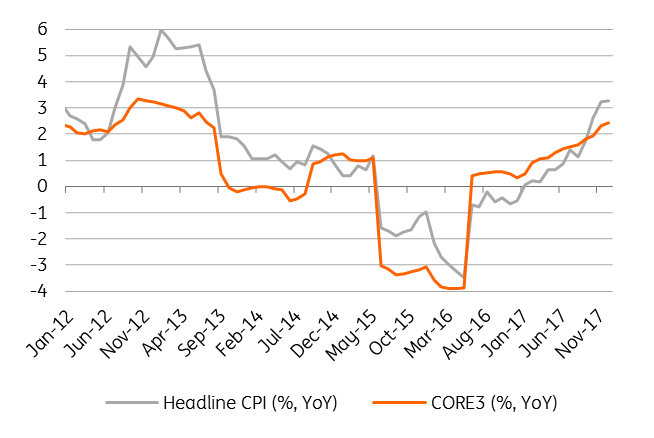

Romania: December CPI at 3.3%

This was in line with consensus, but above our call for 3.1%. Core inflation inched higher from 2.3% to 2.4%—in line with our projection

The increase in inflation from 3.2% in November came mainly on the back of food prices, up 0.4% MoM. The forecast error from our side came entirely from three items: bread, eggs and fuel. We expected prices for eggs to decline after the contamination crisis ended. At the same time, we underestimated the oil price pass-through.

In terms of monetary policy outlook, we expect the National Bank of Romania to hike the key rate again at the 7 February meeting. We are likely to see key interest rate hikes accompanied by surplus liquidity conditions, provided that downward pressure on the currency does not intensify. The NBR is apparently trying to strike a balance between higher key rates (to keep inflation expectations anchored) and lower transmission of the hikes into the cost of credit (to mitigate the likely political/public pressures). This scenario did not play out well last time ending with higher rates and a softer Romanian Leu (RON). We still look for three additional rate hikes this year, of 25bp each, with the first two coming in the first half. The pro-active approach is unlikely to lead to a lower terminal rate for the cycle than we currently see at 3.50% unless it is accompanied by consistent policy implementation to keep the key rate relevant.

At the same time, the NBR is likely to continue to talk down the RON to offset the impact of higher interest rates on broad monetary conditions. This bears the risk of inflation overshooting even more and might lead to more sticky inflationary pressures via the expectations channel. We keep our end-2018 inflation projection unchanged at 3.1% YoY, acknowledging that the risk is tilted to the upside, and we are highlighting that average inflation over the year stands at 3.9%, with the peak in 1H18 at 4.5%.

Download

Download snap