Poland: CPI below the NBP target. Core drop less severe

The final reading confirmed CPI undershot the central bank's target. The core inflation drop was less severe than the flash publication suggested, but the transition of solid wages into prices remains limited

The final CPI inflation confirmed deceleration from 1.4%YoY to 1.3%YoY. The drop of the core component (excluding food & energy) was less severe compared to our initial estimates – from 0.8%YoY to 0.7%YoY vs. 0.5-0.6%YoY, according to the flash reading.

Energy components are the major source of deceleration. Monthly changes of gas and fuel prices subtracted jointly nearly 0.1pp from the headline figure. In the core inflation, there were two surprising factors behind the slowdown: a drop of package holiday prices (likely temporary, which subtracted 0.03pp from the headline) and insurances (probably more persistent, subtracting another 0.02pp). Growth in the other categories (i.e. furnishing) was rather disappointing, moreover, recent surveys indicate a drop of household inflation expectations to the level consistent with deflation.

| 0.7 |

Polish Core Inflation (%YoY)ING estimate based on GUS data. |

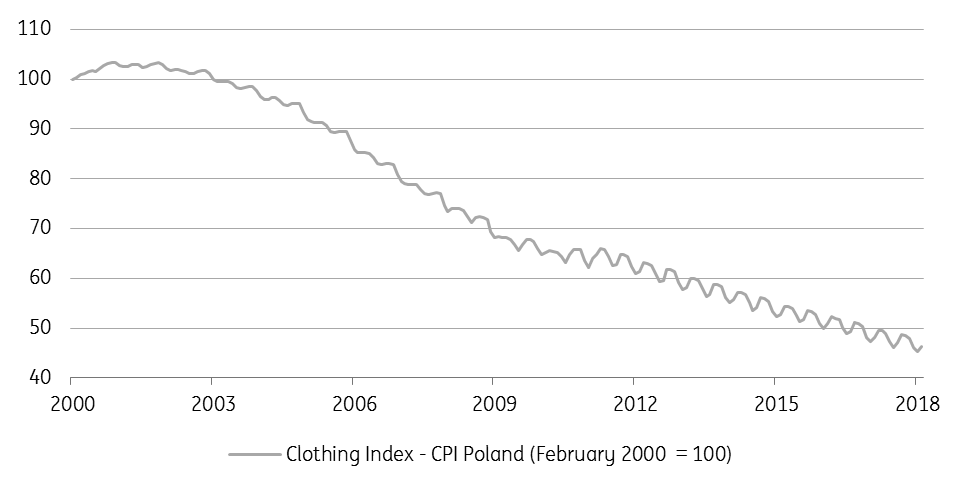

The clothing and footwear component showed a higher than usual growth (adding 0.1pp to the headline). Such a change was likely related to methodological issues. Formerly prices in this category permanently declined by 4-4.5%YoY annually, contradicting average prices of most important goods published by GUS. Our analysis indicates changes in methodology should increase the annual CPI dynamics by 0.3pp.

GUS presented permanent deflation of Clothing & Footwear prices

Change in methodology is likely to increase headline figure by 0.3pp annualy

Overall we still remain pessimistic over inflation prospects in 2018. We see 1.4%YoY-1.5%YoY annual growth, significantly below the NBP March projection (2.1%YoY). CPI is also likely to undershoot central bank target till May-June. The major argument against CPI increases in the coming quarters is a deceleration of food prices (we expect deflation in this category in the 4Q18), no signs of core inflation pick-up and a lack of increase in regulated prices. Today’s data structure is a significant argument against a rate hike in 4Q19.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap