Korea records “bad” fall in July unemployment rate

Yes, you can have a “bad” fall in the unemployment rate, when falling unemployment is driven by a falling labour force and few jobs are being created

| 3.3% |

July unemployment rateDown from 3.7% |

| Lower than expected | |

Unemployment rate not a good barometer for the economy

As well as being a lagged indicator for the rest of the economy, there are good reasons for being very careful when interpreting the meaning of shifts in a country's unemployment rate. This is very much the case with the upbeat sounding fall in Korea's July unemployment rate to 3.3% from 3.7% in June. At first glance, this looks to be a much stronger outcome than the small rise to 3.8% that the consensus had expected.

So what's going on?

The labour market release is quite a detailed piece of data, and we can see exactly what is driving the numerator of the unemployment rate (numbers of unemployed) as well as the denominator (labour force).

As far as the numbers of unemployed are concerned, the news looks good. There were 173 thousand fewer unemployed in July compared to June. The question is, where are all these people going? When you look at the numbers of employed, you see that these only rose by 11 thousand in July, so the unemployment rate is not falling because the unemployed are finding jobs. So where are they going?

The answer is a vague one, but "out of the labour force" is the basic story. This might include retirement, or simply disaffection with employment prospects leading to a "choice" not to work, or a return to homemaking or other non-paid work (looking after elderly, sick, young etc).

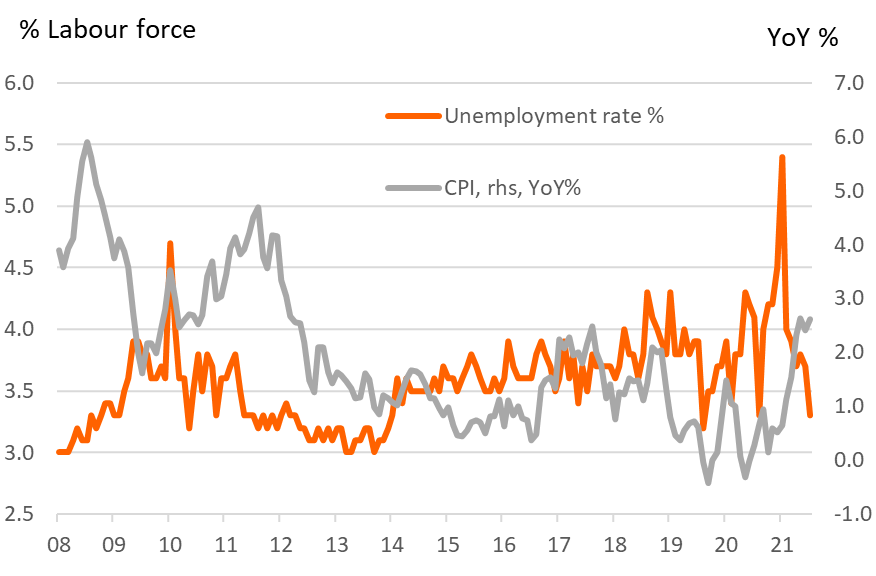

Korean unemployment rate and inflation

Does this mean anything for the BoK?

A release like this poses some headaches for policymakers. On the one hand, any fall in the available labour supply could be viewed as potentially inflationary, though Korea does not really suffer from the same labour market bottlenecks that are affecting economies such as the United States, and its inflation rate remains very low. So that isn't a worry.

But a decline in the labour force long term will weigh on Korea's productive potential - its long-term growth prospects. Again though, this is a long-run story and won't probably have much bearing on any decisions taken by the Bank of Korea (BoK) in the near term.

After giving a clear signal of their intent to start raising rates this year, the biggest risk to our October rate hike forecast remains the Covid-19 backdrop, not the labour market. For now, the Covid situation in Korea is reasonably steady. An October hike still seems plausible. But we will keep watching the data - all it would take would be a few days of bad Covid data and hints of movement restrictions for this forecast to require revising.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap