Romania: Current account continues to widen

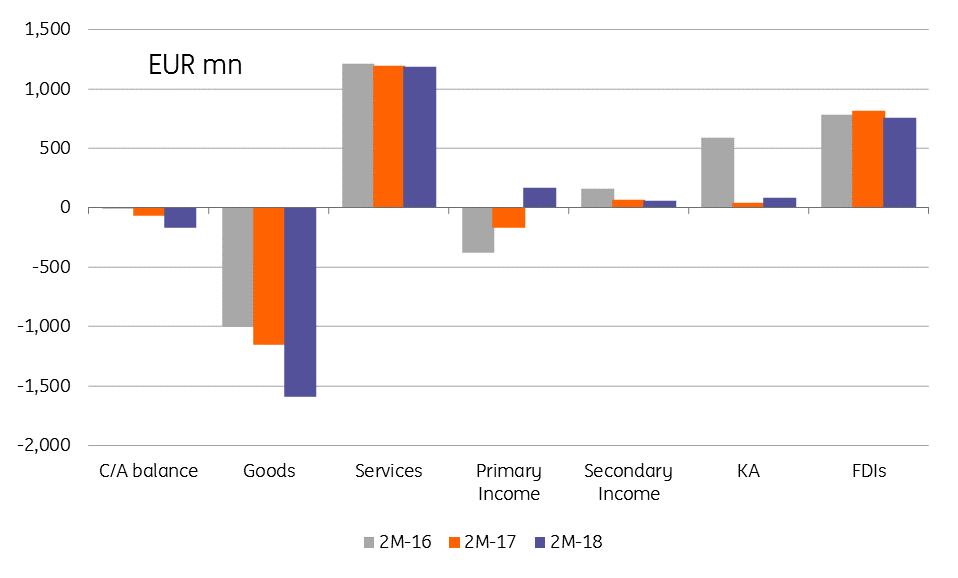

The trade deficit widening by 38% is the main driver of a deteriorating external position. This gives no room for the central bank to promote growth-supportive policies

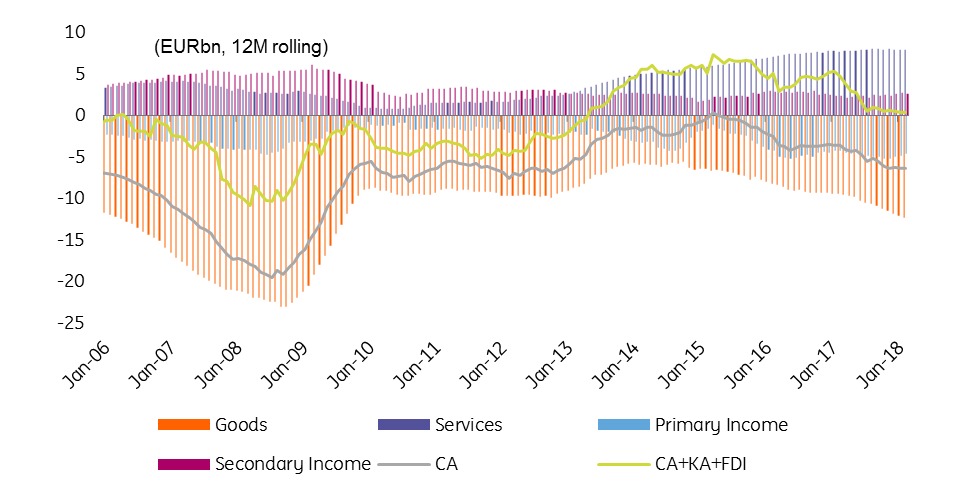

There are some signs that consumption is moderating a bit, but apparently, the trade deficit on some items such as food is more of a structural issue related to competitiveness. There is a visible deterioration trend on other items such as autos and manufacturing products and real interest rates falling further into negative territory are favouring consumption over savings. Also, recent data out of Europe point to softer external demand. On the other hand, an expected improvement of the absorption of EU money could improve that external position.

External balance for the first two months

External position

The recent C/A trends are worrying the central bank as more hikes might be needed to fend-off RON weakness which has a relatively high pass-through into prices in the context of inflation running at rates double the National Bank of Romania's target.Despite some calls from political leaders for the central bank to support economic growth, given the external vulnerabilities, this option looks closed for the NBR.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap