Briefing Romania

4.7700 is the NBR line in the sand, for now

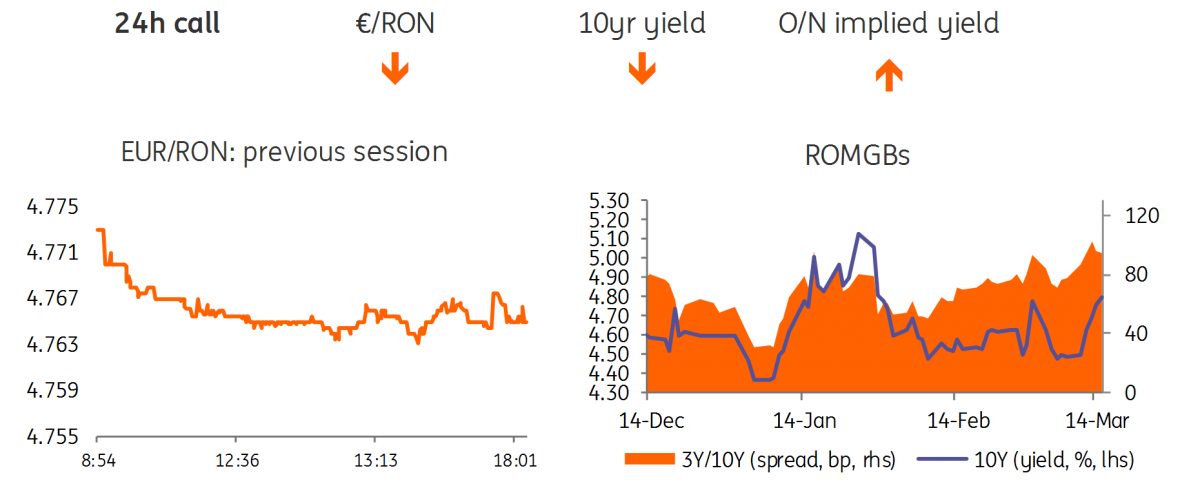

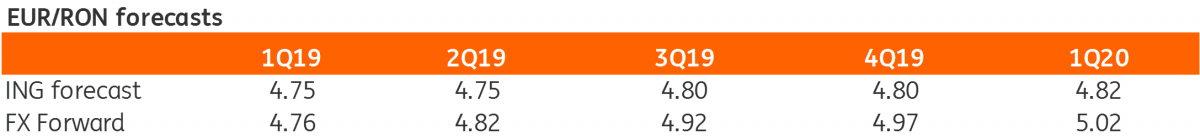

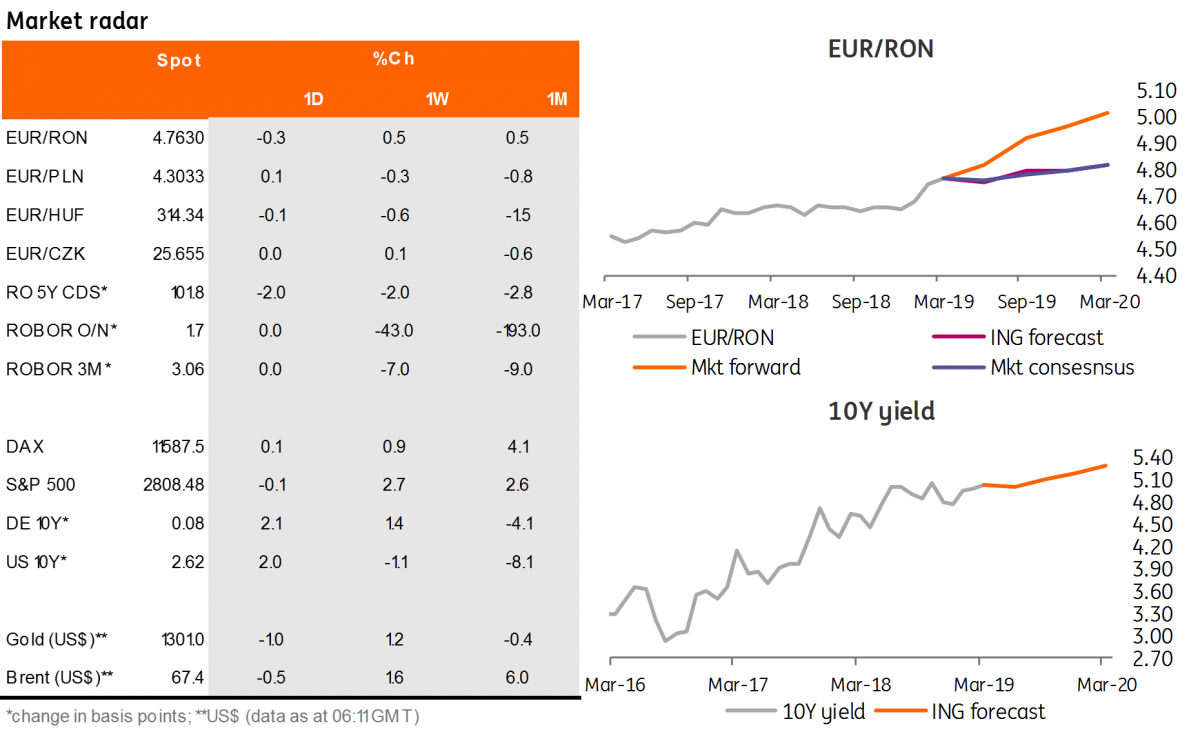

EUR/RON

The EUR/RON failed to break above 4.7700 with clustered trading and significant turnover, though not as much as on Wednesday, supporting the likelihood of official offers ahead of this level. The NBR is drawing a line in the sand around 4.7700 for EUR/RON. This could hold for a while, but eventually the defense line will be moved higher. The 4.7500-4.7700 range should hold for today, awaiting the S&P review tonight. This comes after a two week delay due to the Romanian government appeal against its revision of the outlook to negative from stable.

Government bonds

ROMGBs sold-off yesterday, with back-end yields moving c.8bp higher. The MinFin sold RON304m vs RON300m planned in Jun-2024 at average/cut-off yields of 4.47%/4.51%, above our expectations. There was decent demand, with a 1.4x bid-to-cover ratio.

Money market

Funding implied yields barely changed and traded below the credit facility level of 1.50%, with the liquidity surplus persisting during the current reserve maintenance period. Central bank FX interventions are creating some funding worries ahead, pushing 3M yields c.30bp higher to 4.15% implied mid. This reverberated further up the money market curve.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap