Polish inflation below expectations in December

CPI inflation at the end of 2023 dropped to 6.1% - a positive surprise. Disinflation will continue in the first quarter but the outlook for the remainder of the year is highly uncertain and dependent on administrative and fiscal decisions. The MPC is expected to remain in wait-and-see mode at least until March

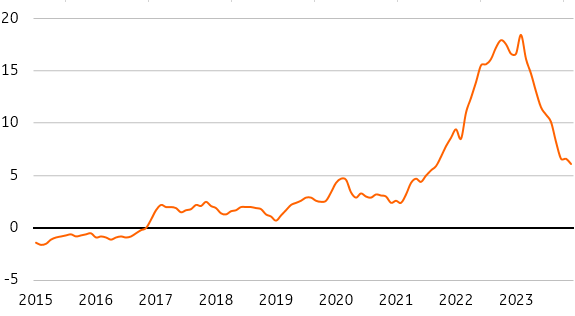

According to the flash estimate, Poland’s CPI inflation eased to 6.1% year-on-year in December 2023, down from 6.6% YoY in November (consensus: 6.5%; ING: 6.7%). Compared to November, fuel prices fell by 1.8% month-on-month, prices of energy carriers declined by 0.3% MoM, prices of food and non-alcoholic beverages rose by 0.2% MoM, and we estimate that prices in core categories increased by about 0.2% MoM.

Poland's CPI inflation, %YoY

We estimate that core inflation, CPI excluding food and energy prices, slowed to around 6.9% YoY in December from 7.3% YoY in November, which is a positive sign. We expect a sharp decline in inflation in early 2024, supported by, among other things, the extension of the anti-inflation shield on electricity and gas prices and keeping the zero VAT rate on food in 1Q24. In the coming months, inflation may temporarily approach the upper limit of deviation from the National Bank of Poland's target (3.5%), but this will not be a sustained decline. The inflation outlook for the rest of the year is highly uncertain amid factors related to administrative and fiscal decisions. If VAT on food is reinstated starting in April, and the government starts to phase out the measures to stabilise electricity and gas prices in the middle of the year, we could see inflation rise again to around 6% YoY in the second half of the year.

Amid these uncertainties, the Monetary Policy Council (MPC) will stick to its wait-and-see policy approach in the coming months. We expect policymakers to keep the NBP rates unchanged next week (main policy rate at 5.75%). The discussion of possible changes in monetary policy parameters will take place in March, on the occasion of the March inflation projection release. In the event of a withdrawal of the anti-inflation shields, the space for interest rate cuts in 2024 seems small (25-50bp).

Download

Download snap