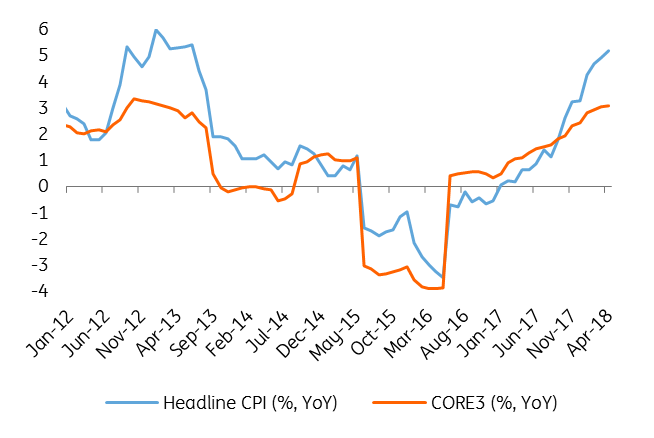

Romania: CPI rises 5.2% in April

The reading was in line with Bloomberg's median estimate but below our call of 5.3% year-on-year. Core inflation inched 0.1ppt higher to 3.1%, in line with our expectations

Romania's CPI increased by 0.5% month-on-month in April driven by the liberalisation of gas prices for households and the increase in excise duty for tobacco. Our forecast error came mainly from an overestimation of the increase in gas prices. The rise in regulated prices for energy and gas drove a 7.2% YoY increase in non-food prices. Food prices are up 4.0% YoY with the highest price jumps seen in fresh fruit, eggs and butter. The services CPI stands at 2.8% YoY. Core inflation continued to grind higher, reaching 3.1% YoY. Headline inflation is expected to converge back towards core inflation once base effects roll off in 4Q18.

Headline CPI pushed higher by supply shocks

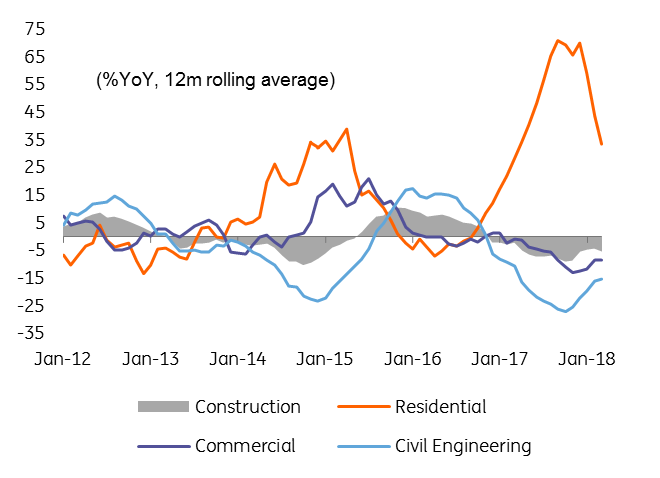

The CPI is consistent with our year-end forecast of 3.6%, which is similar to the central bank's projection. Core inflation inching higher might suggest some underestimation by the National Bank of Romania. For the NBR policy outlook, tomorrow’s 1Q18 GDP reading is more important. We look for a below-consensus reading of 5.0% vs the 5.5% Bloomberg median. While we see a material chance of a sequential contraction due to a decline in consumption and weak industry, today’s construction data is supportive of a meagre QoQ growth rate. We see the NBR on hold at the next meeting on 4 July but still expect one more rate hike this year in 4Q.

Residential market seeing the impact of higher interest rates

Download

Download snap