RBA drifting towards a hike

Minutes from the 5 April RBA meeting suggest that the first rate hike from the Reserve Bank of Australia (RBA) this cycle may not be too far off. Incoming inflation data and in particular wage price data will be pivotal in this decision

Cut to the chase

Central Bank minutes are somewhat formulaic, and to save time, it often pays to start at the end and work towards the front. In the case of the RBA, the penultimate paragraph of the minutes, which deals with the policy decision, is where all the important messages can be found. You can read them verbatim for yourself here.

The key phrase was "...These developments have brought forward the likely timing of the first increase in interest rates". We will consider what "these developments" were shortly, but whatever they were, this was the key conclusion. No more "patient" RBA. This is a signal that rates could change soon.

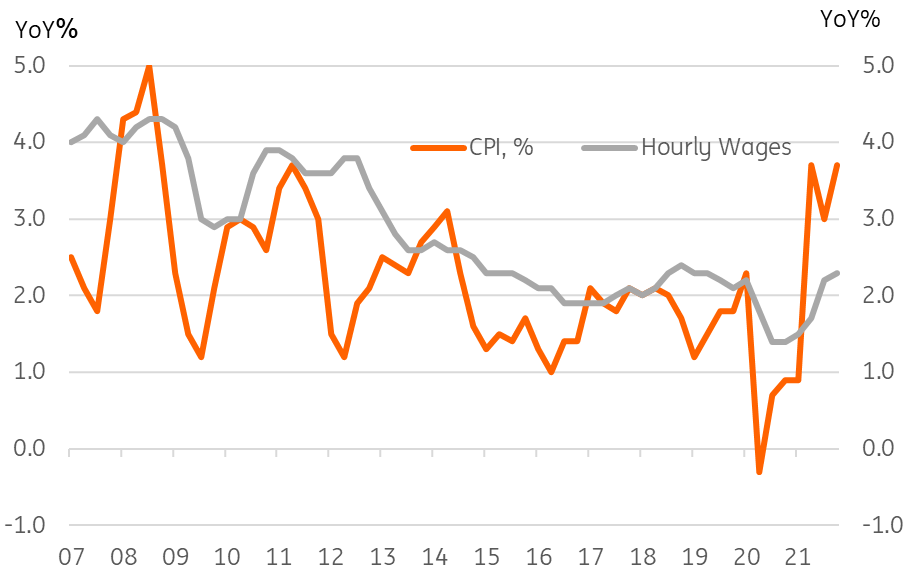

Exactly how soon will depend on the other key remark in that paragraph. "Over coming months, important additional evidence will be available on both inflation and the evolution of labour costs". We don't need to know precisely what the inflation number will be to say with some confidence that the 1Q22 figure will remain well above the RBA's 2-3% target range. And the evidence both internationally and from local survey evidence is that it will increase further from the 3.7%YoY rate in 4Q21.

RBA decision now rests on wages and CPI data

Wither wages?

One factor the RBA has clung to in the past is that for the increase in inflation to be sustainable (and surely this is now a semantic question as it is already looking fairly sustained), we need to see wages growth at 3% or higher. The latest minutes are a bit more equivocal, omitting any reference to 3%, but sticking to the view that they need to be higher than they currently are and that the current rate of wages growth isn't very alarming.

We don't get new wages data until 18 May, so not until after the 3 May RBA meeting. But that meeting will publish a new set of RBA minutes.

So a likely timeline of events might look something like this:

- 27 April - 1Q22 CPI data comes out, and it remains at least 3.7%, and probably pushes above - maybe exceeding 4%YoY;

- 3 May - RBA meeting - no change to policy cash rates or exchange settlement rate, but published forecasts show growth staying resilient and higher for longer inflation;

- 18 May - Wage price index released. It is up from the 2.3% 4Q21 figure, but not quite at the previous 3% threshold - though close enough not to matter

- 7 June - RBA moves Cash rate target from 10bp to 25bp. May also move the Exchange settlement rate from 0% to 15bp or even 20bp so that cash rates trade slightly closer to their target in an environment of ample exchange settlement balances.

Other points of interest

Other than these key points, the surrounding commentary was, as ever, thorough, though not particularly germane to the looming rate decision. Quite a lot of space was devoted to the exchange settlement rate, currently 0bp and the cash rate's actual trading position relative to the target cash rate. As it is likely that ample exchange settlement (ES) balances will persist for some time, this makes us wonder if we will see the ES rate move more than the cash rate target when rates are eventually moved, so that the cash rate trades a bit closer to the target than it has been doing.

Beyond that, there was the usual consideration of whether some of the price increases being noted were one-off price adjustments or part of a period of rising price increases. This discussion sounds a bit like the US Fed's "transitory/non-transitory" dilemma", and is looking a bit dated in the light of recent history.

There was also some discussion about non-labour cost measures being more prominent, which may be one argument for a less rigid approach to the previous 3% wage-price hurdle than previously suggested.

None of this detracts from the key message though, which is that the RBA is getting a lot closer to its first rate hike this cycle. And seems to be setting out a path for delivery before the end of this quarter.

Download

Download snap