Romanian budget deficit hits a new peak

At an estimated 9.8% of GDP, the 2020 budget gap in Romania came well-above the official target and is the highest on record. But it is the smallest expansion in the CEE space. We expect fiscal consolidation to start this year, but progress will be gradual

After seeing the budget for FY20, there are a few negative records which are worth highlighting.

This is a new record in both absolute and relative terms

Budget balance as % of GDP

In nominal terms, December 2020 marked the highest monthly deficit ever at RON17.9bn

The share of deficit in total revenues reached historical highs

Deficit as percentage of revenues

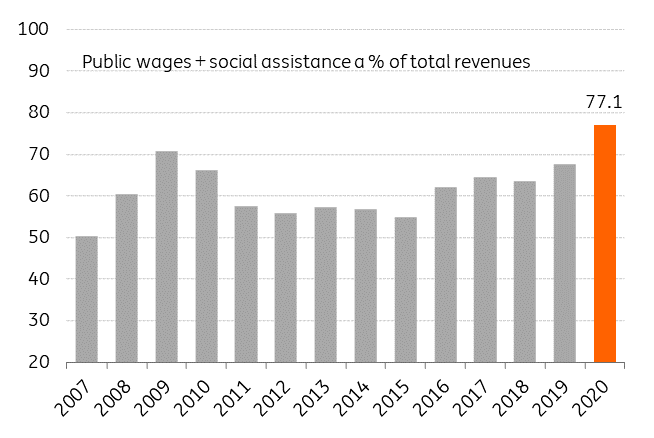

The share of public wages and social spending in total revenues reached…you guessed, historical highs

Wages+social spending as % of revenues

It isn’t all that grim either

In all fairness, 2020 was a terrible year for pretty much everyone and Romania is no exception. The “negative records” were probably expected by most analysts and the market.

Looking at things from a different angle, in 2020 Romania had the smallest expansion of the budget deficit in the CEE space. This perspective obviously has its pros and cons as one interpretation could be better fiscal discipline (without being totally off track in our view) rather than simply having less fiscal space to provide impulse to the economy.

2020 vs 2019 deficit expansion (%)

The situation looks a bit more complicated when the twin deficits issue are taken into account, where Romania stands out more prominently.

The 2020 economic slump did not come with a -otherwise expectable- correction of the external imbalances. On the contrary, as of November 2020 (the latest available data) the trade balance deficit was 6.0% higher than in the same period of 2019, suggesting fundamental competitiveness issues for the economy.

The trade gap was the root cause of the current account deficit which we estimate to have closed 2020 at around 4.7% of GDP.

So what should we make of this?

For 2021, we have a long-standing forecast for the budget deficit at 7.3% of GDP which we maintain.

In nominal terms, after adding the 2021 redemptions, it means that the financing needs should be only marginally lower in 2021 compared to 2020. Given the above expectations issuance pace witnessed recently, we believe that the finance ministry is in a relatively comfortable position and will afford to act opportunistically every now and then.

Compared to 2020 when Romania issued almost EUR12bn in Eurobonds (plus c.EUR2.3bn on the local market), the funding split is likely to be less tilted towards the hard currency, though we still expect a decent issuance here as well (say around EUR7bn of Eurobonds). Retail bonds issuance in RON could increase as well, but it is unlikely to reach a much larger size compared to our estimation of RON4bn issued in 2020.

Overall, we believe that a deficit in the vicinity of 7.0% in 2021 is achievable but not under a no policy change.

The government will need to come up with some (long-expected) fiscal measures to trigger a consolidation cycle. If properly balanced and targeted, we believe these measures don’t need to be spectacular in size and impact. A “little bit of everything” should do the math.