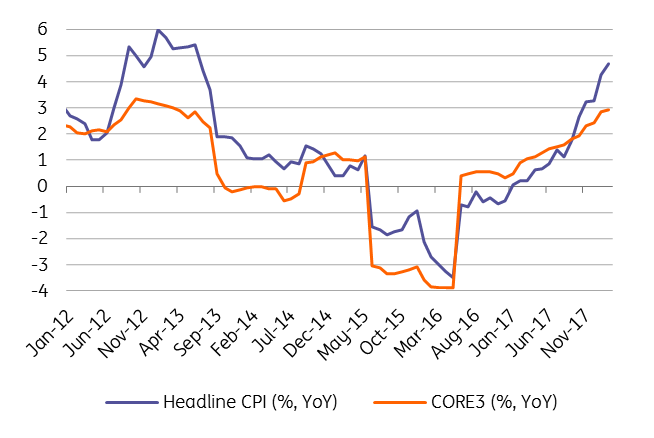

Romania: Inflation at highest level since June 2013

Romania's CPI print of 4.7% year-on-year was in line with our call, the market consensus and the central bank forecast. Core inflation inched higher from 2.8% to 2.9%, also in line with our expectations

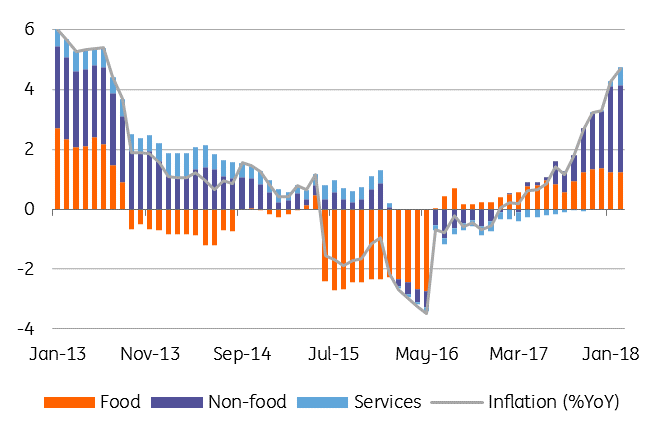

The two main factors influencing today’s CPI figure were an increase in regulated gas prices, which drove the entire 0.1% month-on-month increase in non-food items while on the services side we had important base effects, as the elimination of some indirect taxes in February 2017 dropped out of the statistical base. This led to a 2.9% YoY increase for services prices versus 0.9% year-on-year in January and contributed 0.6ppt to the 4.7% rise in February CPI inflation.

Broad based inflationary pressures

Food inflation stood at 3.7% YoY (0.6% MoM) and contributed some 1.2ppt to the CPI, while the 6.3% YoY increase in non-food items translated into a 2.9ppt contribution. Overall, we reiterate our 3.4% year-end inflation projection, with an expected peak in 2Q18 at 4.9%.

Headline above core on regulated and oil prices

What it means for policy

In terms of the monetary policy outlook, we expect the National bank of Romania to deliver two more hikes of 25bps each at the following two rate-setting meetings on 4 April and 7 May and then take a pause for the rest of the year. As the NBR seems reluctant to tighten the liquidity control, we see risks for a third hike at the 4 July meeting, as it has to show determination in containing inflation expectations as long as inflation readings remain on an uptrend.

Download

Download snap