Poland’s December data underwhelms but cheaper energy improves outlook

Data for December suggests that fourth-quarter and full-year GDP growth will be a bit weaker than expected. However, the economic outlook for 2023 has improved thanks to the drop in gas prices, supporting our above-consensus growth forecast of 1%

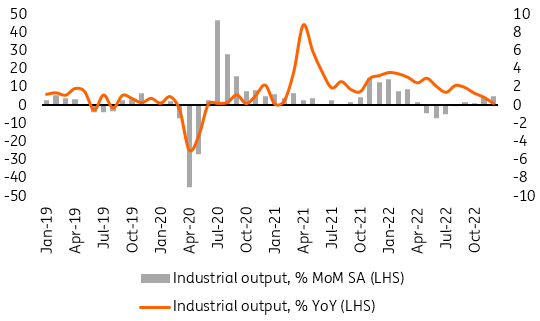

Industrial output decelerates

In December, production decelerated further. In year-on-year terms, the rate of growth slowed to 1% vs. 4.5% in November. This was close to expectations (ING 1.2%, consensus 1.7%). In monthly terms, output grew for a fourth consecutive month (seasonally-adjusted), up by 0.7%. Monthly declines were recorded between the second and third quarters, after the outbreak of the war in Ukraine.

Industrial output continues to slow

Industrial output (% YoY)

Export sectors are still strong thanks to improvements in global supply chains. At the same time, heavy industry (power generation, metallurgy, chemicals) looks weaker due to high energy prices (shutdowns in the chemical industry and some steel mills due to expensive gas). Gas prices have been falling since December which should help to unlock production in some sectors, potentially adding about 0.2pp to GDP in the first quarter. However, production will be negatively affected by the high base in energy production from the first half of last year when the Polish power industry exported a lot of electricity, competing with the expensive gas from Western producers.

Still, the GDP outlook for 2023 has improved thanks to falling gas prices, which significantly raises the outlook for the European and German economies - Poland's main trading partners. The net effect of these developments is positive, supporting our 1% YoY GDP forecast for 2023, which is above consensus.

Construction output in contraction

Construction output fell 0.8% YoY in December, compared to a 4% YoY increase a month earlier and a consensus estimate of 2.7% YoY. In October and November, production was supported by unusually warm temperatures. But this effect was no longer present in December. As a result, work related to public investment, i.e. civil engineering (up 1.4% vs 6.9% YoY a month earlier) and specialised construction works (down 1.7% after an 8.6% YoY increase in November), declined significantly. Building construction also fell for a second consecutive month (down 0.8% vs -4.2% YoY in November).

The construction outlook remains negative and in fact, is likely to be one of the weakest areas in the economy this year. Infrastructure investment is suffering from a lack of EU funds and rising prices, making it difficult to execute tenders. Even accessing the Recovery Fund this year will not change this picture in 2023, as tenders and design work will need to be completed before actual construction can begin.

Residential construction, meanwhile, is suffering from a slump in demand. Higher interest rates and regulatory requirements have significantly weakened the demand for credit. This has been compounded by a general deterioration in household sentiment, which discourages households from making major purchases like durable goods and housing. Developers, on the other hand, still have a very large number of apartments under construction - only recently falling below record levels. In all likelihood, projects already underway are now being completed, while new ones are not being started.

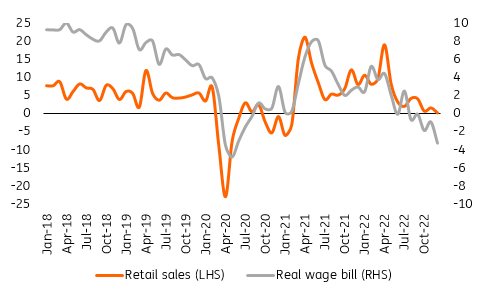

Retail sales increasingly weak

In December, retail sales of goods rose by merely 0.2% YoY (consensus: 1.4%; ING: 1.5%), following a 1.6% YoY increase in November (all in real terms). The trends seen in previous months are continuing. Sales of durable goods remain weak. The decline in sales of furniture, consumer electronics and household appliances deepened to double-digit levels (-10.4% YoY), while increases in total sales were driven by rising consumption of primary goods (pharmaceuticals: +7.6% YoY; food: +1.9% YoY). The strong increase in the price of necessities (food, fuel) is limiting consumers' ability to purchase other products. This is especially so against a backdrop of shrinking real household income from work. Real wages in the enterprise sector fell by 5.3% YoY in December.

Retail sales remain weak

Real retail sales and wages (% YoY)

December's goods sales performance was weak. Growth in pharmaceutical sales was buoyed by the strong wave of seasonal flu. The slightly lower magnitude of the year-on-year decline in fuel sales might have been related to concerns about price increases as VAT on gasoline and diesel was due to rise from 8% in December to 23% in January. Annual growth rates in food and clothing sales slowed markedly. Retail sales data in recent months suggest a further weakening of goods consumption in the fourth quarter after an already soft third quarter.

GDP estimate for 4Q22. Slightly improved outlook for 2023

Overall, the December data was marginally weaker than expected (wages, construction output, retail sales), while industrial production slowed in line with our nowcasting models, but was marginally weaker than the trend rate. Based on that, we estimate GDP growth in 4Q22 at 2.0% YoY and for the full year at just below 5%, slightly weaker than previously expected. On the other hand, the GDP outlook for 2023 has improved thanks to the falling gas prices. This has significantly improved the forecasts for the European and German economies - Poland's main trading partners. The net effect of these developments is positive, supporting our 1% YoY GDP forecast for 2023, which is above consensus.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap