Briefing Romania

Hawkish NBR supports RON

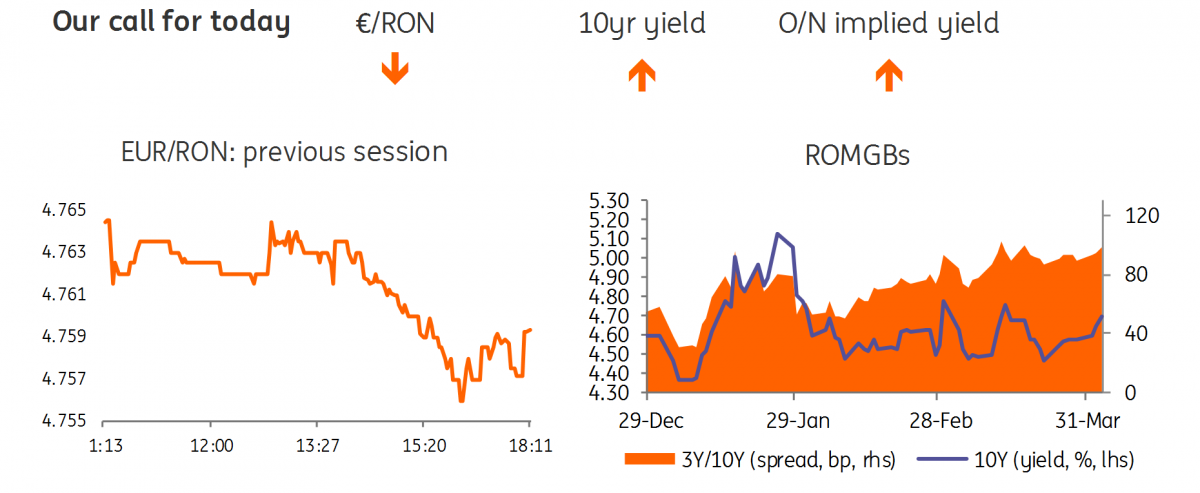

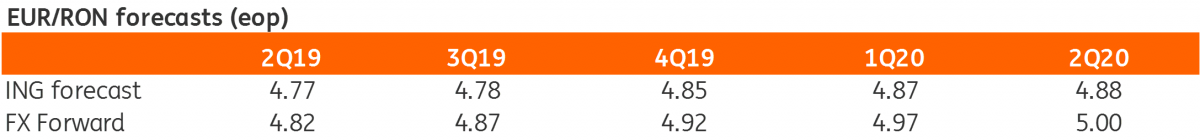

EUR/RON

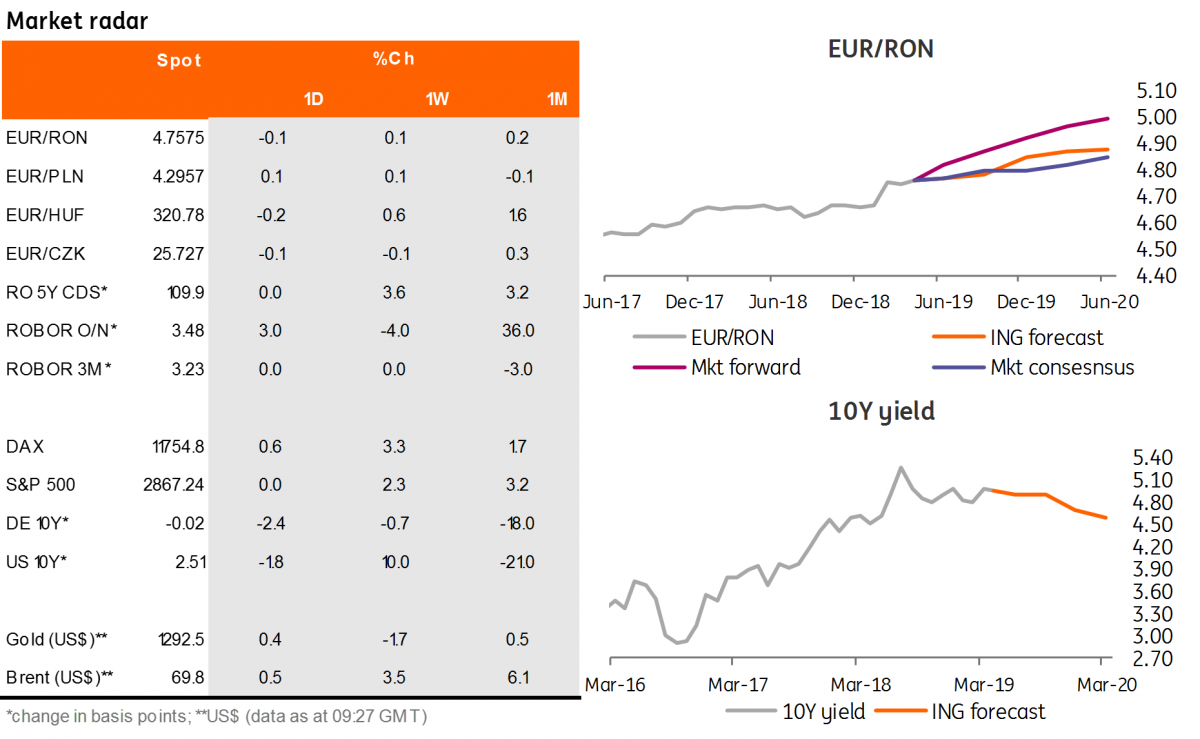

The EUR/RON inched lower and closed below 4.7600 after hawkish comments from the NBR governor and a pledge “maintaining strict control over money market liquidity” aimed at “deterring amplifying FX pressures”. A 4.7500-4.7650 range is seen for today with risks to the downside if stops are triggered.

Government bonds

ROMGBs yield curve bear-flattened as the front yields spiked higher on the NBR's firm liquidity commitment. 10Y yields closed 8 basis points higher.

Money market

The forward curve shifted higher after the NBR governor's comments that the “era of surplus liquidity” has ended and short-term money market rates could stay around the credit facility level of 3.50%. 3M implied yields jumped c.65bp to 4.65%. The implied cash rate was also c.20bp up at 4.40% due to liquidity shortages after recent NBR FX interventions.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap