Romania: Trade balance continued to widen in October

Relative stabilisation in the food sector aside, we find little evidence of a correction in Romania's external imbalances

After a benign September, the trade balance returned to widening in October. It deteriorated by a staggering 42.5% compared to October 2017 and stood at EUR11.84 billion (or 5.9% of GDP for the January-October period), its highest since 2012.

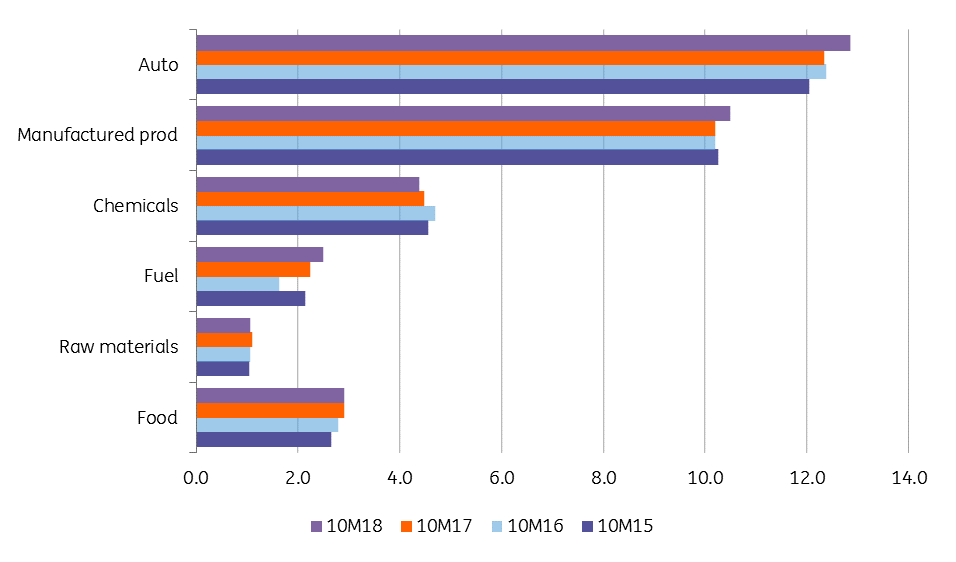

Apart from food items and raw materials where the pace of deterioration seems to have levelled off lately, the latter on the back of sharply lower oil prices, all other sectors posted wider deficits in October. The auto sector continues to drive the widening on the imports side, contributing 6.9 percentage points to the total 16.1% expansion.

January-October imports as % of GDP

Despite nominal rises in all sectors, exports remain sluggish. Moreover, the auto sector - previously a stalwart of Romanian trade – posted a EUR122 million deficit in October 2018 – the largest since December 2017. For the whole January-October 2018 period, imports rose 10.3% year-on-year and exports 9.2%.

January-October trade balance as % of GDP

The tentative signs of rebalancing seen in the first part of the year look long gone, now with the economy bracing for its highest post-crisis trade deficit. Together with the meagre FDI numbers, this should put additional depreciation pressure on the Romanian leu. Until now the interest rate differential has largely offset the fundamentals. However, with no clear signs of a correction in external imbalances, a correction in the FX space looks increasingly likely.