Romania: Lending still holding strong

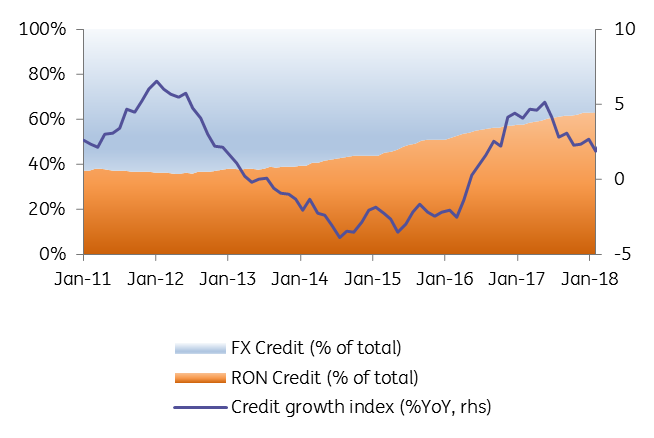

Our credit growth index expanded by 6.2% YoY in Feb-2018, a mild deceleration from 6.9% in Jan-2018, but the good momentum seems to hold up

Credit in local currency expanded by 15.8% YoY in February, from 16.9% in January, while FX lending shrunk at a constant pace of 9.9%, thus bringing the share of RON lending at an historical high of 62.9%. The index for individuals maintained its good momentum and expanded by 9.7% YoY as in January, with both consumer loans and mortgages coming out broadly in line with previous data, at 10.0% YoY and 35.8% YoY, respectively, from 10.2% and 36.3%.

Share of RON lending at an all-time high

Corporate lending growth decelerated to 2.9% YoY from 4.2% in the previous month. Corporate loans in RON with maturity above 5Y expanded by a hefty 23.7%. We monitor this indicator closely, as it should provide reasonable hints about the prospects of private investments.

Consumer loans succumbing under tightening?

We don’t expect the central bank to raise interest rates high and fast enough to keep up with inflation this year. Hence, with real interest rates into negative territory, consumption should prevail against savings in consumers' trade-off decisions. Nevertheless, we expect weak consumer confidence (which is pointing south for some time now) on fiscal uncertainties and below expectations real wage growth to lead to a slowdown in domestic demand.