Rising supply of nickel intermediary products could ease tightness

The rising supply of nickel intermediary products could be converted into Class 1 nickel as market tightness persists, which could also increase the availability of the right type of nickel for exchange deliveries

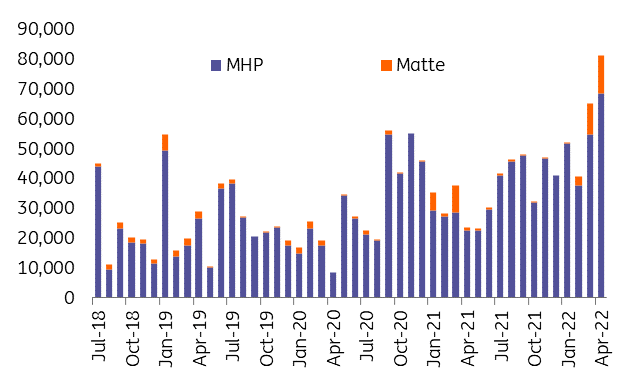

China’s imports of MHP (mixed hydroxide precipitate) and matte hit a fresh record in April after the speed-up of NPI-to-matte conversion and the ramp-up of MHP projects from Indonesia, both suitable for making sulphate to meet the demand from the battery industry. During the first four months of 2022, total MHP imports into China have almost doubled from the same period of last year. Meanwhile, imports of matte jumped by 56% year-on-year, with March and April seeing the strongest volumes.

Surging imports of MHP and matte into China (tonnes)

However, as the supply of feed sources for making sulphate accelerated, especially after the epic squeeze in early March, end-use demand for sulphate was hit hard by Covid lockdowns and some sulphate and precursors producers were reported to have cutbacks.

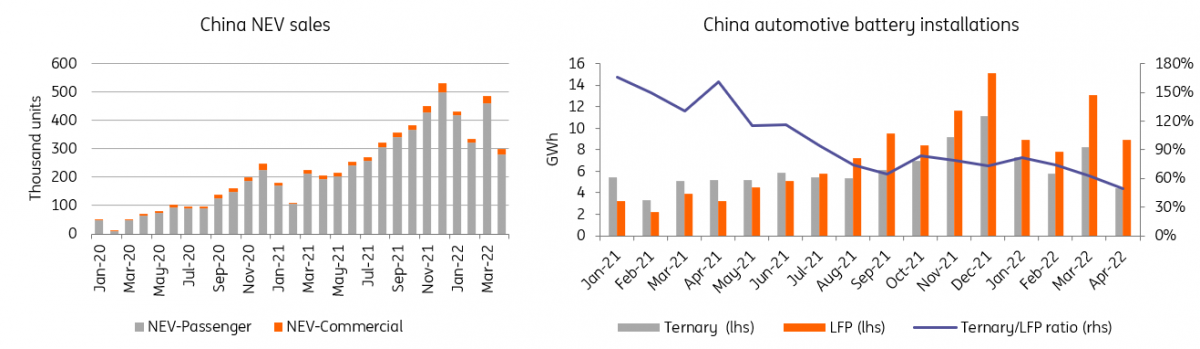

Nickel usage in the battery and NEV sector craters amid Covid lockdowns

China's ternary battery installations hit a speed bump in April, along with new energy vehicle sales after lockdowns. Ternary battery installations plunged 47% month-on-month in April; meanwhile, total NEV sales dropped by 38% MoM. As a result, converting briquettes for making sulphate has been struggling to make profits.

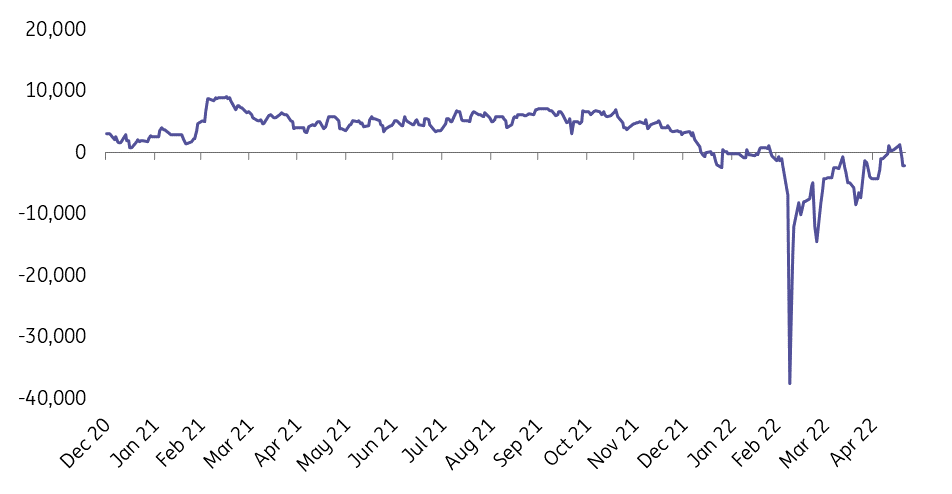

Theoretical margin of converting briquettes into sulphate based on spot prices (yuan/tonne)

The current forecasts of the market surplus are primarily dominated by Class 2 supply. Instead, the Class 1 market has remained tight, especially those for exchange deliverable nickel. As a result, Shanghai Futures Exchange nearby spreads have recently surged to a record backwardation.

This now creates incentives to convert matte/MHP into Class 1 nickel that meets the standards for exchange delivery. China Huayou recently announced that it will restart its plant to produce refined nickel using MHP. Meanwhile, we estimate at least 4kt matte was used to swap for Class 1 nickel last month. All of these suggest that the currently elevated London Metal Exchange prices could invite deliveries due to improving availabilities in the right type of nickel. Should that happen, spreads could come under further pressure.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap