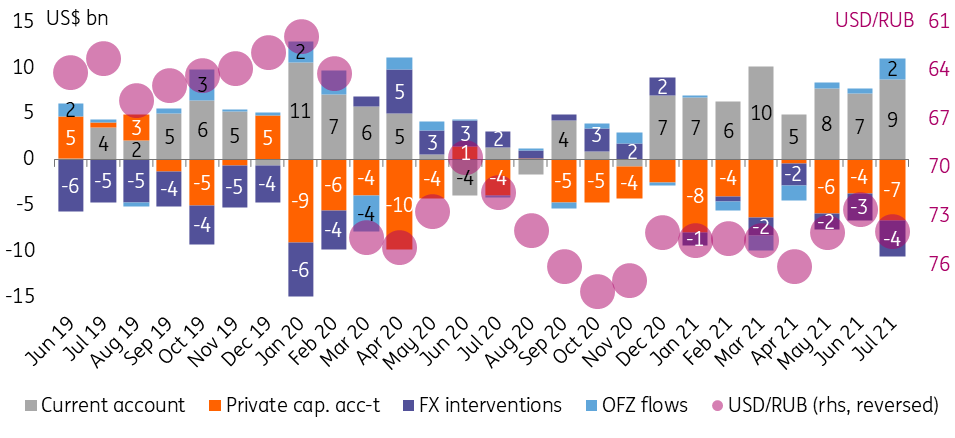

The Russian balance of payments data for 7M21 suggests that the monthly current account surplus widened from US$6.6bn in 2Q21 to US$8.7bn in July (and US$51.7bn in 7M21), exceeding our expectations of US$6-7bn and outnumbering the local net private capital outflow, which totaled US$6.6bn in July and US$34.9bn in 7M21. We have the following observations and takeaways:

- Widening of the current account surplus in July is a positive result, given the relatively flat oil price performance and reopening of several popular summer tourism destinations, including Turkey. It points at a possible increase in volumes of fuel exports and continued strong performance of non-fuel export items. To remind, there is easing in the OPEC+ restrictions starting in August, which should also be supportive of the current acount until the year-end. Our full-year current account projections of US$65bn for this year have a scope for increase, but the fast growth of merchandise imports remains a constraining factor.

- The July current account was only partially sterilized by the FX purchases, which totaled US$4.0 bn in July and were announced at US$4.3bn for August. We continue to believe, that the strong non-fuel component of the current account, especially as the period of annual dividend payments by the large corporates is over, lowers the importance of FX purchases for the balance of risks for the ruble until 4Q21, when some narrowing in the current account is possible. At the same time, our expectations of a reduction in the annual FX purchases by up to US$10bn this year failed to materialise, as the government indicated that the financing of the domestic infrastructure projects out of the sovereign fund is likely to be postponed till 2022.

- Another positive point is that according to the preliminary estimates by the National Settlement Depository, the portfolio inflow into the local currency public debt market (OFZ) increased from US$0.6bn in June to US$2.3bn in July (the highest since pre-pandemic February 2020), with inflows continuing into August. This is the result of the continued tightening in the Bank of Russia's monetary policy stance and lack of negative events on the foreign policy front.

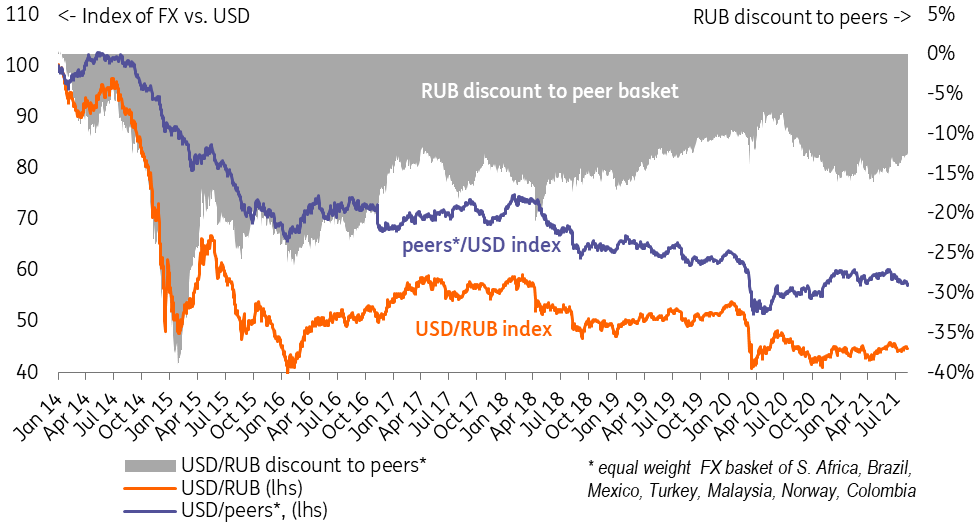

- The strong current account and portfolio inflows assured the ruble's relatively strong performance vs. peers, as its discount narrowed from 14% in June to 13% in July, the lowest level since October 2020. At the same time, that did not prevent the ruble's depreciation vs. USD due to the latter's strong performance globally and Russia's continued net capital outflow from the private sector, which according to the Bank of Russia is driven by the accumulation of the foreign assets.

Figure 1: Strong current account and portfolio inflows in OFZ are supportive, but private capital outflow remains an issue

Figure 2: Ruble appears defensive in the face of global EM woes

Outlook for 3Q21 improved, but strong USDRUB appreciation would still be an optimistic case

The balance of payments data for July supports an upgrade of the 3Q21 target from USDRUB 75.0 to 74.0, and we remain constructive for the medium term. At the same time, a noticeable appreciation from the current levels would require weakening USD globally, and some meaningful slowdown in the local capital outflow from Russia, both of which are so far outside the base case.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap