Briefing Romania

Parliament passes the budget bill

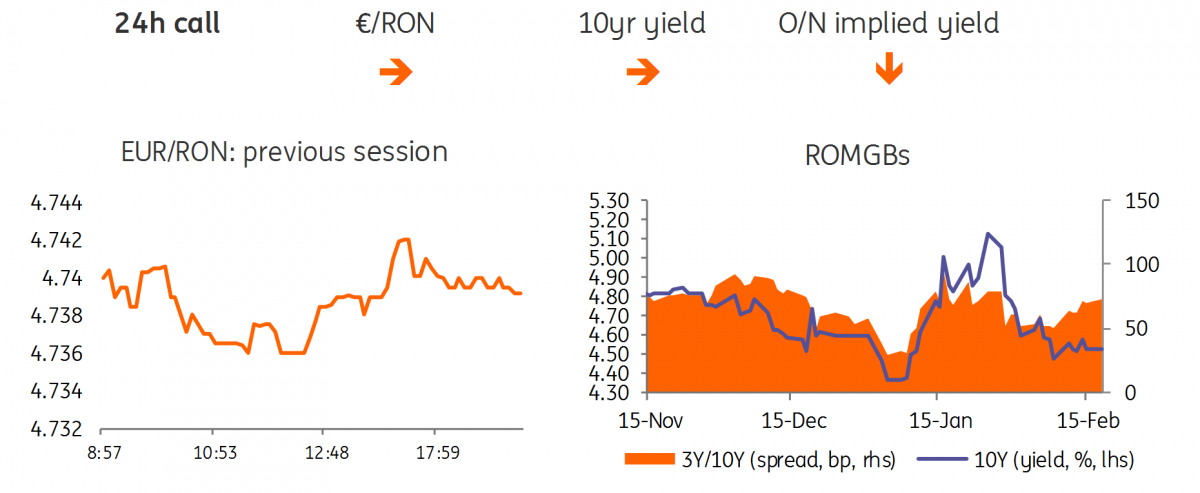

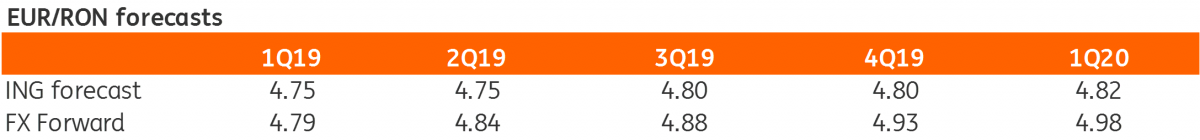

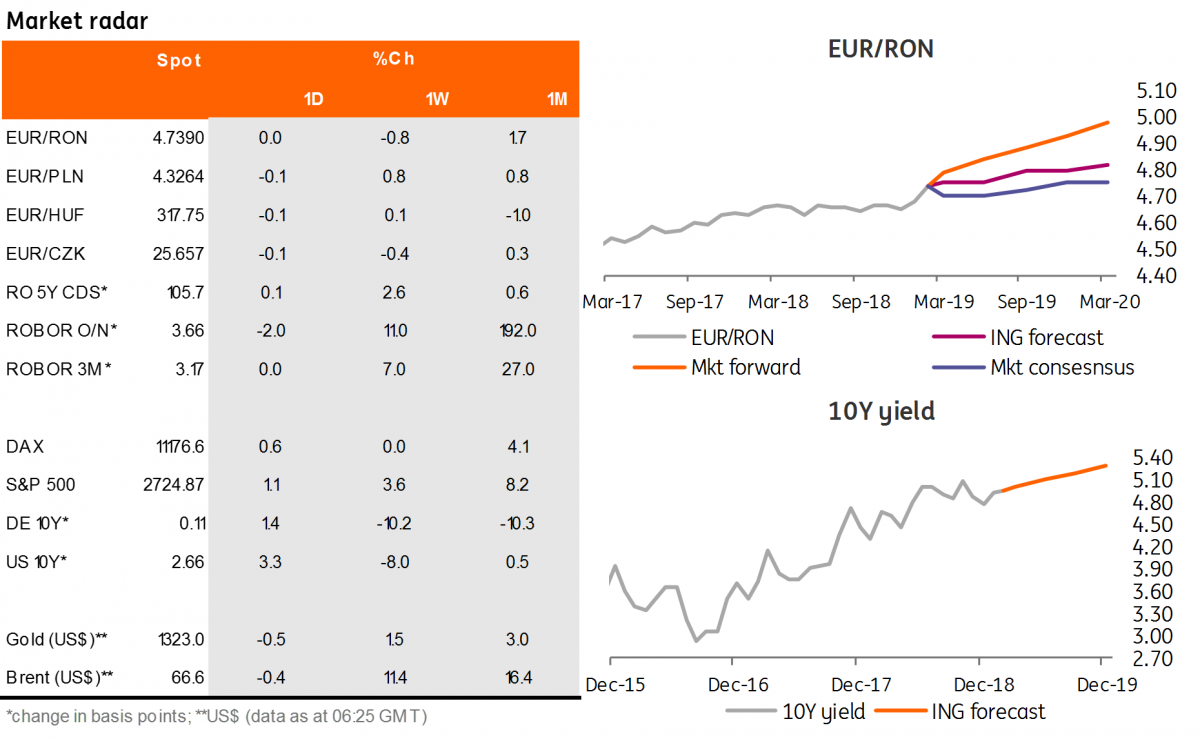

EUR/RON

The EUR/RON floated again around 4.7400 on below average turnover which seems to be the new normal for the pair these days. Lower carry is still nowhere in sight, hence testing below 4.7400 could continue today.

Government bonds

The Romanian government bond market is rather quiet again and will likely continue to be this way until the outcome of today’s meeting of the National Committee for Macroprudential Oversight is made public. Today, the Ministry of Finance auctions RON200 million in Feb-2029 bonds (the new 10Y benchmark). There is still uncertainty regarding the eventual changes in the 114 government emergency decree from December, which included a set of sectorial taxes, including the ROBOR-linked bank levy. Hence, we would expect cautious demand for a 10Y tenor. That said, the amount is not that impressive and could be covered at the higher end of the secondary market yields, of 4.85-4.90%.

The 2019 state budget bill was voted in Parliament on Friday targeting a -2.76% of GDP deficit (from -2.55% initially), due to an increase child benefits (a quasi-permanent spending).

Money Market

The money market curve remained flat on Friday. Hopes for some lower funding rates are again on the rise as we enter the last week of the minimum reserve period. Plus, the RON5.9 billion redemption on 25 February should anchor expectations for a normalisation in cash rates. As we approach the end of the reserve maintenance period, the National Bank of Romania might be tempted to inject liquidity via a repo auction.

The week ahead

The Eurozone PMI will be among the most closely watched figures this week. The 'r' word has been used out loud already as the January PMI dropped to just 51 (anything below 50 signals contracting activity). Over in Germany, the narrative is that confidence indicators should bring the first tentative signs of a bottoming out after the recent stretch of disappointing macro data. On the local front, we expect the EUR/RON to stay within a 4.7300-4.7500 range.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap