Romania Briefing

The National Bank of Romania's press briefing is in focus

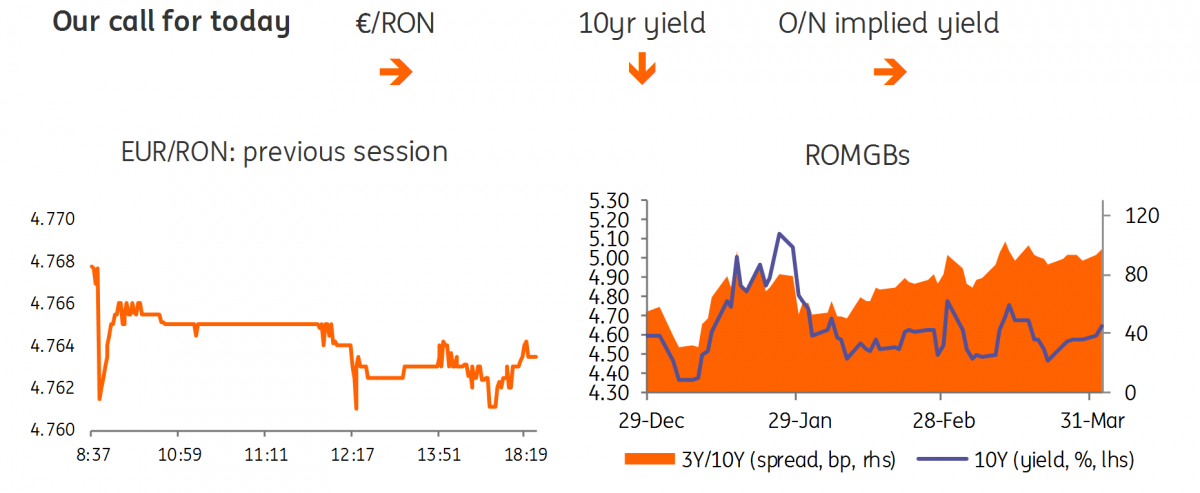

EUR/RON

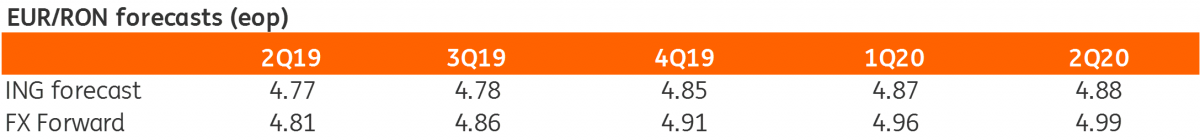

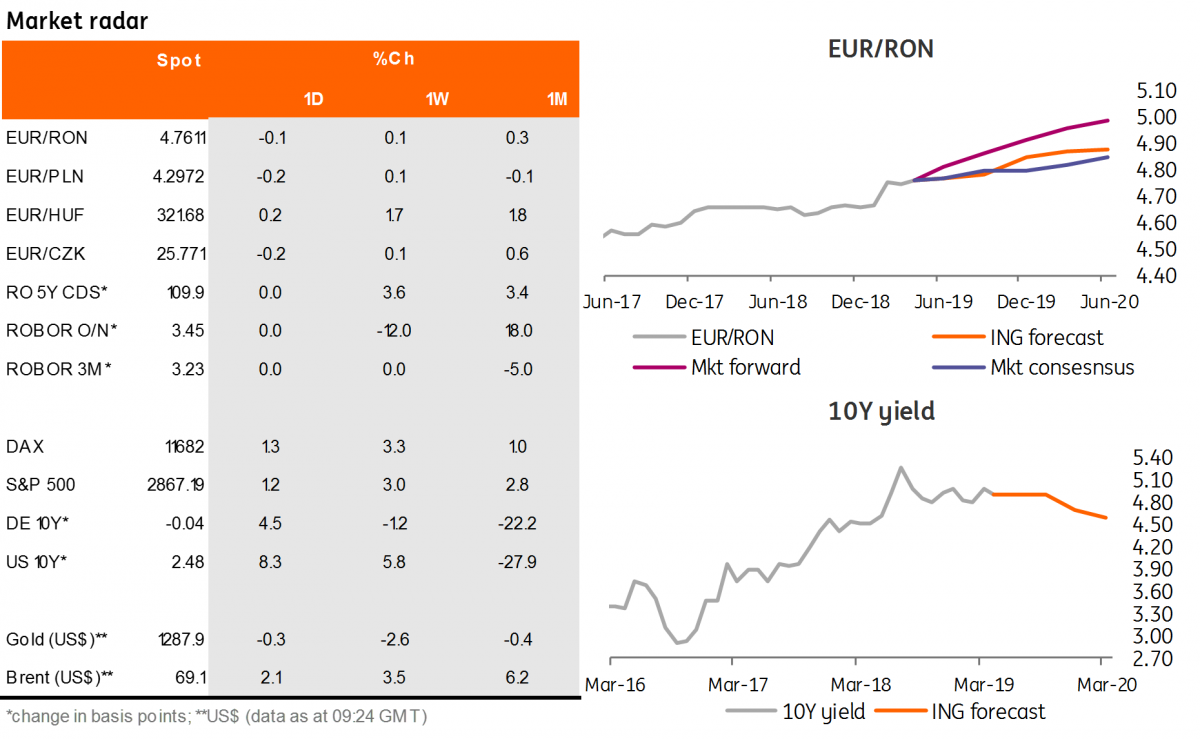

The EUR/RON traded in a tight 4.7600-4.7700 range yesterday on heavy turnover. Clustered trading at 4.7650 is indicative of official offers. With the upside limited by the NBR and the downside by the fundamentals, 4.7550-4.7650 range could hold in EUR/RON for today.

Government bonds

ROMGBs' yield curve shifted higher yesterday with the weak auction for June-2023 bonds exacerbating the selling pressure. MinFin sold RON392.5m bonds, below the RON500m target, with total demand at RON443.5m. A dovish NBR today could be somewhat supportive for RON debt.

Money market

Cash implied rate was little changed around 4.20% with the NBR not providing liquidity via an open market operation despite the shortage, likely aiming at discouraging positioning for a weaker RON. The 3M-1Y segment remained inverted from 4.00% to 3.75%. RON8.8bn bond redemption on 29 April should restore the equilibrium in liquidity, though large quarterly payments to the state budget ahead of it are likely to lead to another squeeze.

Download

Download snap