Precious metals: Gold lacking the safe haven allure

Gold prices ended last week fairly flat with US trade tariffs spurring only the briefest of rallies while funds continued to liquidate. All eyes are now on US inflation and Treasury auctions to see if the outflows can be reversed

Gold lacking safe haven allure

Gold’s performance was disappointing following news (February 28th) that the US would indeed impose steep trade tariffs on aluminium and steel. Despite the obvious threats to global growth and a sell-off in equities, gold prices did not show evidence of safe haven flows until March 6th when bullion briefly managed to surge 1% and come close to the $1340 mark. These gains were short-lived, however, and erased by the next day.

Gold's lack of allure as a safe haven is most evident when priced in Japanese yen. Following the tariff news, yen-based gold prices hit their lowest level since August. In JPY terms, prices are down 5% since the stock market correction at the start of February.

Competition from other assets and frustration over stale dollar-based returns has resulted in an exodus of fund positioning with no real conviction for shorting either. Comex open interest has fallen 17% from its January high and 7% in March alone. Net money manager positioning was flat in the week ending Tuesday 6th but this masked a general withdrawal by both longs and shorts. Similarly, short interest on the SPDR ETF actually ended February at the highest level since November though this was largely the result of a decline in long holdings overall.

In our last precious note, we cautioned that a return in real yields could further divert flows. However, whilst real rates have indeed settled in higher, the upturn in inflation-linked swaps seems to have actually peaked for now. The fact that steel and aluminium tariffs did not trigger a deeper bond sell-off beyond inflationary bets showed that the contagion to US holdings and indeed the dollar was fairly benign. Now that the proposals are watered down (i.e exemptions) it might seem like a smart move, but our FX team remains cautious, noting that Trump's trade war is a reason for foreign investors to shy away from US Treasuries. All eyes will be on US Treasury auctions this week for signs of major trading partners diversifying away from US debt holdings. Weakness in US holdings ought to weigh upon the dollar and boost safe-haven inflows, whether gold can begin attracting these allocations will determine the near-term outlook.

Gold positioning exodus (Comex open interest, '000 lots)

All eyes on inflation data tomorrow

The highlight of the economic calendar will be the US inflation data tomorrow, with wounds still sore from the inflation-induced equity sell-off in February. Friday's US jobs report showed that payrolls increased by 313,000 last month and well above the market consensus, but wage growth slowed to 0.2% from 0.1% the month before. Filling vacancies without raising pay points to non-inflationary growth, which is not a positive development for gold though our economists have raised doubts. Other reports show businesses struggling to find workers, which suggests future payrolls will slow and pay growth will quicken. Consumer price inflation could hit 3% by the summer, which drives our constructive forecasts for gold this year.

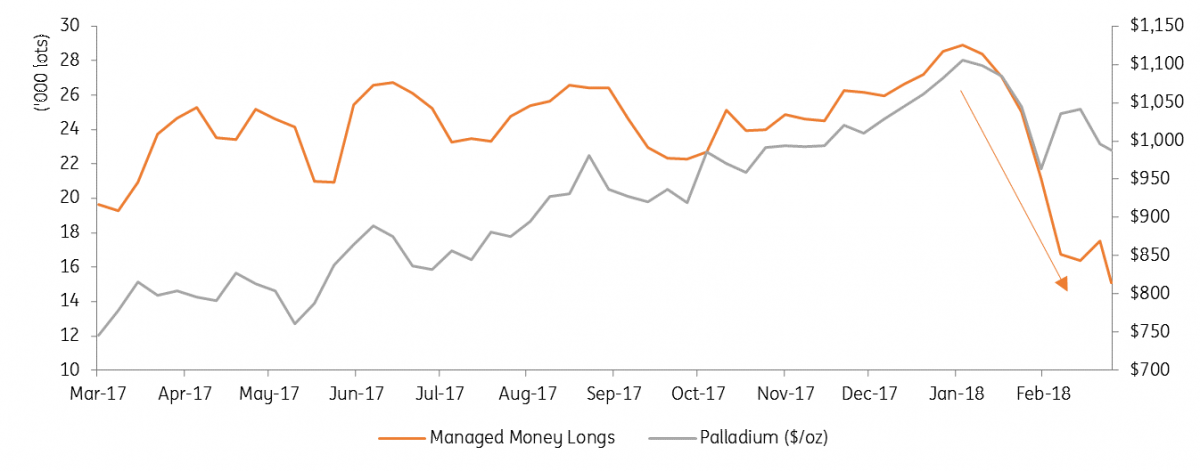

Trump tariffs hit palladium hardest

Palladium was the most immediate victim of President Trump's tariffs, with prices falling 5% the next day. Commenters speculated that higher input costs for aluminium and steel could hit US auto markets and spill over into the global trade of parts and vehicles. The US traded nearly $430 billion in vehicles, parts and accessories in 2017 and auto dealings with Europe became a hot topic in the Twittersphere. However, we think the scale of the move was more a reflection of the prevailing ongoing liquidation in palladium than a precise link to fundamentals. CFTC data shows that managed money has liquidated by more than 50% since peaking in mid-January.

The platinum-palladium ratio recovered slightly on the post-tariff sell-off but remains comfortably below parity. The forward curves have pushed back platinum overtaking palladium until December 2018 compared to a June date last month. Based on our own forecasts, we don’t think such a move will happen for the next few years due to platinum's weaker fundamentals with the palladium backwardation actually making it more expensive for investors to short the ratio. For platinum, another jolt comes from Germany where the top court validated cities’ rights to limit/ban diesel cars in the city centre to fight pollution. The ruling could have wide repercussions across Europe, where nearly half of the vehicles are diesel-powered – diesel cars emit nearly 8-10 times more nitrogen oxides than gasoline.

Palladium managed money longs down by over 50%

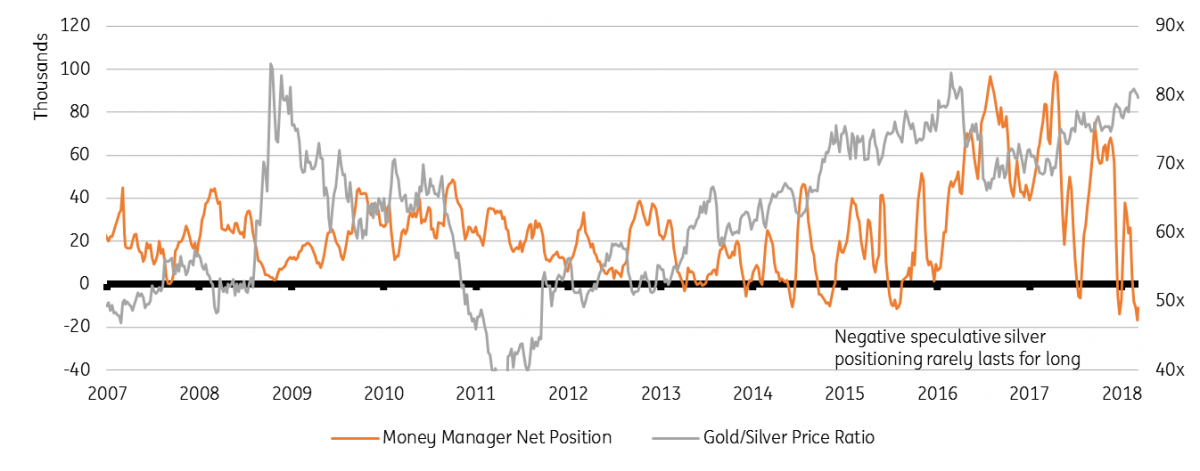

Silver: Still undervalued to gold

The gold-silver ratio remains around the 80x level seen during the great financial crisis, deeply inconsistent with our positive outlook for the global economy. Silver money manager positioning data remains net short for four weeks running which has only happened three times since 2006 and, at the most, lasted six weeks. It seems highly likely therefore that silver fund positioning will soon turn.

Net short silver positioning rarely lasts long

Download

Download snap

16 March 2018

Week In Review: Calm before the storm? This bundle contains {bundle_entries}{/bundle_entries} articles