Romania: Lending holding up well despite rising rates

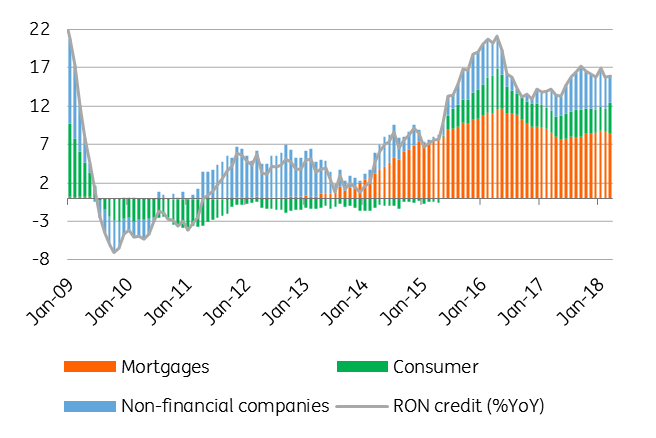

Our credit growth index accelerated in March to 6.6% year-on-year from 6.3% in February, as Romanian leu (RON) lending still holds strong, posting a solid 15.9% YoY growth

The acceleration of RON lending was driven mainly by consumer loans, which printed a surprisingly strong 5.2% month-on-month increase. This was the highest since December 2014 and second highest post-GFC and comes against a backdrop of rising interest rates over the past few months. The strength of consumer lending may be due to the effect of Easter and also the fact that many of these loans have a fixed rate and most banks have not yet begun to adjust their deposit/lending rates to the new market reality after the central bank tightened its liquidity management. Nevertheless, the RON loans usually linked to ROBOR fixing such as mortgages and corporate loans still posted a month-to-month acceleration, albeit a modest one, coming out at 1.9% and 1.8% respectively in March, compared to 1.8% and 0% in February. The share of RON in total lending has reached a new all-time high at 63.5% (from 62.9% in February). Corporate loans with maturities above five years expanded by 19.8% YoY, indicating that the prospects for private investments remain solid.

Consumer loans still holding strong

...even with the NBR in tightening mode

In our last lending report, we wrote that we didn't expect the central bank to raise interest rates fast enough or high enough to keep up with the acceleration in inflation this year, therefore keeping real rates deep in negative territory. Since then, the NBR has decided to implement firm liquidity management by organising regular one week full allotment deposit taking auctions, thus making the key rate more relevant for the cost of loans. Though these developments will probably help in containing inflation expectations and lead to a lower terminal rate in this hiking cycle, real rates will still remain in negative territory for most of this year (possibly even into the first part of 2019 as well). Hence, the consumption/savings decisions seem to be still in favour of the former.