Romania Briefing

Unwarranted expectations

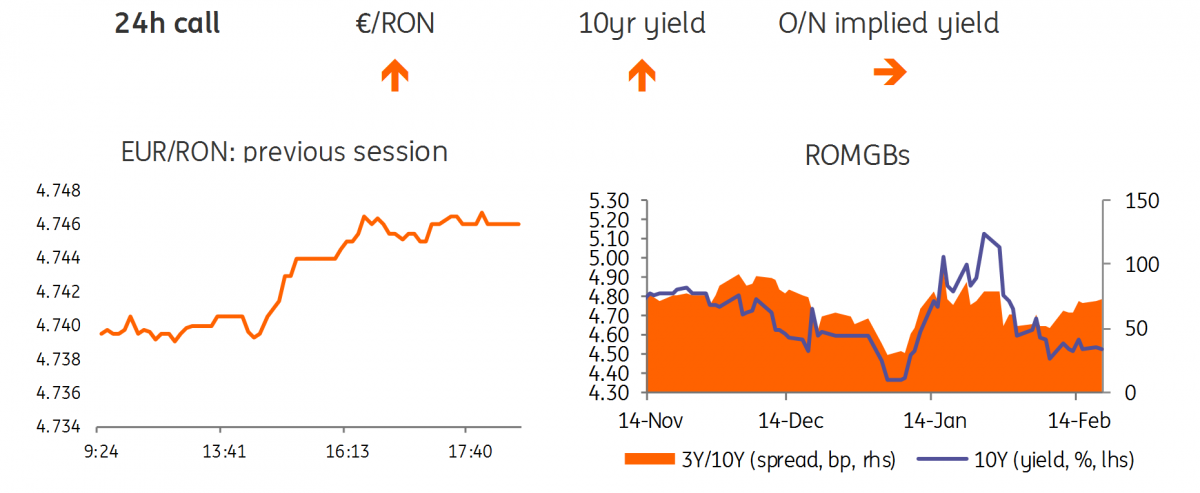

EUR/RON

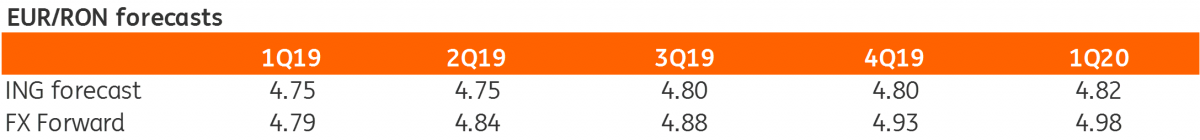

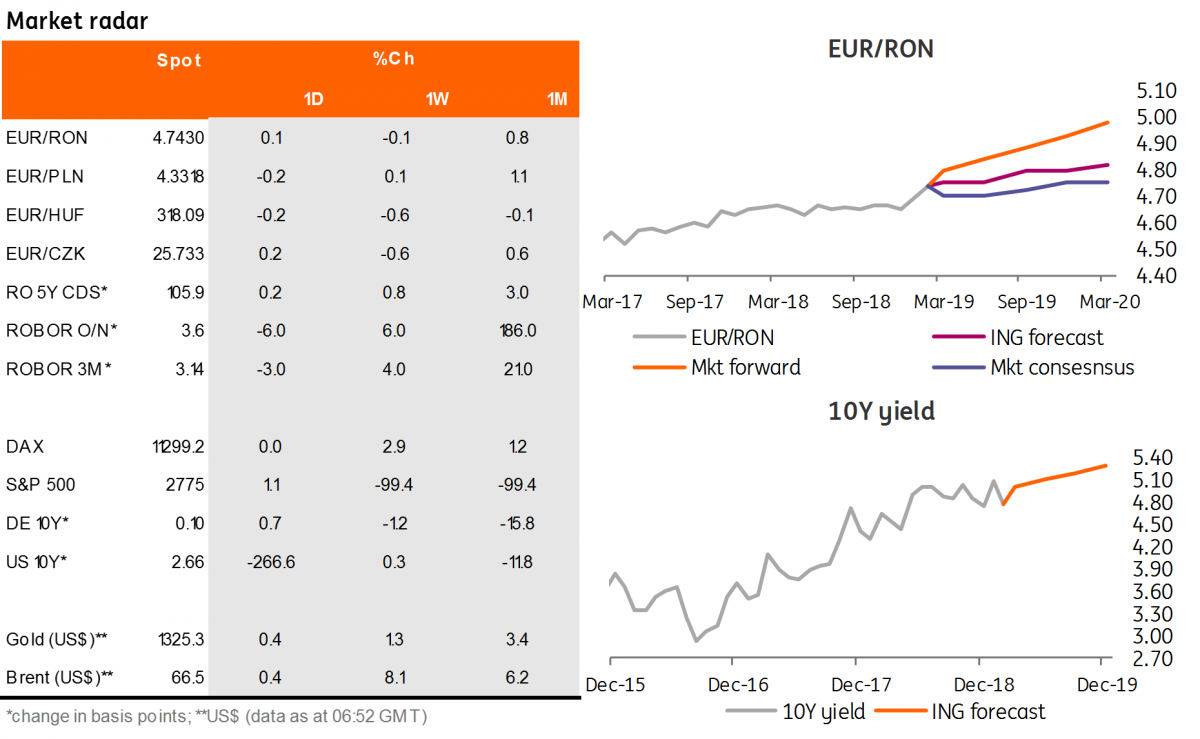

The EUR/RON closed just above 4.7450 yesterday on below average turnover. The first half of the trading day was quiet but the long-awaited meeting of the National Committee for Macroprudential Oversight (NCMO), which was expected to provide some forward guidance for breaking the deadlock between the government and the central bank, did not provide a breakthrough in the debate on the design of the bank levy, which led to a spike higher for the EUR/RON. The conclusion of the meeting was that NCMO “identified solutions for possible scenarios for the adaptation” of the government emergency decree which included the bank tax. Hence, today’s government meeting is unlikely to bring any changes. The prospects for improving the fundamentals of the Romanian leu via fiscal consolidation and structural reforms are limited, with a heavy election calendar ahead. Economic imbalances are likely to be partially offset in the short-term by a combination of a weaker currency and higher interest rates. Hence, once carry becomes less prohibitive to short the Romanian currency- as liquidity should normalise due to bond redemptions- we expect the EUR/RON to resume its uptrend. For today, we see a 4.7400-4.7550 range.

Government bonds

The Romanian government bond yield curve bull flattened yesterday with 10-year yields dropping around 10 basis points after the February-2029 bond auction did not match all of the genuine demand. The Ministry of Finance upsized the 10Y auction size to ORN347 million versus the RON200 million planned, at an average and cut-off yield of 4.78% on strong demand, with a bid-to-target ratio at 4x. The average of rejected bids was 4.84% suggesting that most of the demand came from one investor. It's possible this was driven by expectations that the bank levy would be amended swiftly to incorporate the main central bank suggestions. Expectations for a swift normalisation could be unwarranted for a while.

Money Markey

Funding rates remained stubbornly high, at around 6.25% implied yields, with no sign of the National Bank of Romania providing relief via a repo liquidity injection in the last week of the reserve maintenance period. It looks like the central bank is perceiving that RON depreciation pressure is more persistent and is using liquidity management as the first line of defence to discourage short RON positioning. A RON5.9 billion bond redemption on 25 February could ease the liquidity conditions despite monthly budget payments due on the same day. The money market implied yield curve remains inverted as the back end was largely unchanged with market pricing in another two big bond redemptions of almost RON9 billion each on 29 April and 24 June. Even if the budget bill sign-off faces hurdles, it is likely that government spending could speed up in March. The main uncertainty for the liquidity outlook is related to the extent to which the NBR will be covering the external shortfall from its FX reserves.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

RomaniaDownload

Download snap