Romania: Spending starts 3Q on a weaker note

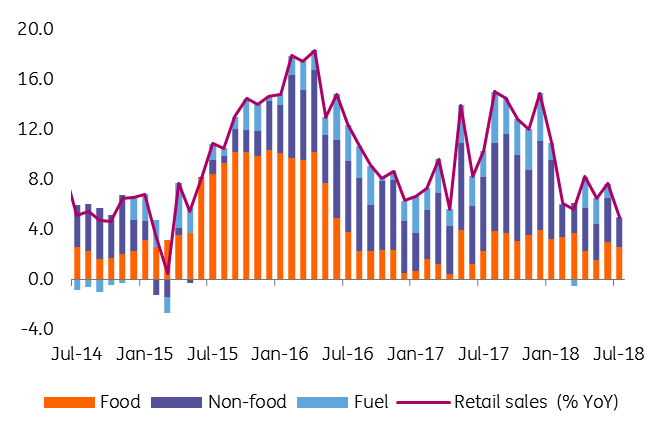

Retail sales decelerated in July to 5.0% year-on-year from 7.6% in the previous month despite a sharp improvement in consumer confidence

Retails sales expanding at a slower pace

The slowdown was seen across the components. Less volatile turnover for non-food items decelerated to 6.1% YoY in July from 9.1% in the previous month. Retail sales data tends to be volatile and subject to important revisions and the improvement in consumer confidence over the last two months suggests that the July pullback in consumption could be reversed.

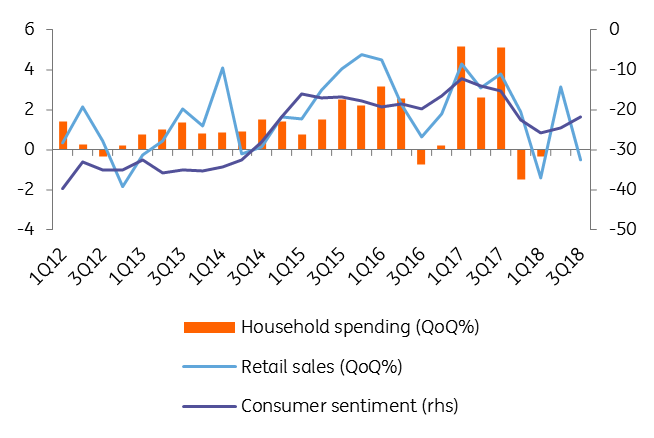

3Q18 consumer sentiment diverges from sales

The retail sales release is the first data point for the third quarter and the print was relatively sluggish. Soft data for the first two months of the third quarter paints a mixed picture with consumer sentiment improving quite significantly and better manufacturing confidence, but a sharp deterioration in the outlook for the services sector. It is unlikely that the National bank of Romania will have enough new information on the GDP outlook at the last two policy meetings of the year to reassess its output gap and subsequently the inflation outlook. Hence, the NBR Board is likely to keep rates unchanged this year and use liquidity management to fend-off FX weakening pressures if needed.

Download

Download snap