Solid Czech retail sales in January

As in neighbouring countries, Czech retail sales surprised positively in January and rose 4.7% YoY. This was driven mainly by an acceleration in non-food sales. The growth rate was close to the 2018 average, although we expect some slowdown this year.

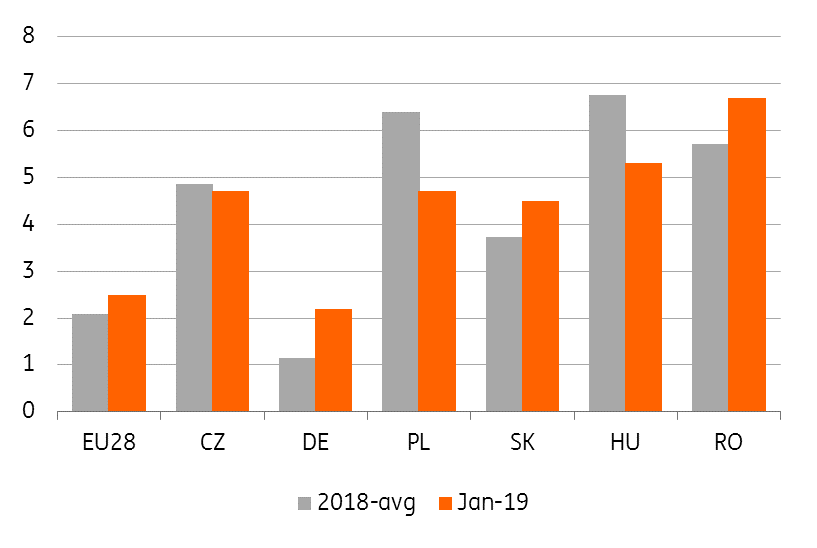

Retail sales (excluding cars) increased by 4.7% year on year in January, a rate similar to the 2018 average (4.9% YoY). The advantage of the January comparison is that it is not affected by a different number of working days, and thus indicates real year-on-year sales growth. Compared to December 2018, affected by calendar bias this figure is slightly stronger (4.7% vs 4.3% working day adjusted), mainly due to non-food goods sales.

| 4.7% YoY |

Czech retail salesclose to the 2018 avg of 4.9% |

| Higher than expected | |

Non-food items accelerated again

A closer look reveals some slowdown in food sales, up by less than 1% YoY in January. This was below the average 2% growth of 2018 (working day adjusted). On the other hand, non-food sales growth accelerated to 7.8% after a somewhat weaker December, and in line with 2018-average dynamics. According to the CZSO, the strongest sales were recorded in shops focused on sport - favorable snow conditions contributed to increased purchases of new winter equipment in January. However, the 23% YoY growth for this sub-segment came on a very low base from last year.

Car sales remain on a weak footing

Car sales were strongly affected by new emissions norms throughout Europe in the second half of 2018. Although EU28 new car registrations are no longer falling and grew by 7% YoY, some countries including the Czech Republic experienced further double digit falls (-17% YoY in CZ). February data suggests that the situation in the Czech economy is also gradually stabilizing, with the YoY figure weakening further to just 7%. Total January car sales fell by 5.1%, the same YoY rate as in December and after taking calendar effects into account.

Retail trade excluding motor vehicles (% YoY, adjusted for calendar days)

Retail sales likely to slow further this year, to close to 4%

Retail sales grew at slightly below 5% in 2018 after growing at 5.5% in 2017. This year, a further moderate slowdown in retail sales growth can be expected - due to weaker economic growth and slightly weaker wage dynamics. Retail sales might also be affected by the fact that households are signalling their intention to save more, amid concerns about the economic outlook. Last but not least, data on the structure of household consumption in 4Q18 indicates that households are slightly reducing their spending on goods, but are increasing spending on services. This might be due to demand for some goods becoming saturated and so households using ther higher income for services. This combination of factors should lead to slightly weaker retail dynamics this year and we estimate a level of 4%. However, total household consumption should still be one of the main factors supporting domestic economic growth this year and should remain solidly above the EU-average, as in recent years.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap