Indonesia’s central bank keeps rates unchanged, citing global growth concerns

Bank Indonesia opted to hold out on rate hikes for now, keeping rates untouched to bolster the economic recovery

| 3.5% |

BI policy rate |

| As expected | |

Central bank remains unfazed by simmering inflation pressures

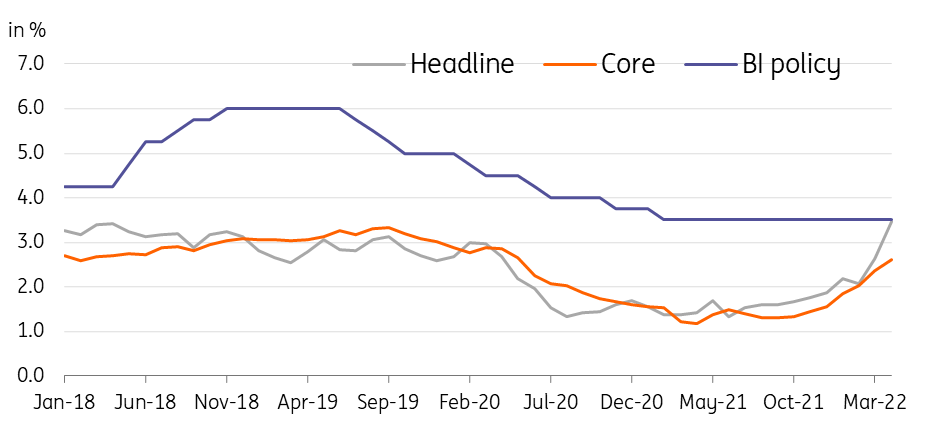

Bank Indonesia (BI) kept policy rates unchanged at 3.5%, matching the market consensus. BI Governor Perry Warjiyo cited concerns about the pace of global growth suggesting that Indonesia’s ongoing economic recovery would need support from monetary authorities. BI retained both growth and current account projections from the previous meeting but recognised the threat of rising price pressures.

Warjiyo indicated that inflation would remain under control although he admitted that inflation expectations warranted monitoring. BI may have felt less pressure to hike policy rates today after fiscal authorities rolled out a subsidy package to help contain the recent increase in food and energy prices.

Inflation remains on the uptrend but BI appears confident that fiscal measures can contain price pressures

Bank Indonesia enacts dovish pause

We had expected BI to keep policy rates unchanged at today’s meeting, however we believed that Governor Warjiyo would at least set the table for a June rate hike. Warjiyo did the exact opposite by pledging sustained support for the economic recovery and citing Indonesian rupiah (IDR) stability.

It appears the central bank remains confident that inflation can be contained by subsidies rolled out by fiscal authorities and that IDR would remain supported by a healthy trade surplus in the near term. As such, it appears BI is in no hurry to hike policy rates in the near term unless we see a substantial pickup in core inflation in the coming months and or heightened weakness from IDR. With BI enacting a dovish pause, expect IDR to come under some pressure as BI opts not to join the rate hike camp for now.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap