Romania: ESI drops to the lowest level in three years

This is the third consecutive monthly drop, with confidence sentiment coming softer in industry and in services while consumer confidence is struggling to make a comeback

Starting with the negatives, the most important component, confidence for industry eased further in March on lower expected production and in line with most recent data showing industrial production decelerating. Services, the second most important segment by weight in the index, also deteriorated on lower expected demand, while the only ray of hope was brought by consumer confidence, which improved slightly for the first time in seven months, but it is still far from the Mar-17 all-time highs. In fact, even with this MoM improvement, 1Q18 was the worst quarter for consumer confidence since 3Q14 with the never-ending political noise, fiscal complacency and increasing uncertainty on wage path all weighing in. Construction posted a mild MoM and QoQ improvement, but the sector has a low weight in the broad index.

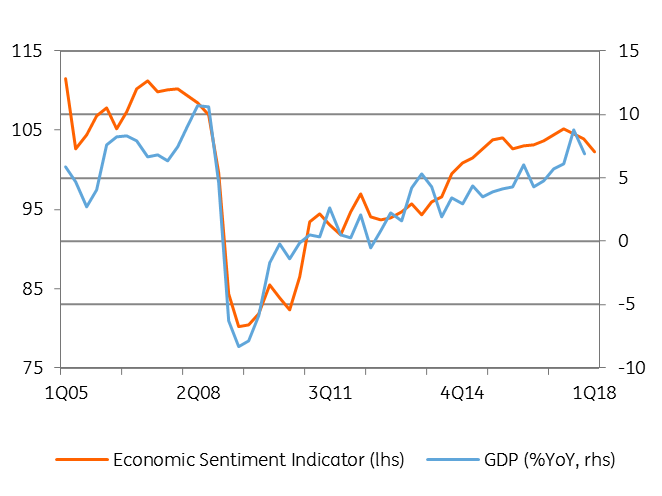

ESI points to weaker GDP growth ahead

With the latest ESI readings in the Eurozone offering little reason to be optimistic about Romanian exports and hopes for a boost to public investments this year getting smaller by the day (after 2017 was the lowest on record in this regard), together with an increasing interest rates environment and higher inflation, it looks like the Romanian economy is heading towards an abrupt slowdown. Hence, with most of the data pointing south in the first months of 2018, the risk balance is tilted to the downside for our above-consensus GDP growth call of 4.7% for 2018 versus the 4.2% Bloomberg median.