Romania: Retail sales nose-dived in February

Advanced retail sales decelerated to 6.6% YoY in February from a downwardly revised 11.0% in January. Hard data is catching up with surveys.

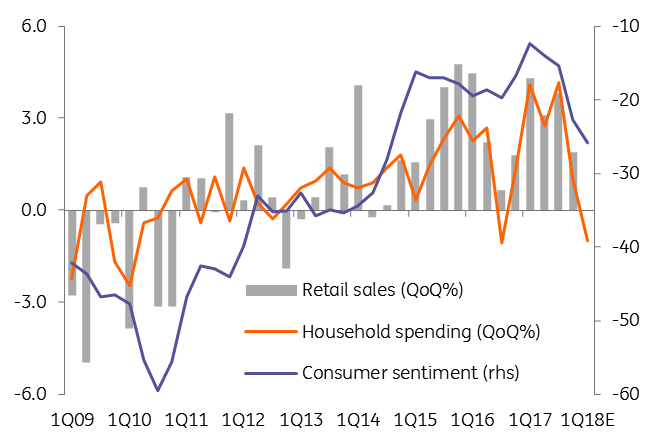

Romanian retail sales had the second consecutive monthly drop and the -2.3% MoM seasonally and working day adjusted decline in February was the largest since April 2014. Consumer confidence declined steadily from its all-time high in Mar-17 but is showing some signs of stabilisation in Mar-18. The sequential drop in consumer confidence in 4Q17 was the sharpest QoQ decline since the Global Financial Crisis and it continues to move south in QoQ terms in 1Q18. Retail sales decelerated in 4Q17 from 3.8% to 1.9% QoQ advance as household spending slowed down from 4.2% to 1.0% QoQ. The first two months of 1Q18 point to a likely sequential decrease in retail sales as households spend less after higher interest rates and a weaker currency bite into incomes; the growth in real wages decreased sharply due to both higher inflation and a slower advance in nominal salaries, while fiscal uncertainties persist.

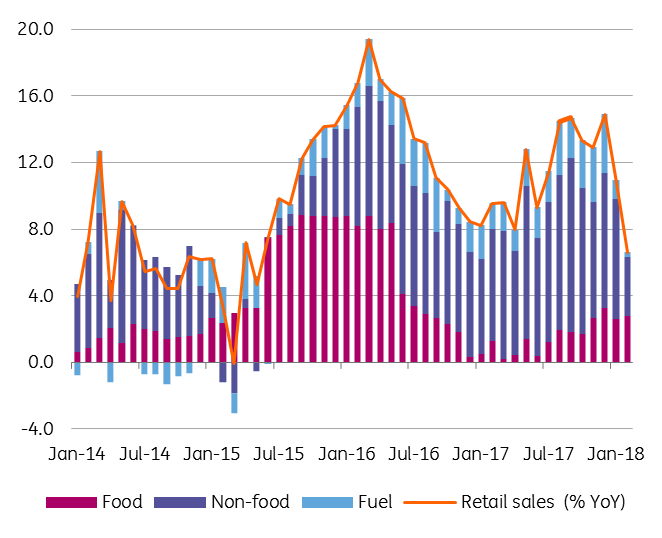

Retail sales sharply gyrating south

Sales for non-food items slowed down from 16.5% to 7.5% YoY in February, coming back in single digits territory for the first time since Nov-15. Sales for food items slowed down from 8.8% to 8.0% YoY, while fuel sales decelerated from 7.1% to 0.7% YoY, but the latter tend to be very volatile. The major driver for the deceleration from 11.0% to 6.6% in retail sales were the non-food items component which halved its contribution to the expansion of the broad index.

Consumption heading for a contraction in 1Q18?

Add to the soft consumption data, the downward revision for sequential 4Q17 GDP growth from 0.6% to 0.5% QoQ, important for carry-over effect, and the prospects for GDP growth in 2018 are on the weaker side. Maybe the central bank, The NBR, had asymmetrical information at yesterday meeting, including preliminary data on March CPI, which shifted the balance towards a no change decision, against the market consensus. Soft confidence indicators recently for the Eurozone and Germany, already reflected by a sharp slowdown in confidence for Romanian manufacturers, are mainly driven by lower export orders point to a weaker external demand. This was already reflected by a slowdown in manufacturing output data for January. All these suggest that our growth forecast of 4.7% for 2018 is too optimistic. Hence, we put it on review for a downward revision. The amplitude of the revision depends on incoming high-frequency data. On the other hand, maybe an early April Easter might somewhat help March consumption.

Download

Download snap